ACCT 420: Linear Regression

Session 2

Dr. Richard M. Crowley

rcrowley@smu.edu.sg

http://rmc.link/

Front matter

Learning objectives

- Theory:

- Develop a logical approach to problem solving with data

- Statistics

- Causation

- Hypothesis testing

- Develop a logical approach to problem solving with data

- Application:

- Predicting revenue for real estate firms

- Methodology:

- Univariate stats

- Linear regression

- Visualization

Datacamp

- For next week:

- Just 2 chapters:

- 1 on linear regression

- 1 on tidyverse methods

- Just 2 chapters:

- The full list of Datacamp materials for the course is up on eLearn

R Installation

- If you haven’t already, make sure to install R and R Studio!

- Instructions are in Session 1’s slides

- You will need it for this week’s assignment

- Please install a few packages using the following code

- These packages are also needed for the first assignment

- You are welcome to explore other packages as well, but those will not be necessary for now

- Assignments will be provided as R Markdown files

The format will generally all be filled out – you will just add to it, answer questions, analyze data, and explain your work. Instructions and hints are in the same file

R Markdown: A quick guide

- Headers and subheaders start with

#and##, respectively - Code blocks starts with

```{r}and end with```- By default, all code and figures will show up in the document

- Inline code goes in a block starting with

`rand ending with` - Italic font can be used by putting

*or_around text - Bold font can be used by putting

**around text- E.g.:

**bold text**becomes bold text

- E.g.:

- To render the document, click

- Math can be placed between

$to use LaTeX notation- E.g.

$\frac{revt}{at}$becomes \(\frac{revt}{at}\)

- E.g.

- Full equations (on their own line) can be placed between

$$ - A block quote is prefixed with

> - For a complete guide, see R Studio’s R Markdown::Cheat Sheet

Application: Revenue prediction

The question

How can we predict revenue for a company, leveraging data about that company, related companies, and macro factors

- Specific application: Real estate companies

More specifically…

- Can we use a company’s own accounting data to predict it’s future revenue?

- Can we use other companies’ accounting data to better predict all of their future revenue?

- Can we augment this data with macro economic data to further improve prediction?

- Singapore business sentiment data

Linear models

What is a linear model?

\[ \hat{y}=\alpha + \beta \hat{x} + \varepsilon \]

- The simplest model is trying to predict some outcome \(\hat{y}\) as a function of an input \(\hat{x}\)

- \(\hat{y}\) in our case is a firm’s revenue in a given year

- \(\hat{x}\) could be a firm’s assets in a given year

- \(\alpha\) and \(\beta\) are solved for

- \(\varepsilon\) is the error in the measurement

I will refer to this as an OLS model – Ordinary Least Square regression

Example

Let’s predict UOL’s revenue for 2016

- Compustat has data for them since 1989

- Complete since 1994

- Missing CapEx before that

- Complete since 1994

## revt at

## Min. : 94.78 Min. : 1218

## 1st Qu.: 193.41 1st Qu.: 3044

## Median : 427.44 Median : 3478

## Mean : 666.38 Mean : 5534

## 3rd Qu.:1058.61 3rd Qu.: 7939

## Max. :2103.15 Max. :19623Linear models in R

- To run a linear model, use lm()

- The first argument is a formula for your model, where

~is used in place of an equals sign- The left side is what you want to predict

- The right side is inputs for prediction, separated by

+

- The second argument is the data to use

- The first argument is a formula for your model, where

- Additional variations for the formula:

- Functions transforming inputs (as vectors), such as log()

- Fully interacting variables using

*- I.e.,

A*Bincludes:A,B, andA times Bin the model

- I.e.,

- Interactions using

:- I.e.,

A:Bonly includesA times Bin the model

- I.e.,

Example: UOL

##

## Call:

## lm(formula = revt ~ at, data = uol)

##

## Residuals:

## Min 1Q Median 3Q Max

## -295.01 -101.29 -41.09 47.17 926.29

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -13.831399 67.491305 -0.205 0.839

