ACCT 420: Advanced linear regression

Session 4

Dr. Richard M. Crowley

Front matter

Learning objectives

- Theory:

- Further understand:

- Statistics

- Causation

- Data

- Time

- Further understand:

- Application:

- Predicting revenue quarterly and weekly

- Methodology:

- Univariate

- Linear regression (OLS)

- Visualization

Datacamp

- Explore on your own

- No specific required class this week

Based on your feedback…

- To help with replicating slides, each week I will release:

- A code file that can directly replicate everything in the slides

- The data files used, where allowable.

- I may occasionally use proprietary data that I cannot distribute as is – those will not be distributed

- To help with coding

- I have released a practice on mutate and ggplot

- We will go back to having in class R practices when new concepts are included

- To help with statistics

- We will go over some statistics foundations today

Assignments for this course

- Based on feedback received today, I may host extra office hours on Wednesday

Quick survey: rmc.link/420hw1

Statistics Foundations

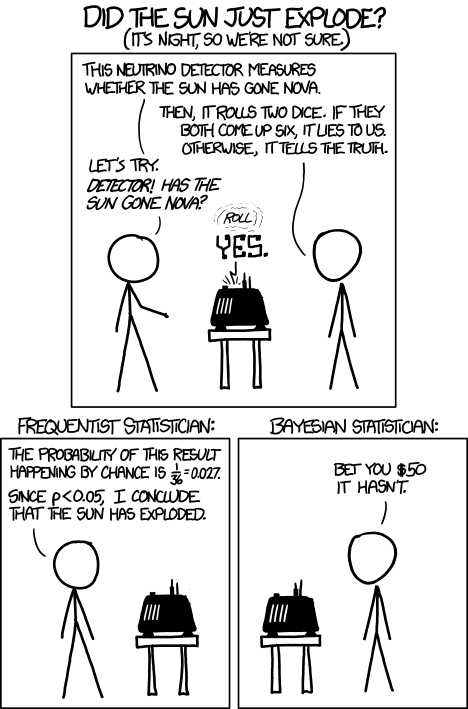

Frequentist statistics

A specific test is one of an infinite number of replications

- The “correct” answer should occur most frequently, i.e., with a high probability

- Focus on true vs false

- Treat unknowns as fixed constants to figure out

- Not random quantities

- Where it’s used

- Classical statistics methods

- Like OLS

- Classical statistics methods

Bayesian statistics

Focus on distributions and beliefs

- Prior distribution – what is believed before the experiment

- Posterior distribution: an updated belief of the distribution due to the experiment

- Derive distributions of parameters

- Where it’s used:

- Many machine learning methods

- Bayesian updating acts as the learning

- Bayesian statistics

- Many machine learning methods

Frequentist vs Bayesian methods

This is why we use more than 1 data point

Frequentist perspective: Repeat the test

detector <- function() {

dice <- sample(1:6, size=2, replace=TRUE)

if (sum(dice) == 12) {

"exploded"

} else {

"still there"

}

}

experiment <- replicate(1000,detector())

# p value

paste("p-value: ",

sum(experiment == "still there") / 1000,

"-- Reject H_A that sun exploded")## [1] "p-value: 0.962 -- Reject H_A that sun exploded"Frequentist: The sun didn’t explode

Bayes persepctive: Bayes rule

P(A|B) = \frac{P(B|A) P(A)}{P(B)}

- A: The sun exploded

- B: The detector said it exploded

- P(A): Really, really small. Say, ~0.

- P(B): \frac{1}{6}\times\frac{1}{6} = \frac{1}{36}

- P(B|A): \frac{35}{36}

P(A|B) = \frac{P(B|A) P(A)}{P(B)} = \frac{\frac{35}{36}\times\sim 0}{\frac{1}{36}} = 35\times \sim 0 \approx 0

Bayesian: The sun didn’t explode

What analytics typically relies on

- Regression approaches

- Most often done in a frequentist manner

- Can be done in a Bayesian manner as well

- Artificial Intelligence

- Often frequentist

- Sometimes neither – “It just works”

- Machine learning

- Sometimes Bayesian, sometime frequentist

- We’ll see both

We will use both to some extent – for our purposes, we will not debate the merits of either school of thought, but use tools derived from both

Confusion from frequentist approaches

- Possible contradictions:

- F test says the model is good yet nothing is statistically significant

- Individual p-values are good yet the model isn’t

- One measure says the model is good yet another doesn’t

There are many ways to measure a model, each with their own merits. They don’t always agree, and it’s on us to pick a reasonable measure.

Frequentist approaches to things

Hypotheses

- H_0: The status quo is correct

- Your proposed model doesn’t work

- H_A: The model you are proposing works

- Frequentist statistics can never directly support H_0!

- Only can fail to find support for H_A

- Even if our p-value is 1, we can’t say that the results prove the null hypothesis!

OLS terminology

- y: The output in our model

- \hat{y}: The estimated output in our model

- x_i: An input in our model

- \hat{x}_i: An estimated input in our model

- \hat{~}: Something estimated

- \alpha: A constant, the expected value of y when all x_i are 0

- \beta_i: A coefficient on an input to our model

- \varepsilon: The error term

- This is also the residual from the regression

- What’s left if you take actual y minus the model prediction

- This is also the residual from the regression

Regression

- Regression (like OLS) has the following assumptions

- The data is generated following some model

- E.g., a linear model

- Next week, a logistic model

- E.g., a linear model

- The data conforms to some statistical properties as required by the test

- The model coefficients are something to precisely determine

- I.e., the coefficients are constants

- p-values provide a measure of the chance of an error in a particular aspect of the model

- For instance, the p-value on \beta_1 in y=\alpha + \beta_1 x_1 + \varepsilon essentially gives the probability that the sign of \beta_1 is wrong

- The data is generated following some model

OLS Statistical properties

y = \alpha + \beta_1 x_1 + \beta_2 x_2 + \ldots + \varepsilon

\hat{y} = \alpha + \beta_1 \hat{x}_1 + \beta_2 \hat{x}_2 + \ldots + \hat{\varepsilon}

- There should be a linear relationship between y and each x_i

- I.e., y is [approximated by] a constant multiple of each x_i

- Otherwise we shouldn’t use a linear regression

- Each \hat{x}_i is normally distributed

- Not so important with larger data sets, but a good to adhere to

- Each observation is independent

- We’ll violate this one for the sake of causality

- Homoskedasticity: Variance in errors is constant

- This is important

- Not too much multicollinearity

- Each \hat{x}_i should be relatively independent from the others

- Some is OK

Practical implications

Models designed under a frequentist approach can only answer the question of “does this matter?”

- Is this a problem?

- Often, this is enough

Linear model implementation

What exactly is a linear model?

- Anything OLS is linear

- Many transformations can be recast to linear

- Ex.: log(y) = \alpha + \beta_1 x_1 + \beta_2 x_2 + \beta_3 {x_1}^2 + \beta_4 x_1 \cdot x_2

- This is the same as y' = \alpha + \beta_1 x_1 + \beta_2 x_2 + \beta_3 x_3 + \beta_4 x_4 where:

- y' = log(y)

- x_3 = {x_1}^2

- x_4 = x_1 \cdot x_2

- This is the same as y' = \alpha + \beta_1 x_1 + \beta_2 x_2 + \beta_3 x_3 + \beta_4 x_4 where:

- Ex.: log(y) = \alpha + \beta_1 x_1 + \beta_2 x_2 + \beta_3 {x_1}^2 + \beta_4 x_1 \cdot x_2

Linear models are very flexible

Mental model of OLS: 1 input

Simple OLS measures a simple linear relationship between an input and an output

- E.g.: Our first regression last week: Revenue on assets

Mental model of OLS: Multiple inputs

OLS measures simple linear relationships between a set of inputs and one output

- E.g.: Our main models last week: Future revenue regressed on multiple accounting and macro variables

Other linear models: IV Regression (2SLS)

IV/2SLS models linear relationships where the effect of some x_i on y may be confounded by outside factors.

- E.g.: Modeling the effect of management pay duration (like bond duration) on firms’ choice to issue earnings forecasts

- Instrument with CEO tenure (Cheng, Cho, and Kim 2015)

Other linear models: SUR

SUR models systems with related error terms

- E.g.: Modeling both revenue and earnings simultaneously

Other linear models: 3SLS

3SLS models systems of equations with related outputs

- E.g.: Modeling both stock return, volatility, and volume simultaneously

Other linear models: SEM

SEM can model abstract and multi-level relationships

- E.g.: Showing that organizational commitment leads to higher job satisfaction, not the other way around (Poznanski and Bline 1999)

Modeling choices: Model selection

Pick what fits your problem!

- For forecasting a quantity

- Usually some sort of linear model regressed using OLS

- The other model types mentioned are great for simultaneous forecasting of multiple outputs

- For forecasting a binary outcome

- Usually logit or a related model (we’ll start this next week)

- For forensics:

- Usually logit or a related model

Modeling choices: Variable selection

- The options:

- Use your own knowledge to select variables

- Use a selection model to automate it

Own knowledge

- Build a model based on your knowledge of the problem and situation

- This is generally better

- The result should be more interpretable

- For prediction, you should know relationships better than most algorithms

Modeling choices: Automated selection

- Traditional methods include:

- Forward selection: Start with nothing and add variables with the most contribution to Adj R^2 until it stops going up

- Backward selection: Start with all inputs and remove variables with the worst (negative) contribution to Adj R^2 until it stops going up

- Stepwise selection: Like forward selection, but drops non-significant predictors

- Newer methods:

- Lasso and Elastic Net based models

- Optimize with high penalties for complexity (i.e., # of inputs)

- We will discuss these in week 6

- Lasso and Elastic Net based models

The overfitting problem

Or: Why do we like simpler models so much?

- Overfitting happens when a model fits in-sample data too well…

- To the point where it also models any idiosyncrasies or errors in the data

- This harms prediction performance

- Directly harming our forecasts

An overfitted model works really well on its own data, and quite poorly on new data

Statistical tests and Interpretation

Coefficients

- In OLS: \beta_i

- A change in x_i by 1 leads to a change in y by \beta_i

- Essentially, the slope between x and y

- The blue line in the chart is the regression line for \hat{Revenue} = \alpha + \beta_i \hat{Assets} for retail firms since 1960

P-values

- p-values tell us the probability that an individual result is due to random chance

“The P value is defined as the probability under the assumption of no effect or no difference (null hypothesis), of obtaining a result equal to or more extreme than what was actually observed.”"

– Dahiru 2008

- These are very useful, particularly for a frequentist approach

- First used in the 1700s, but popularized by Ronald Fisher in the 1920s and 1930s

P-values: Rule of thumb

- If p<0.05 and the coefficient matches our mental model, we can consider this as supporting our model

- If p<0.05 but the coefficient is opposite, then it is suggesting a problem with our model

- If p>0.10, it is rejecting the alternative hypothesis

- If 0.05 < p < 0.10 it depends…

- For a small dataset or a complex problem, we can use 0.10 as a cutoff

- For a huge dataset or a simple problem, we should use 0.05

One vs two tailed tests

- Best practice:

- Use a two tailed test

- Second best practice:

- If you use a 1-tailed test, use a p-value cutoff of 0.025 or 0.05

- This is equivalent to the best practice, just roundabout

- If you use a 1-tailed test, use a p-value cutoff of 0.025 or 0.05

- Common but semi-inappropriate:

- Use a two tailed test with cutoffs of 0.05 or 0.10 because your hypothesis is directional

R^2

- R^2 = Explained variation / Total variation

- Variation = difference in the observed output variable from its own mean

- A high R^2 indicates that the model fits the data very well

- A low R^2 indicates that the model is missing much of the variation in the output