## at 0.122914 0.009678 12.701 6.7e-13 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 221.2 on 27 degrees of freedom

## Multiple R-squared: 0.8566, Adjusted R-squared: 0.8513

## F-statistic: 161.3 on 1 and 27 DF, p-value: 6.699e-13Why is it called Ordinary Least Squares?

Example: UOL

- This model wasn’t so interesting…

- Bigger firms have more revenue – this is a given

- How about… revenue growth?

- And change in assets

- i.e., Asset growth

\[ \Delta x_t = \frac{x_t}{x_{t-1}} - 1 \]

Calculating changes in R

- The easiest way is using tidyverse’s dplyr

- This has a lag() function

- The default way to do it is to create a vector manually

# tidyverse

uol <- uol %>%

mutate(revt_growth1 = revt / lag(revt) - 1)

# R way

uol$revt_growth2 = uol$revt / c(NA, uol$revt[-length(uol$revt)]) - 1

# Check that both ways are equivalent

identical(uol$revt_growth1, uol$revt_growth2)## [1] TRUEYou can use whichever you are comfortable with

A note on mutate()

- mutate() adds variables to an existing data frame

- If you need to manipulate a bunch of columns at once:

- across() applies a transformation to specified columns in a data frame

- You can mix in starts_with() or ends_with() to pick columns by pattern

- If you need to manipulate a bunch of columns at once:

- Mutate can be very powerful when making more complex variables

- Examples:

- Calculating growth within company in a multi-company data frame

- Normalizing data to be within a certain range for multiple variables at once

- Examples:

Example: UOL with changes

# Make the other needed change

uol <- uol %>%

mutate(at_growth = at / lag(at) - 1) %>% # Calculate asset growth

rename(revt_growth = revt_growth1) # Rename for readability

# Run the OLS model

mod2 <- lm(revt_growth ~ at_growth, data = uol)

summary(mod2)##

## Call:

## lm(formula = revt_growth ~ at_growth, data = uol)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.57736 -0.10534 -0.00953 0.15132 0.42284

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.09024 0.05620 1.606 0.1204

## at_growth 0.53821 0.27717 1.942 0.0631 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.2444 on 26 degrees of freedom

## (1 observation deleted due to missingness)

## Multiple R-squared: 0.1267, Adjusted R-squared: 0.09307

## F-statistic: 3.771 on 1 and 26 DF, p-value: 0.06307Example: UOL with changes

- \(\Delta\)Assets doesn’t capture \(\Delta\)Revenue so well

- Perhaps change in total assets is a bad choice?

- Or perhaps we need to expand our model?

Scaling up!

\[ \hat{y}=\alpha + \beta_1 \hat{x}_1 + \beta_2 \hat{x}_2 + \ldots + \varepsilon \]

- OLS doesn’t need to be restricted to just 1 input!

- Not unlimited though (yet – we’ll get there)

- Number of inputs must be less than the number of observations minus 1

- Not unlimited though (yet – we’ll get there)

- Each \(\hat{x}_i\) is an input in our model

- Each \(\beta_i\) is something we will solve for

- \(\hat{y}\), \(\alpha\), and \(\varepsilon\) are the same as before

Scaling up our model

We have… 464 variables from Compustat Global alone!

- Let’s just add them all?

- We only have 28 observations…

- 28 << 464…

Now what?

Scaling up our model

Building a model requires careful thought!

- This is where having accounting and business knowledge comes in!

What makes sense to add to our model?

Practice: mutate()

- This practice is to make sure you understand how to use mutate with lags

- These are very important when dealing with business data!

- Do exercises 1 on today’s R practice file:

- R Practice

- Shortlink: rmc.link/420r2

Statistics Foundations

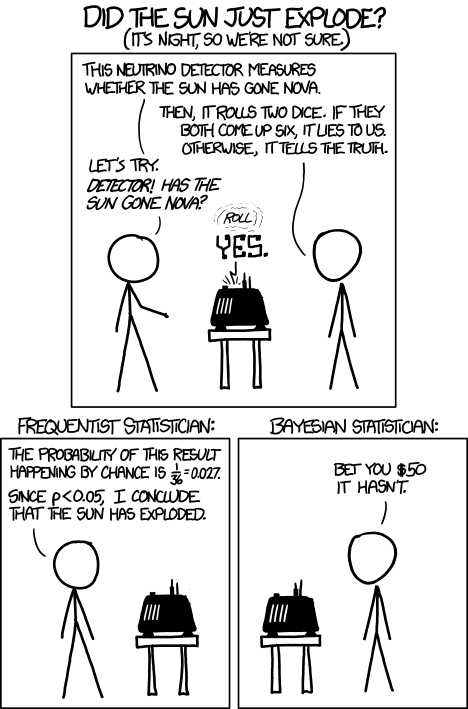

Frequentist statistics

A specific test is one of an infinite number of replications

- The “correct” answer should occur most frequently, i.e., with a high probability

- Focus on true vs false

- Treat unknowns as fixed constants to figure out

- Not random quantities

- Where it’s used

- Classical statistics methods

- Like OLS

- Classical statistics methods