- R^2 is technically a biased estimator

- Adjusted R^2 downweights R^2 and makes it unbiased

- R^2_{Adj} = P R^2 + 1 - P

- Where P=\frac{n-1}{n-p-1}

- n is the number of observations

- p is the number of inputs in the model

- R^2_{Adj} = P R^2 + 1 - P

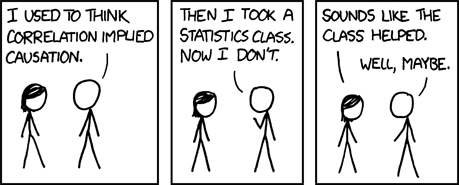

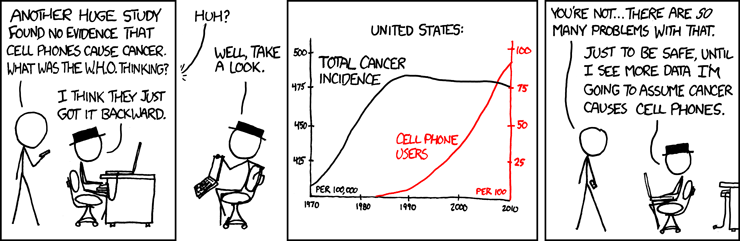

Causality

What is causality?

A \rightarrow B

- Causality is A causing B

- This means more than A and B are correlated

- I.e., If A changes, B changes. But B changing doesn’t mean A changed

- Unless B is 100% driven by A

- Very difficult to determine, particularly for events that happen [almost] simultaneously

- Examples of correlations that aren’t causation

Time and causality

A \rightarrow B or A \leftarrow B?

A_t \rightarrow B_{t+1}

- If there is a separation in time, it’s easier to say A caused B

- Observe A, then see if B changes after

- Conveniently, we have this structure when forecasting

- Recall last week’s model:

Revenue_{t+1} = Revenue_t + \ldots

Time and causality break down

A_t \rightarrow B_{t+1}? \quad OR \quad C \rightarrow A_t and C \rightarrow B_{t+1}?

- The above illustrates the Correlated omitted variable problem

- A doesn’t cause B… Instead, some other force C causes both

- Bane of social scientists everywhere

- This is less important for predictive analytics, as we care more about performance, but…

- It can complicate interpreting your results

- Figuring out C can help improve you model’s predictions

- So find C!

Today’s application: Quarterly retail revenue

The question

How can we predict quarterly revenue for retail companies, leveraging our knowledge of such companies

- In aggregate

- By Store

- By department

More specifically…

- Consider time dimensions

- What matters:

- Last quarter?

- Last year?

- Other timeframes?

- Cyclicality

- What matters:

Time and OLS

Time matters a lot for retail

How to capture time effects?

- Autoregression

- Regress y_t on earlier value(s) of itself

- Last quarter, last year, etc.

- Regress y_t on earlier value(s) of itself

- Controlling for time directly in the model

- Essentially the same as fixed effects last week

Quarterly revenue prediction

The data

- From quarterly reports

- Two sets of firms:

- US “Hypermarkets & Super Centers” (GICS: 30101040)

- US “Multiline Retail” (GICS: 255030)

- Data from Compustat - Capital IQ > North America - Daily > Fundamentals Quarterly

Formalization

- Question

- How can we predict quarterly revenue for large retail companies?

- Hypothesis (just the alternative ones)

- Current quarter revenue helps predict next quarter revenue

- 3 quarters ago revenue helps predict next quarter revenue (Year-over-year)

- Different quarters exhibit different patterns (seasonality)

- A long-run autoregressive model helps predict next quarter revenue

- Prediction

- Use OLS for all the above – t-tests for coefficients

- Hold out sample: 2015-2017

Variable generation

library(tidyverse) # As always

library(plotly) # interactive graphs

library(lubridate) # import some sensible date functions

# Generate quarter over quarter growth "revtq_gr"

df <- df %>% group_by(gvkey) %>% mutate(revtq_gr=revtq / lag(revtq) - 1) %>% ungroup()

# Generate year-over-year growth "revtq_yoy"

df <- df %>% group_by(gvkey) %>% mutate(revtq_yoy=revtq / lag(revtq, 4) - 1) %>% ungroup()

# Generate first difference "revtq_d"

df <- df %>% group_by(gvkey) %>% mutate(revtq_d=revtq - lag(revtq)) %>% ungroup()

# Generate a proper date

# Date was YYMMDDs10: YYYY/MM/DD, can be converted from text to date easily

df$date <- as.Date(df$datadate) # Built in to R- Use mutate for variables using lags

- as.Date() can take a date formatted as “YYYY/MM/DD” and convert to a proper date value

- You can convert other date types using the

format=argument- i.e., “DD.MM.YYYY” is format code “%d.%m.%Y”

- Full list of date codes

- You can convert other date types using the

Example output

| conm | date | revtq | revtq_gr | revtq_yoy | revtq_d |

|---|---|---|---|---|---|

| ALLIED STORES | 1962-04-30 | 156.5 | NA | NA | NA |

| ALLIED STORES | 1962-07-31 | 161.9 | 0.0345048 | NA | 5.4 |

| ALLIED STORES | 1962-10-31 | 176.9 | 0.0926498 | NA | 15.0 |

| ALLIED STORES | 1963-01-31 | 275.5 | 0.5573770 | NA | 98.6 |

| ALLIED STORES | 1963-04-30 | 171.1 | -0.3789474 | 0.0932907 | -104.4 |

| ALLIED STORES | 1963-07-31 | 182.2 | 0.0648743 | 0.1253860 | 11.1 |

## # A tibble: 6 x 3

## conm date datadate

## <chr> <date> <chr>

## 1 ALLIED STORES 1962-04-30 1962/04/30

## 2 ALLIED STORES 1962-07-31 1962/07/31

## 3 ALLIED STORES 1962-10-31 1962/10/31

## 4 ALLIED STORES 1963-01-31 1963/01/31

## 5 ALLIED STORES 1963-04-30 1963/04/30

## 6 ALLIED STORES 1963-07-31 1963/07/31Create 8 quarters (2 years) of lags

# Custom Function to generate a series of lags

multi_lag <- function(df, lags, var, ext="") {

lag_names <- paste0(var,ext,lags)

lag_funs <- setNames(paste("dplyr::lag(.,",lags,")"), lag_names)

df %>% group_by(gvkey) %>% mutate_at(vars(var), funs_(lag_funs)) %>% ungroup()

}

# Generate lags "revtq_l#"

df <- multi_lag(df, 1:8, "revtq", "_l")

# Generate changes "revtq_gr#"

df <- multi_lag(df, 1:8, "revtq_gr")

# Generate year-over-year changes "revtq_yoy#"

df <- multi_lag(df, 1:8, "revtq_yoy")

# Generate first differences "revtq_d#"

df <- multi_lag(df, 1:8, "revtq_d")

# Equivalent brute force code for this is in the appendix- paste0(): creates a string vector by concatenating all inputs

- paste(): same as paste0(), but with spaces added in between

- setNames(): allows for storing a value and name simultaneously

- mutate_at(): is like mutate but with a list of functions

Example output

| conm | date | revtq | revtq_l1 | revtq_l2 | revtq_l3 | revtq_l4 |

|---|---|---|---|---|---|---|

| ALLIED STORES | 1962-04-30 | 156.5 | NA | NA | NA | NA |

| ALLIED STORES | 1962-07-31 | 161.9 | 156.5 | NA | NA | NA |

| ALLIED STORES | 1962-10-31 | 176.9 | 161.9 | 156.5 | NA | NA |

| ALLIED STORES | 1963-01-31 | 275.5 | 176.9 | 161.9 | 156.5 | NA |

| ALLIED STORES | 1963-04-30 | 171.1 | 275.5 | 176.9 | 161.9 | 156.5 |

| ALLIED STORES | 1963-07-31 | 182.2 | 171.1 | 275.5 | 176.9 | 161.9 |

Clean and split into training and testing

# Clean the data: Replace NaN, Inf, and -Inf with NA

df <- df %>%

mutate_if(is.numeric, funs(replace(., !is.finite(.), NA)))

# Split into training and testing data

# Training data: We'll use data released before 2015

train <- filter(df, year(date) < 2015)

# Testing data: We'll use data released 2015 through 2018

test <- filter(df, year(date) >= 2015)Univariate stats

Univariate stats

- To get a better grasp on the problem, looking at univariate stats can help

summary(df[,c("revtq","revtq_gr","revtq_yoy", "revtq_d","fqtr")])## revtq revtq_gr revtq_yoy

## Min. : 0.00 Min. :-1.0000 Min. :-1.0000

## 1st Qu.: 64.46 1st Qu.:-0.1112 1st Qu.: 0.0077

## Median : 273.95 Median : 0.0505 Median : 0.0740

## Mean : 2439.38 Mean : 0.0650 Mean : 0.1273

## 3rd Qu.: 1254.21 3rd Qu.: 0.2054 3rd Qu.: 0.1534

## Max. :136267.00 Max. :14.3333 Max. :47.6600

## NA's :367 NA's :690 NA's :940

## revtq_d fqtr

## Min. :-24325.21 Min. :1.000

## 1st Qu.: -19.33 1st Qu.:1.000

## Median : 4.30 Median :2.000

## Mean : 22.66 Mean :2.478

## 3rd Qu.: 55.02 3rd Qu.:3.000

## Max. : 15495.00 Max. :4.000

## NA's :663ggplot2 for visualization

- The next slides will use some custom functions using ggplot2

- ggplot2 has an odd syntax:

- It doesn’t use pipes (

%>%), but instead adds everything together (+)

- It doesn’t use pipes (

library(ggplot2) # or tidyverse -- it's part of tidyverse

df %>%

ggplot(aes(y=var_for_y_axis, x=var_for_y_axis)) +

geom_point() # scatterplotaes()is for aesthetics – how the chart is set up- Other useful aesthetics:

group=to set groups to list in the legend. Not needed if using the below thoughcolor=to set color by some grouping variable. Putfactor()around the variable if you want discrete groups, otherwise it will do a color scale (light to dark)shape=to set shapes for points – see here for a list

ggplot2 for visualization

library(ggplot2) # or tidyverse -- it's part of tidyverse

df %>%

ggplot(aes(y=var_for_y_axis, x=var_for_y_axis)) +

geom_point() # scatterplotgeomstands for geometry – any shapes, lines, etc. start withgeom- Other useful geoms:

geom_line(): makes a line chartgeom_bar(): makes a bar chart – y is the height, x is the categorygeom_smooth(method="lm"): Adds a linear regression into the chartgeom_abline(slope=1): Adds a 45° line

- Add

xlab("Label text here")to change the x-axis label - Add

ylab("Label text here")to change the y-axis label - Add

ggtitle("Title text here")to add a title - Plenty more details in the ‘Data Visualization Cheat Sheet’ on eLearn

Plotting: Distribution of revenue

Revenue

- Quarterly growth

Year-over-year growth

- First difference

What do we learn from these graphs?

- Revenue

- ~

- Quarterly growth

- ~

- Year-over-year growth

- ~

- First difference

- ~

What do we learn from these graphs?

- Revenue

- This is really skewed data – a lot of small revenue quarters, but a significant amount of large revenue quarters in the tail

- Potential fix: use

log(revtq)?

- Potential fix: use

- This is really skewed data – a lot of small revenue quarters, but a significant amount of large revenue quarters in the tail

- Quarterly growth

- Quarterly growth is reasonably close to normally distributed

- Good for OLS

- Quarterly growth is reasonably close to normally distributed

- Year-over-year growth

- Year over year growth is reasonably close to normally distributed

- Good for OLS

- Year over year growth is reasonably close to normally distributed

- First difference

- Reasonably close to normally distributed, with really long tails

- Good enough for OLS

- Reasonably close to normally distributed, with really long tails

Plotting: Mean revenue by quarter

Revenue

- Quarterly growth

Year-over-year growth

- First difference

What do we learn from these graphs?