Bayesian statistics

Focus on distributions and beliefs

- Prior distribution – what is believed before the experiment

- Posterior distribution: an updated belief of the distribution due to the experiment

- Derive distributions of parameters

- Where it’s used:

- Many machine learning methods

- Bayesian updating acts as the learning

- Bayesian statistics

- Many machine learning methods

A separate school of statistics thought

Frequentist vs Bayesian methods

This is why we use more than 1 data point

Frequentist perspective: Repeat the test

detector <- function() {

dice <- sample(1:6, size=2, replace=TRUE)

if (sum(dice) == 12) {

"exploded"

} else {

"still there"

}

}

experiment <- replicate(1000,detector())

# p value

p <- sum(experiment == "still there") / 1000

if (p < 0.05) {

paste("p-value: ", p, "-- Fail to reject H_A, sun appears to have exploded")

} else {

paste("p-value: ", p, "-- Reject H_A that sun exploded")

}## [1] "p-value: 0.965 -- Reject H_A that sun exploded"Frequentist: The sun didn’t explode

Bayes persepctive: Bayes rule

\[ P(A|B) = \frac{P(B|A) P(A)}{P(B)} \]

- \(A\): The sun exploded

- \(B\): The detector said it exploded

- \(P(A)\): Really, really small. Say, ~0.

- \(P(B)\): \(\frac{1}{6}\times\frac{1}{6} = \frac{1}{36}\)

- \(P(B|A)\): \(\frac{35}{36}\)

\[ P(A|B) = \frac{P(B|A) P(A)}{P(B)} = \frac{\frac{35}{36}\times\sim 0}{\frac{1}{36}} = 35\times \sim 0 \approx 0 \]

Bayesian: The sun didn’t explode

What analytics typically relies on

- Regression approaches

- Most often done in a frequentist manner

- Can be done in a Bayesian manner as well

- Artificial Intelligence

- Often frequentist

- Sometimes neither – “It just works”

- Machine learning

- Sometimes Bayesian, sometime frequentist

- We’ll see both

We will use both to some extent – for our purposes, we will not debate the merits of either school of thought, but we will use tools derived from both

Confusion from frequentist approaches

- Possible contradictions:

- \(F\) test says the model is good yet nothing is statistically significant

- Individual \(p\)-values are good yet the model isn’t

- One measure says the model is good yet another doesn’t

There are many ways to measure a model, each with their own merits. They don’t always agree, and it’s on us to pick a reasonable measure.

Formalizing frequentist testing

Why formalize?

- Our current approach has been ad hoc

- What is our goal?

- How will we know if we have achieved it?

- Formalization provides more rigor

Scientific method

- Question

- What are we trying to determine?

- Hypothesis

- What do we think will happen? Build a model

- Prediction

- What exactly will we test? Formalize model into a statistical approach

- Testing

- Test the model

- Analysis

- Did it work?

Hypotheses

- Null hypothesis, a.k.a. \(H_0\)

- The status quo

- Typically: The model doesn’t work

- Alternative hypothesis, a.k.a. \(H_1\) or \(H_A\)

- The model does work (and perhaps how it works)

- Frequentist statistics can never directly support \(H_0\)!

- Only can fail to find support for \(H_A\)

- Even if our \(p\)-value is 1, we can’t say that the results prove the null hypothesis!

We will use test statistics to test the hypotheses

Regression

- Regression (like OLS) has the following assumptions

- The data is generated following some model

- E.g., a linear model

- In two weeks, a logistic model

- E.g., a linear model

- The data conforms to some statistical properties as required by the test

- The model coefficients are something to precisely determine

- I.e., the coefficients are constants

- \(p\)-values provide a measure of the chance of an error in a particular aspect of the model

- For instance, the p-value on \(\beta_1\) in \(y=\alpha + \beta_1 x_1 + \varepsilon\) essentially gives the probability that the sign of \(\beta_1\) is wrong

- The data is generated following some model

OLS Statistical properties

\[ \begin{align*} \text{Theory:}\quad y &= \alpha + \beta_1 x_1 + \beta_2 x_2 + \ldots + \varepsilon \\ \text{Data:}\quad \hat{y} &= \alpha + \beta_1 \hat{x}_1 + \beta_2 \hat{x}_2 + \ldots + \hat{\varepsilon} \end{align*} \]

- There should be a linear relationship between \(y\) and each \(x_i\)

- I.e., \(y\) is [approximated by] a constant multiple of each \(x_i\)

- Otherwise we shouldn’t use a linear regression

- Each \(\hat{x}_i\) is normally distributed

- Not so important with larger data sets, but a good to adhere to

- Each observation is independent

- We’ll violate this one for the sake of causality

- Homoskedasticity: Variance in errors is constant

- This is important

- Not too much multicollinearity

- Each \(\hat{x}_i\) should be relatively independent from the others

- Some is OK

Practical implications

Models designed under a frequentist approach can only answer the question of “does this matter?”

- Is this a problem?

Linear model implementation

What exactly is a linear model?

- Anything OLS is linear

- Many transformations can be recast to linear

- Ex.: \(log(y) = \alpha + \beta_1 x_1 + \beta_2 x_2 + \beta_3 {x_1}^2 + \beta_4 x_1 \cdot x_2\)

- This is the same as \(y' = \alpha + \beta_1 x_1 + \beta_2 x_2 + \beta_3 x_3 + \beta_4 x_4\) where:

- \(y' = log(y)\)

- \(x_3 = {x_1}^2\)

- \(x_4 = x_1 \cdot x_2\)

- This is the same as \(y' = \alpha + \beta_1 x_1 + \beta_2 x_2 + \beta_3 x_3 + \beta_4 x_4\) where:

- Ex.: \(log(y) = \alpha + \beta_1 x_1 + \beta_2 x_2 + \beta_3 {x_1}^2 + \beta_4 x_1 \cdot x_2\)

Linear models are very flexible

Mental model of OLS: 1 input

Simple OLS measures a simple linear relationship between an input and an output

- E.g.: Our first regression this week: Revenue on assets

Mental model of OLS: Multiple inputs

OLS measures simple linear relationships between a set of inputs and one output

- E.g.: This is what we did when scaling up earlier this session

Other linear models: IV Regression (2SLS)

IV/2SLS models linear relationships where the effect of some \(x_i\) on \(y\) may be confounded by outside factors.

- E.g.: Modeling the effect of management pay duration (like bond duration) on firms’ choice to issue earnings forecasts

- Instrument with CEO tenure (Cheng, Cho, and Kim 2015)

Other linear models: SUR

SUR models systems with related error terms

- E.g.: Modeling both revenue and earnings simultaneously

Other linear models: 3SLS

3SLS models systems of equations with related outputs

- E.g.: Modeling stock return, volatility, and volume simultaneously

Other linear models: SEM

SEM can model abstract and multi-level relationships

- E.g.: Showing that organizational commitment leads to higher job satisfaction, not the other way around (Poznanski and Bline 1999)

Modeling choices: Model selection

Pick what fits your problem!

- For forecasting a quantity:

- Usually some sort of linear model regressed using OLS

- The other model types mentioned are great for simultaneous forecasting of multiple outputs

- For forecasting a binary outcome:

- Usually logit or a related model (we’ll start this in 2 weeks)

- For forensics:

- Usually logit or a related model

There are many more model types though!

Modeling choices: Variable selection

- The options:

- Use your own knowledge to select variables

- Use a selection model to automate it

Own knowledge

- Build a model based on your knowledge of the problem and situation

- This is generally better

- The result should be more interpretable

- For prediction, you should know relationships better than most algorithms

Modeling choices: Automated selection

- Traditional methods include:

- Forward selection: Start with nothing and add variables with the most contribution to Adj \(R^2\) until it stops going up

- Backward selection: Start with all inputs and remove variables with the worst (negative) contribution to Adj \(R^2\) until it stops going up

- Stepwise selection: Like forward selection, but drops non-significant predictors

- Newer methods:

- Lasso and Elastic Net based models

- Optimize with high penalties for complexity (i.e., # of inputs)

- We will discuss these in week 5

- These are proven to be better

- Lasso and Elastic Net based models

The overfitting problem