- Revenue

- ~

- Quarterly growth

- ~

- Year-over-year growth

- ~

- First difference

- ~

What do we learn from these graphs?

- Revenue

- Revenue seems cyclical!

- Quarterly growth

- Definitely cyclical!

- Year-over-year growth

- Year over year difference is less cyclical – more constant

- First difference

- Definitely cyclical!

Plotting: Revenue vs lag by quarter

Revenue

- Quarterly growth

Year-over-year growth

- First difference

What do we learn from these graphs?

- Revenue

- Revenue is really linear! But each quarter has a distinct linear relation.

- Quarterly growth

- All over the place. Each quarter appears to have a different pattern though. Quarters will matter.

- Year-over-year growth

- Linear but noisy.

- First difference

- Again, all over the place. Each quarter appears to have a different pattern though. Quarters will matter.

Correlation matrices

cor(train[,c("revtq","revtq_l1","revtq_l2","revtq_l3", "revtq_l4")],

use="complete.obs")## revtq revtq_l1 revtq_l2 revtq_l3 revtq_l4

## revtq 1.0000000 0.9916167 0.9938489 0.9905522 0.9972735

## revtq_l1 0.9916167 1.0000000 0.9914767 0.9936977 0.9898184

## revtq_l2 0.9938489 0.9914767 1.0000000 0.9913489 0.9930152

## revtq_l3 0.9905522 0.9936977 0.9913489 1.0000000 0.9906006

## revtq_l4 0.9972735 0.9898184 0.9930152 0.9906006 1.0000000cor(train[,c("revtq_gr","revtq_gr1","revtq_gr2","revtq_gr3", "revtq_gr4")],

use="complete.obs")## revtq_gr revtq_gr1 revtq_gr2 revtq_gr3 revtq_gr4

## revtq_gr 1.00000000 -0.32291329 0.06299605 -0.22769442 0.64570015

## revtq_gr1 -0.32291329 1.00000000 -0.31885020 0.06146805 -0.21923630

## revtq_gr2 0.06299605 -0.31885020 1.00000000 -0.32795121 0.06775742

## revtq_gr3 -0.22769442 0.06146805 -0.32795121 1.00000000 -0.31831023

## revtq_gr4 0.64570015 -0.21923630 0.06775742 -0.31831023 1.00000000Retail revenue has really high autocorrelation! Concern for multicolinearity. Revenue growth is less autocorrelated and oscillates.

Correlation matrices

cor(train[,c("revtq_yoy","revtq_yoy1","revtq_yoy2","revtq_yoy3", "revtq_yoy4")],

use="complete.obs")## revtq_yoy revtq_yoy1 revtq_yoy2 revtq_yoy3 revtq_yoy4

## revtq_yoy 1.0000000 0.6554179 0.4127263 0.4196003 0.1760055

## revtq_yoy1 0.6554179 1.0000000 0.5751128 0.3665961 0.3515105

## revtq_yoy2 0.4127263 0.5751128 1.0000000 0.5875643 0.3683539

## revtq_yoy3 0.4196003 0.3665961 0.5875643 1.0000000 0.5668211

## revtq_yoy4 0.1760055 0.3515105 0.3683539 0.5668211 1.0000000cor(train[,c("revtq_d","revtq_d1","revtq_d2","revtq_d3", "revtq_d4")],

use="complete.obs")## revtq_d revtq_d1 revtq_d2 revtq_d3 revtq_d4

## revtq_d 1.0000000 -0.6181516 0.3309349 -0.6046998 0.9119911

## revtq_d1 -0.6181516 1.0000000 -0.6155259 0.3343317 -0.5849841

## revtq_d2 0.3309349 -0.6155259 1.0000000 -0.6191366 0.3165450

## revtq_d3 -0.6046998 0.3343317 -0.6191366 1.0000000 -0.5864285

## revtq_d4 0.9119911 -0.5849841 0.3165450 -0.5864285 1.0000000Year over year change fixes the multicollinearity issue. First difference oscillates like quarter over quarter growth.

R Practice

- This practice will look at predicting Walmart’s quarterly revenue using:

- 1 lag

- Cyclicality

- Practice using:

- Do the exercises in today’s practice file

- R Practice

- Shortlink: rmc.link/420r4

Forecasting

1 period models

- 1 Quarter lag

- We saw a very strong linear pattern here earlier

mod1 <- lm(revtq ~ revtq_l1, data=train)- Quarter and year lag

- Year-over-year seemed pretty constant

mod2 <- lm(revtq ~ revtq_l1 + revtq_l4, data=train)- 2 years of lags

- Other lags could also help us predict

mod3 <- lm(revtq ~ revtq_l1 + revtq_l2 + revtq_l3 + revtq_l4 +

revtq_l5 + revtq_l6 + revtq_l7 + revtq_l8, data=train)- 2 years of lags, by observation quarter

- Take into account cyclicality observed in bar charts

mod4 <- lm(revtq ~ (revtq_l1 + revtq_l2 + revtq_l3 + revtq_l4 +

revtq_l5 + revtq_l6 + revtq_l7 + revtq_l8):factor(fqtr),

data=train)Quarter lag

summary(mod1)##

## Call:

## lm(formula = revtq ~ revtq_l1, data = train)

##

## Residuals:

## Min 1Q Median 3Q Max

## -24438.7 -34.0 -11.7 34.6 15200.5

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 15.639975 13.514877 1.157 0.247

## revtq_l1 1.003038 0.001556 644.462 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 1152 on 7676 degrees of freedom