Or: Why do we like simpler models so much?

- Overfitting happens when a model fits in-sample data too well…

- To the point where it also models any idiosyncrasies or errors in the data

- This harms prediction performance

- Directly harming our forecasts

An overfitted model works really well on its own data, and quite poorly on new data

Statistical tests and Interpretation

Coefficients

- In OLS: \(\beta_i\)

- A change in \(x_i\) by 1 leads to a change in \(y\) by \(\beta_i\)

- Essentially, the slope between \(x\) and \(y\)

- The blue line in the chart is the regression line for \(\hat{Revenue} = \alpha + \beta_i \hat{Assets}\) for retail firms since 1960

P-values

- \(p\)-values tell us the probability that an individual result is due to random chance

“The P value is defined as the probability under the assumption of no effect or no difference (null hypothesis), of obtaining a result equal to or more extreme than what was actually observed.”

– Dahiru 2008

- These are very useful, particularly for a frequentist approach

- First used in the 1700s, but popularized by Ronald Fisher in the 1920s and 1930s

P-values: Rule of thumb

- If \(p<0.05\) and the coefficient sign matches our mental model, we can consider this as supporting our model

- If \(p<0.05\) but the coefficient is opposite, then it is suggesting a problem with our model

- If \(p>0.10\), it is rejecting the alternative hypothesis

- If \(0.05 < p < 0.10\) it depends…

- For a small dataset or a complex problem, we can use \(0.10\) as a cutoff

- For a huge dataset or a simple problem, we should use \(0.05\)

- We may even set a lower threshold if we have a ton of data

One vs two tailed tests

- Best practice:

- Use a two tailed test

- Second best practice:

- If you use a 1-tailed test, use a p-value cutoff of 0.025 or 0.05

- This is equivalent to the best practice, just roundabout

- If you use a 1-tailed test, use a p-value cutoff of 0.025 or 0.05

- Common but generally inappropriate:

- Use a one tailed test with cutoffs of 0.05 or 0.10 because your hypothesis is directional

\(R^2\)

- \(R^2\) = Explained variation / Total variation

- Variation = difference in the observed output variable from its own mean

- A high \(R^2\) indicates that the model fits the data very well

- A low \(R^2\) indicates that the model is missing much of the variation in the output

- \(R^2\) is technically a biased estimator

- Adjusted \(R^2\) downweights \(R^2\) and makes it unbiased

- \(R^2_{Adj} = P R^2 + 1 - P\)

- Where \(P=\frac{n-1}{n-p-1}\)

- \(n\) is the number of observations

- \(p\) is the number of inputs in the model

- \(R^2_{Adj} = P R^2 + 1 - P\)

Test statistics

- Testing a coefficient:

- Use a \(t\) or \(z\) test

- Testing a model as a whole

- \(F\)-test, check adjusted R squared as well

- Testing across models

- Chi squared (\(\chi^2\)) test

- Vuong test (comparing \(R^2\))

- Akaike Information Criterion (AIC) (Comparing MLEs, lower is better)

All of these have p-values, except for AIC

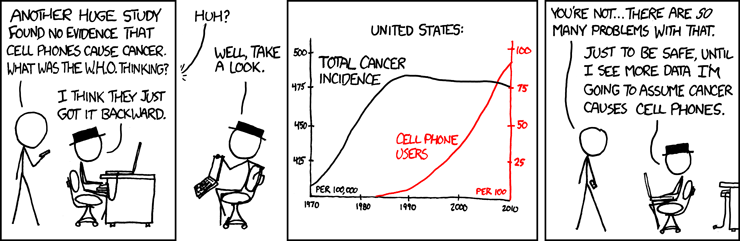

Causality

What is causality?

\(A \rightarrow B\)

- Causality is \(A\) causing \(B\)

- This means more than \(A\) and \(B\) are correlated

- I.e., If \(A\) changes, \(B\) changes. But \(B\) changing doesn’t mean \(A\) changed

- Unless \(B\) is 100% driven by \(A\)

- Very difficult to determine, particularly for events that happen [almost] simultaneously

- Examples of correlations that aren’t causation

Time and causality

\(A \rightarrow B\) or \(A \leftarrow B\)?

\(A_t \rightarrow B_{t+1}\)

- If there is a separation in time, it’s easier to say \(A\) caused \(B\)

- Observe \(A\), then see if \(B\) changes after

- Conveniently, we have this structure when forecasting

- Consider a model like:

\[ Revenue_{t+1} = Revenue_t + \ldots \]

It would be quite difficult for \(Revenue_{t+1}\) to cause \(Revenue_t\)

Time and causality break down

\(A_t \rightarrow B_{t+1}\)? \(\quad\) OR \(\quad\) \(C \rightarrow A_t\) and \(C \rightarrow B_{t+1}\)?

- The above illustrates the Correlated omitted variable problem

- \(A\) doesn’t cause \(B\)… Instead, some other force \(C\) causes both

- The bane of social scientists everywhere

- This is less important for predictive analytics, as we care more about performance, but…

- It can complicate interpreting your results

- Figuring out \(C\) can help improve you model’s predictions

- So find C!

Revisiting the previous problem

Formalizing our last test

- Question

- \(~\)

- Hypotheses

- \(H_0\):

- \(H_1\):

- Prediction

- \(~\)

- Testing:

- \(~\)

- Statistical tests:

- Individual variables:

- Model:

Is this model better?

## Analysis of Variance Table

##

## Model 1: revt_growth ~ at_growth

## Model 2: revt_growth ~ lct_growth + che_growth + ebit_growth

## Res.Df RSS Df Sum of Sq Pr(>Chi)

## 1 26 1.5534

## 2 24 1.1918 2 0.36168 0.0262 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1A bit better at \(p<0.05\)

- This means our model with change in current liabilities, cash, and EBIT appears to be better than the model with change in assets.

Panel data

Expanding our methodology

- Why should we limit ourselves to 1 firm’s data?

- The nature of data analysis is such:

Adding more data usually helps improve predictions

- Assuming:

- The data isn’t of low quality (too noisy)

- The data is relevant

- Any differences can be reasonably controlled for

Expanding our question

- Previously: Can we predict revenue using a firm’s accounting information?

- This is simultaneous, and thus is not forecasting

- Now: Can we predict future revenue using a firm’s accounting information?

- By trying to predict ahead, we are now in the realm of forecasting

- What do we need to change?

- \(\hat{y}\) will need to be 1 year in the future

First things first

- When using a lot of data, it is important to make sure the data is clean

- In our case, we may want to remove any very small firms

# Ensure firms have at least $1M (local currency), and have revenue

# df contains all real estate companies excluding North America

df_clean <- df %>%

filter(at>1, revt>0)

# We cleaned out 578 observations!

print(c(nrow(df), nrow(df_clean)))## [1] 5161 4583Looking back at the prior models

uol <- uol %>% mutate(revt_lead = lead(revt)) # From dplyr

forecast1 <- lm(revt_lead ~ lct + che + ebit, data=uol)

library(broom) # Lets us view bigger regression outputs in a tidy fashion

tidy(forecast1) # Present regression output## # A tibble: 4 x 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 87.4 124. 0.707 0.486

## 2 lct 0.213 0.291 0.731 0.472

## 3 che 0.112 0.349 0.319 0.752

## 4 ebit 2.49 1.03 2.42 0.0236## # A tibble: 1 x 12

## r.squared adj.r.squared sigma statistic p.value df logLik AIC BIC

## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 0.655 0.612 357. 15.2 0.00000939 3 -202. 414. 421.

## # ... with 3 more variables: deviance <dbl>, df.residual <int>, nobs <int>This model is ok, but we can do better.

Expanding the prior model

## # A tibble: 7 x 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 15.6 97.0 0.161 0.874

## 2 revt 1.49 0.414 3.59 0.00174

## 3 act 0.324 0.165 1.96 0.0629

## 4 che 0.0401 0.310 0.129 0.898

## 5 lct -0.198 0.179 -1.10 0.283

## 6 dp 3.63 5.42 0.669 0.511

## 7 ebit -3.57 1.36 -2.62 0.0161- Revenue to capture stickiness of revenue

- Current assest & Cash (and equivalents) to capture asset base

- Current liabilities to capture payments due

- Depreciation to capture decrease in real estate asset values

- EBIT to capture operational performance

Expanding the prior model

## # A tibble: 1 x 12

## r.squared adj.r.squared sigma statistic p.value df logLik AIC BIC

## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 0.903 0.875 203. 32.5 0.00000000141 6 -184. 385. 396.

## # ... with 3 more variables: deviance <dbl>, df.residual <int>, nobs <int>## Analysis of Variance Table

##

## Model 1: revt_lead ~ lct + che + ebit

## Model 2: revt_lead ~ revt + act + che + lct + dp + ebit

## Res.Df RSS Df Sum of Sq Pr(>Chi)

## 1 24 3059182

## 2 21 863005 3 2196177 1.477e-11 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1This is better (Adj. \(R^2\), \(\chi^2\), AIC).

Panel data