## (662 observations deleted due to missingness)

## Multiple R-squared: 0.9819, Adjusted R-squared: 0.9819

## F-statistic: 4.153e+05 on 1 and 7676 DF, p-value: < 2.2e-16Quarter and year lag

summary(mod2)##

## Call:

## lm(formula = revtq ~ revtq_l1 + revtq_l4, data = train)

##

## Residuals:

## Min 1Q Median 3Q Max

## -20245.7 -18.4 -4.4 19.1 9120.8

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 5.444986 7.145633 0.762 0.446

## revtq_l1 0.231759 0.005610 41.312 <2e-16 ***

## revtq_l4 0.815570 0.005858 139.227 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 592.1 on 7274 degrees of freedom

## (1063 observations deleted due to missingness)

## Multiple R-squared: 0.9954, Adjusted R-squared: 0.9954

## F-statistic: 7.94e+05 on 2 and 7274 DF, p-value: < 2.2e-162 years of lags

summary(mod3)##

## Call:

## lm(formula = revtq ~ revtq_l1 + revtq_l2 + revtq_l3 + revtq_l4 +

## revtq_l5 + revtq_l6 + revtq_l7 + revtq_l8, data = train)

##

## Residuals:

## Min 1Q Median 3Q Max

## -5005.6 -12.9 -3.7 9.3 5876.3

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 4.02478 4.37003 0.921 0.3571

## revtq_l1 0.77379 0.01229 62.972 < 2e-16 ***

## revtq_l2 0.10497 0.01565 6.707 2.16e-11 ***

## revtq_l3 -0.03091 0.01538 -2.010 0.0445 *

## revtq_l4 0.91982 0.01213 75.800 < 2e-16 ***

## revtq_l5 -0.76459 0.01324 -57.749 < 2e-16 ***

## revtq_l6 -0.08080 0.01634 -4.945 7.80e-07 ***

## revtq_l7 0.01146 0.01594 0.719 0.4721

## revtq_l8 0.07924 0.01209 6.554 6.03e-11 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 346 on 6666 degrees of freedom

## (1665 observations deleted due to missingness)

## Multiple R-squared: 0.9986, Adjusted R-squared: 0.9986

## F-statistic: 5.802e+05 on 8 and 6666 DF, p-value: < 2.2e-162 years of lags, by observation quarter

summary(mod4)##

## Call:

## lm(formula = revtq ~ (revtq_l1 + revtq_l2 + revtq_l3 + revtq_l4 +

## revtq_l5 + revtq_l6 + revtq_l7 + revtq_l8):factor(fqtr),

## data = train)

##

## Residuals:

## Min 1Q Median 3Q Max

## -6066.6 -13.9 0.1 15.1 4941.1

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -0.201107 4.004046 -0.050 0.959944

## revtq_l1:factor(fqtr)1 0.488584 0.021734 22.480 < 2e-16 ***

## revtq_l1:factor(fqtr)2 1.130563 0.023017 49.120 < 2e-16 ***

## revtq_l1:factor(fqtr)3 0.774983 0.028727 26.977 < 2e-16 ***

## revtq_l1:factor(fqtr)4 0.977353 0.026888 36.349 < 2e-16 ***

## revtq_l2:factor(fqtr)1 0.258024 0.035136 7.344 2.33e-13 ***

## revtq_l2:factor(fqtr)2 -0.100284 0.024664 -4.066 4.84e-05 ***

## revtq_l2:factor(fqtr)3 0.212954 0.039698 5.364 8.40e-08 ***

## revtq_l2:factor(fqtr)4 0.266761 0.035226 7.573 4.14e-14 ***

## revtq_l3:factor(fqtr)1 0.124187 0.036695 3.384 0.000718 ***

## revtq_l3:factor(fqtr)2 -0.042214 0.035787 -1.180 0.238197

## revtq_l3:factor(fqtr)3 -0.005758 0.024367 -0.236 0.813194

## revtq_l3:factor(fqtr)4 -0.308661 0.038974 -7.920 2.77e-15 ***

## revtq_l4:factor(fqtr)1 0.459768 0.038266 12.015 < 2e-16 ***

## revtq_l4:factor(fqtr)2 0.684943 0.033366 20.528 < 2e-16 ***

## revtq_l4:factor(fqtr)3 0.252169 0.035708 7.062 1.81e-12 ***

## revtq_l4:factor(fqtr)4 0.817136 0.017927 45.582 < 2e-16 ***

## revtq_l5:factor(fqtr)1 -0.435406 0.023278 -18.704 < 2e-16 ***

## revtq_l5:factor(fqtr)2 -0.725000 0.035497 -20.424 < 2e-16 ***

## revtq_l5:factor(fqtr)3 -0.160408 0.036733 -4.367 1.28e-05 ***

## revtq_l5:factor(fqtr)4 -0.473030 0.033349 -14.184 < 2e-16 ***

## revtq_l6:factor(fqtr)1 0.059832 0.034672 1.726 0.084453 .

## revtq_l6:factor(fqtr)2 0.154990 0.025368 6.110 1.05e-09 ***

## revtq_l6:factor(fqtr)3 -0.156840 0.041147 -3.812 0.000139 ***

## revtq_l6:factor(fqtr)4 -0.106082 0.037368 -2.839 0.004541 **

## revtq_l7:factor(fqtr)1 0.060031 0.038599 1.555 0.119936

## revtq_l7:factor(fqtr)2 0.061381 0.034510 1.779 0.075344 .

## revtq_l7:factor(fqtr)3 0.028149 0.025385 1.109 0.267524

## revtq_l7:factor(fqtr)4 -0.277337 0.039380 -7.043 2.08e-12 ***

## revtq_l8:factor(fqtr)1 -0.016637 0.033568 -0.496 0.620177

## revtq_l8:factor(fqtr)2 -0.152379 0.028014 -5.439 5.54e-08 ***

## revtq_l8:factor(fqtr)3 0.052208 0.027334 1.910 0.056179 .

## revtq_l8:factor(fqtr)4 0.103495 0.015777 6.560 5.78e-11 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 299.7 on 6642 degrees of freedom

## (1665 observations deleted due to missingness)

## Multiple R-squared: 0.9989, Adjusted R-squared: 0.9989

## F-statistic: 1.935e+05 on 32 and 6642 DF, p-value: < 2.2e-16Testing out of sample

- RMSE: Root mean square Error

- RMSE is very affected by outliers, and a bad choice for noisy data that you are OK with missing a few outliers here and there

- Doubling error quadruples that part of the error

rmse <- function(v1, v2) {

sqrt(mean((v1 - v2)^2, na.rm=T))

}- MAE: Mean absolute error

- MAE is measures average accuracy with no weighting

- Doubling error doubles that part of the error

mae <- function(v1, v2) {

mean(abs(v1-v2), na.rm=T)

}Both are commonly used for evaluating OLS out of sample

Testing out of sample

| adj_r_sq | rmse_in | mae_in | rmse_out | mae_out | |

|---|---|---|---|---|---|

| 1 period | 0.9818514 | 1151.3535 | 322.73819 | 2947.3619 | 1252.5196 |

| 1 and 4 periods | 0.9954393 | 591.9500 | 156.20811 | 1400.3841 | 643.9823 |

| 8 periods | 0.9985643 | 345.8053 | 94.91083 | 677.6218 | 340.8236 |

| 8 periods w/ quarters | 0.9989231 | 298.9557 | 91.28056 | 645.5415 | 324.9395 |

1 quarter model

8 period model, by quarter

What about for revenue growth?

Backing out a revenue prediction, revt_t=(1+growth_t)\times revt_{t-1}

| adj_r_sq | rmse_in | mae_in | rmse_out | mae_out | |

|---|---|---|---|---|---|

| 1 period | 0.0910390 | 1106.3730 | 308.48331 | 3374.728 | 1397.6541 |

| 1 and 4 periods | 0.4398456 | 530.6444 | 154.15086 | 1447.035 | 679.3536 |

| 8 periods | 0.6761666 | 456.2551 | 123.34075 | 1254.201 | 584.9709 |

| 8 periods w/ quarters | 0.7758834 | 378.4082 | 98.45751 | 1015.971 | 436.1522 |

1 quarter model

8 period model, by quarter

What about for YoY revenue growth?

Backing out a revenue prediction, revt_t=(1+yoy\_growth_t)\times revt_{t-4}

| adj_r_sq | rmse_in | mae_in | rmse_out | mae_out | |

|---|---|---|---|---|---|

| 1 period | 0.4370372 | 513.3264 | 129.2309 | 1867.4957 | 798.0327 |

| 1 and 4 periods | 0.5392281 | 487.6441 | 126.6012 | 1677.4003 | 731.2841 |

| 8 periods | 0.5398870 | 384.2923 | 101.0104 | 822.0065 | 403.5445 |

| 8 periods w/ quarters | 0.1563169 | 714.4285 | 195.3204 | 1231.8436 | 617.2989 |

1 quarter model

8 period model

What about for first difference?

Backing out a revenue prediction, revt_t= change_t+ revt_{t-1}

| adj_r_sq | rmse_in | mae_in | rmse_out | mae_out | |

|---|---|---|---|---|---|

| 1 period | 0.3532044 | 896.7969 | 287.77940 | 2252.7605 | 1022.0960 |

| 1 and 4 periods | 0.8425348 | 454.8651 | 115.52694 | 734.8120 | 377.5281 |

| 8 periods | 0.9220849 | 333.0054 | 95.95924 | 651.4967 | 320.0567 |

| 8 periods w/ quarters | 0.9397434 | 292.3102 | 86.95563 | 659.4412 | 319.7305 |

1 quarter model

8 period model, by quarter

Takeaways

- The first difference model works about as well as the revenue model at predicting next quarter revenue

- From earlier, it doesn’t suffer (as much) from multicollinearity either

- This is why time series analysis is often done on first differences

- Or second differences (difference in differences)

- This is why time series analysis is often done on first differences

- From earlier, it doesn’t suffer (as much) from multicollinearity either

- The other models perform pretty well as well

- Extra lags generally seems helpful when accounting for cyclicality

- Regressing by quarter helps a bit, particularly with revenue growth

What about for revenue growth?

Predicting quarter over quarter revenue growth itself

| adj_r_sq | rmse_in | mae_in | rmse_out | mae_out | |

|---|---|---|---|---|---|

| 1 period | 0.0910390 | 0.3509269 | 0.2105219 | 0.2257396 | 0.1750580 |

| 1 and 4 periods | 0.4398456 | 0.2681899 | 0.1132003 | 0.1597771 | 0.0998087 |

| 8 periods | 0.6761666 | 0.1761825 | 0.0867347 | 0.1545298 | 0.0845826 |

| 8 periods w/ quarters | 0.7758834 | 0.1462979 | 0.0765792 | 0.1459460 | 0.0703554 |

1 quarter model

8 period model, by quarter

What about for YoY revenue growth?

Predicting YoY revenue growth itself| adj_r_sq | rmse_in | mae_in | rmse_out | mae_out | |

|---|---|---|---|---|---|

| 1 period | 0.4370372 | 0.3116645 | 0.1114610 | 0.1515638 | 0.0942544 |

| 1 and 4 periods | 0.5392281 | 0.2451749 | 0.1015699 | 0.1498755 | 0.0896079 |

| 8 periods | 0.5398870 | 0.1928940 | 0.0764447 | 0.1346238 | 0.0658011 |

| 8 periods w/ quarters | 0.1563169 | 0.3006075 | 0.1402156 | 0.1841025 | 0.0963205 |

1 quarter model

8 period model

What about for first difference?

Predicting first difference in revenue itself

| adj_r_sq | rmse_in | mae_in | rmse_out | mae_out | |

|---|---|---|---|---|---|

| 1 period | 0.3532044 | 896.7969 | 287.77940 | 2252.7605 | 1022.0960 |

| 1 and 4 periods | 0.8425348 | 454.8651 | 115.52694 | 734.8120 | 377.5281 |

| 8 periods | 0.9220849 | 333.0054 | 95.95924 | 651.4967 | 320.0567 |

| 8 periods w/ quarters | 0.9397434 | 292.3102 | 86.95563 | 659.4412 | 319.7305 |

1 quarter model

8 period model, by quarter

Case: Advanced revenue prediction

RS Metrics’ approach

Read the press release: rmc.link/420class4

- How does RS Metrics approach revenue prediction?