- Panel data refers to data with the following characteristics:

- There is a time dimension

- There is at least 1 other dimension to the data (firm, country, etc.)

- Special cases:

- A panel where all dimensions have the same number of observations is called balanced

- Otherwise we call it unbalanced

- A panel missing the time dimension is cross-sectional

- A panel missing the other dimension(s) is a time series

- A panel where all dimensions have the same number of observations is called balanced

- Format:

- Long: Indexed by all dimensions

- Wide: Indexed only by some dimensions

Panel data

Data frames are usually wide panels

All Singapore real estate companies

# Note the group_by -- without it, lead() will pull from the subsequent firm!

# ungroup() tells R that we finished grouping

df_clean <- df_clean %>%

group_by(isin) %>%

mutate(revt_lead = lead(revt)) %>%

ungroup()

All Singapore real estate companies

forecast3 <-

lm(revt_lead ~ revt + act + che + lct + dp + ebit,

data=df_clean[df_clean$fic=="SGP",])

tidy(forecast3)## # A tibble: 7 x 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 25.0 13.2 1.89 5.95e- 2

## 2 revt 0.505 0.0762 6.63 1.43e-10

## 3 act -0.0999 0.0545 -1.83 6.78e- 2

## 4 che 0.494 0.155 3.18 1.62e- 3

## 5 lct 0.396 0.0860 4.60 5.95e- 6

## 6 dp 4.46 1.55 2.88 4.21e- 3

## 7 ebit -0.951 0.271 -3.51 5.18e- 4All Singapore real estate companies

## # A tibble: 1 x 12

## r.squared adj.r.squared sigma statistic p.value df logLik AIC BIC

## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 0.844 0.841 210. 291. 2.63e-127 6 -2237. 4489. 4519.

## # ... with 3 more variables: deviance <dbl>, df.residual <int>, nobs <int>Lower adjusted \(R^2\) – This is worse? Why?

- Note: \(\chi^2\) can only be used for models on the same data

- Same for AIC

Worldwide real estate companies

## # A tibble: 7 x 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 222. 585. 0.379 7.04e- 1

## 2 revt 0.997 0.00655 152. 0

## 3 act -0.00221 0.00547 -0.403 6.87e- 1

## 4 che -0.150 0.0299 -5.02 5.36e- 7

## 5 lct 0.0412 0.0113 3.64 2.75e- 4

## 6 dp 1.52 0.184 8.26 1.89e-16

## 7 ebit 0.308 0.0650 4.74 2.25e- 6Worldwide real estate companies

## # A tibble: 1 x 12

## r.squared adj.r.squared sigma statistic p.value df logLik AIC BIC

## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 0.944 0.944 36459. 11299. 0 6 -47819. 95654. 95705.

## # ... with 3 more variables: deviance <dbl>, df.residual <int>, nobs <int>Higher adjusted \(R^2\) – better!

- Note: \(\chi^2\) can only be used for models on the same data

- Same for AIC

Model accuracy

Why is the UOL model better than the Singapore model?

- Ranking:

- Worldwide real estate model

- UOL model

- Singapore real estate model

Practice: group_by()

- This practice is to make sure you understand how to use mutate with leads and lags when there are multiple companies in the data

- We’ll almost always work with multiple companies!

- Do exercises 2 and 3 on today’s R practice file:

- R Practice

- Shortlink: rmc.link/420r2

Dealing with noise

Noise

Statistical noise is random error in the data

- Many sources of noise:

- Other factors not included in

- Error in measurement

- Accounting measurement!

- Unexpected events / shocks

Noise is OK, but the more we remove, the better!

Removing noise: Singapore model

- Different companies may behave slightly differently

- Control for this using a Fixed Effect

- Note: ISIN uniquely identifies companies

forecast3.1 <-

lm(revt_lead ~ revt + act + che + lct + dp + ebit + factor(isin),

data=df_clean[df_clean$fic=="SGP",])

# n=7 to prevent outputting every fixed effect

print(tidy(forecast3.1), n=15)## # A tibble: 27 x 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 1.58 39.4 0.0401 0.968

## 2 revt 0.392 0.0977 4.01 0.0000754

## 3 act -0.0538 0.0602 -0.894 0.372

## 4 che 0.304 0.177 1.72 0.0869

## 5 lct 0.392 0.0921 4.26 0.0000276

## 6 dp 4.71 1.73 2.72 0.00687

## 7 ebit -0.851 0.327 -2.60 0.00974

## 8 factor(isin)SG1AA6000000 218. 76.5 2.85 0.00463

## 9 factor(isin)SG1AD8000002 -11.7 67.4 -0.174 0.862

## 10 factor(isin)SG1AE2000006 4.02 79.9 0.0503 0.960

## 11 factor(isin)SG1AG0000003 -13.6 61.1 -0.223 0.824

## 12 factor(isin)SG1BG1000000 -0.901 69.5 -0.0130 0.990

## 13 factor(isin)SG1BI9000008 7.76 64.3 0.121 0.904

## 14 factor(isin)SG1DE5000007 -10.8 61.1 -0.177 0.860

## 15 factor(isin)SG1EE1000009 -6.90 66.7 -0.103 0.918

## # ... with 12 more rowsRemoving noise: Singapore model

## # A tibble: 1 x 12

## r.squared adj.r.squared sigma statistic p.value df logLik AIC BIC

## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 0.856 0.844 208. 69.4 1.15e-111 26 -2223. 4502. 4609.

## # ... with 3 more variables: deviance <dbl>, df.residual <int>, nobs <int>## Analysis of Variance Table

##

## Model 1: revt_lead ~ revt + act + che + lct + dp + ebit

## Model 2: revt_lead ~ revt + act + che + lct + dp + ebit + factor(isin)

## Res.Df RSS Df Sum of Sq Pr(>Chi)

## 1 324 14331633

## 2 304 13215145 20 1116488 0.1765This isn’t much different. Why? There is another source of noise within Singapore real estate companies

Another way to do fixed effects

- The library fixest has feols(): fixed effects OLS*

- Better for complex models

- Extremely efficient computationally

library(fixest)

forecast3.2 <-

feols(revt_lead ~ revt + act + che + lct + dp + ebit | isin,

data=df_clean[df_clean$fic=="SGP",])

summary(forecast3.2)## OLS estimation, Dep. Var.: revt_lead

## Observations: 331

## Fixed-effects: isin: 21

## Standard-errors: Clustered (isin)

## Estimate Std. Error t value Pr(>|t|))

## revt 0.392002 0.188714 2.077200 0.050877 .

## act -0.053816 0.154148 -0.349119 0.730649

## che 0.303696 0.302854 1.002800 0.327946

## lct 0.392086 0.238711 1.642500 0.116115

## dp 4.712800 2.630500 1.791600 0.088347 .

## ebit -0.850798 0.779077 -1.092100 0.287788

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

## RMSE: 199.8 Adj. R2: 0.843506

## Within R2: 0.780586Why exactly would we use fixed effects?

- Fixed effects are used when the average of \(\hat{y}\) varies by some group in our data

- In our problem, the average revenue of each firm is different

- Fixed effects absorb this difference

- Further reading:

- Introductory Econometrics by Jeffrey M. Wooldridge

What else can we do?

What else could we do to improve our prediction model?

- Assuming: We have access to any data that is publicly available

End matter

For next week

- For next week:

- 2 chapters on Datacamp

- First assignment

- Turn in on eLearn before class in 2 weeks

- You can work on this in pairs or individually

Packages used for these slides

Custom code

# Graph showing squared error (slide 4.6)

uolg <- uol[,c("at","revt")]

uolg$resid <- mod1$residuals

uolg$xleft <- ifelse(uolg$resid < 0,uolg$at,uolg$at - uolg$resid)

uolg$xright <- ifelse(uolg$resid < 0,uolg$at - uolg$resid, uol$at)

uolg$ytop <- ifelse(uolg$resid < 0,uolg$revt - uolg$resid,uol$revt)

uolg$ybottom <- ifelse(uolg$resid < 0,uolg$revt, uolg$revt - uolg$resid)

uolg$point <- TRUE

uolg2 <- uolg

uolg2$point <- FALSE

uolg2$at <- ifelse(uolg$resid < 0,uolg2$xright,uolg2$xleft)

uolg2$revt <- ifelse(uolg$resid < 0,uolg2$ytop,uolg2$ybottom)

uolg <- rbind(uolg, uolg2)

uolg %>% ggplot(aes(y=revt, x=at, group=point)) +

geom_point(aes(shape=point)) +

scale_shape_manual(values=c(NA,18)) +

geom_smooth(method="lm", se=FALSE) +

geom_errorbarh(aes(xmax=xright, xmin = xleft)) +

geom_errorbar(aes(ymax=ytop, ymin = ybottom)) +

theme(legend.position="none")# Chart of mean revt_lead for Singaporean firms (slide 12.6)

df_clean %>% # Our data frame

filter(fic=="SGP") %>% # Select only Singaporean firms

group_by(isin) %>% # Group by firm

mutate(mean_revt_lead=mean(revt_lead, na.rm=T)) %>% # Determine each firm's mean revenue (lead)

slice(1) %>% # Take only the first observation for each group

ungroup() %>% # Ungroup (we don't need groups any more)

ggplot(aes(x=mean_revt_lead)) + # Initialize plot and select data

geom_histogram(aes(y = ..density..)) + # Plots the histogram as a density so that geom_density is visible

geom_density(alpha=.4, fill="#FF6666") # Plots smoothed density