- What other creative ways might there be?

Weekly revenue prediction

Shifted to week 5

End matter

For next week

- For next week:

- First individual assignment

- Finish by the end of Thursday

- Submit on eLearn

- Datacamp

- Practice a bit more to keep up to date

- Using R more will make it more natural

- Practice a bit more to keep up to date

- First individual assignment

Packages used for these slides

Custom code

# Brute force code for variable generation of quarterly data lags

df <- df %>%

group_by(gvkey) %>%

mutate(revtq_lag1=lag(revtq), revtq_lag2=lag(revtq, 2),

revtq_lag3=lag(revtq, 3), revtq_lag4=lag(revtq, 4),

revtq_lag5=lag(revtq, 5), revtq_lag6=lag(revtq, 6),

revtq_lag7=lag(revtq, 7), revtq_lag8=lag(revtq, 8),

revtq_lag9=lag(revtq, 9), revtq_gr=revtq / revtq_lag1 - 1,

revtq_gr1=lag(revtq_gr), revtq_gr2=lag(revtq_gr, 2),

revtq_gr3=lag(revtq_gr, 3), revtq_gr4=lag(revtq_gr, 4),

revtq_gr5=lag(revtq_gr, 5), revtq_gr6=lag(revtq_gr, 6),

revtq_gr7=lag(revtq_gr, 7), revtq_gr8=lag(revtq_gr, 8),

revtq_yoy=revtq / revtq_lag4 - 1, revtq_yoy1=lag(revtq_yoy),

revtq_yoy2=lag(revtq_yoy, 2), revtq_yoy3=lag(revtq_yoy, 3),

revtq_yoy4=lag(revtq_yoy, 4), revtq_yoy5=lag(revtq_yoy, 5),

revtq_yoy6=lag(revtq_yoy, 6), revtq_yoy7=lag(revtq_yoy, 7),

revtq_yoy8=lag(revtq_yoy, 8), revtq_d=revtq - revtq_l1,

revtq_d1=lag(revtq_d), revtq_d2=lag(revtq_d, 2),

revtq_d3=lag(revtq_d, 3), revtq_d4=lag(revtq_d, 4),

revtq_d5=lag(revtq_d, 5), revtq_d6=lag(revtq_d, 6),

revtq_d7=lag(revtq_d, 7), revtq_d8=lag(revtq_d, 8)) %>%

ungroup()# Custom html table for small data frames

library(knitr)

library(kableExtra)

html_df <- function(text, cols=NULL, col1=FALSE, full=F) {

if(!length(cols)) {

cols=colnames(text)

}

if(!col1) {

kable(text,"html", col.names = cols, align = c("l",rep('c',length(cols)-1))) %>%

kable_styling(bootstrap_options = c("striped","hover"), full_width=full)

} else {

kable(text,"html", col.names = cols, align = c("l",rep('c',length(cols)-1))) %>%

kable_styling(bootstrap_options = c("striped","hover"), full_width=full) %>%

column_spec(1,bold=T)

}

}Custom code

# These functions are a bit ugly, but can construct many charts quickly

# eval(parse(text=var)) is just a way to convert the string name to a variable reference

# Density plot for 1st to 99th percentile of data

plt_dist <- function(df,var) {

df %>%

filter(eval(parse(text=var)) < quantile(eval(parse(text=var)),0.99, na.rm=TRUE),

eval(parse(text=var)) > quantile(eval(parse(text=var)),0.01, na.rm=TRUE)) %>%

ggplot(aes(x=eval(parse(text=var)))) +

geom_density() + xlab(var)

}# Density plot for 1st to 99th percentile of both columns

plt_bar <- function(df,var) {

df %>%

filter(eval(parse(text=var)) < quantile(eval(parse(text=var)),0.99, na.rm=TRUE),

eval(parse(text=var)) > quantile(eval(parse(text=var)),0.01, na.rm=TRUE)) %>%

ggplot(aes(y=eval(parse(text=var)), x=fqtr)) +

geom_bar(stat = "summary", fun.y = "mean") + xlab(var)

}# Scatter plot with lag for 1st to 99th percentile of data

plt_sct <- function(df,var1, var2) {

df %>%

filter(eval(parse(text=var1)) < quantile(eval(parse(text=var1)),0.99, na.rm=TRUE),

eval(parse(text=var2)) < quantile(eval(parse(text=var2)),0.99, na.rm=TRUE),

eval(parse(text=var1)) > quantile(eval(parse(text=var1)),0.01, na.rm=TRUE),

eval(parse(text=var2)) > quantile(eval(parse(text=var2)),0.01, na.rm=TRUE)) %>%

ggplot(aes(y=eval(parse(text=var1)), x=eval(parse(text=var2)), color=factor(fqtr))) +

geom_point() + geom_smooth(method = "lm") + ylab(var1) + xlab(var2)

}# Calculating various in and out of sample statistics

models <- list(mod1,mod2,mod3,mod4)

model_names <- c("1 period", "1 and 4 period", "8 periods", "8 periods w/ quarters")

df_test <- data.frame(adj_r_sq=sapply(models, function(x)summary(x)[["adj.r.squared"]]),

rmse_in=sapply(models, function(x)rmse(train$revtq, predict(x,train))),

mae_in=sapply(models, function(x)mae(train$revtq, predict(x,train))),

rmse_out=sapply(models, function(x)rmse(test$revtq, predict(x,test))),

mae_out=sapply(models, function(x)mae(test$revtq, predict(x,test))))

rownames(df_test) <- model_names

html_df(df_test) # Custom function using knitr and kableExtra