Main results

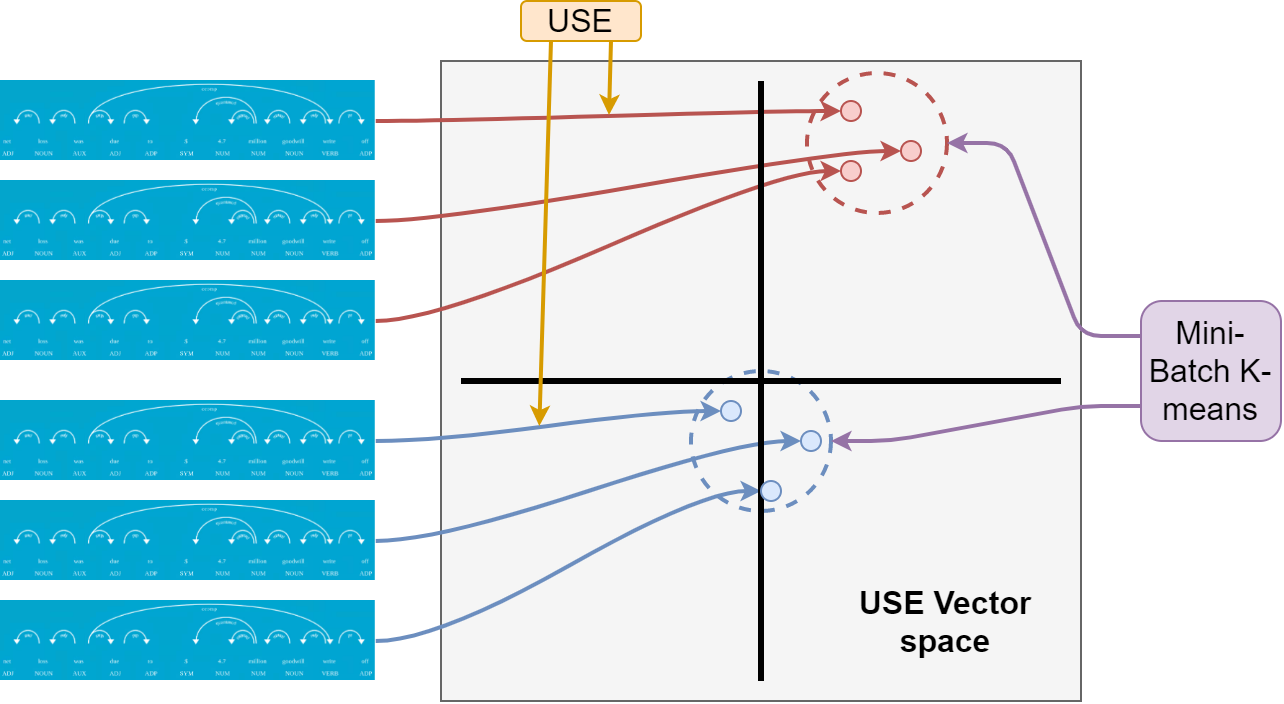

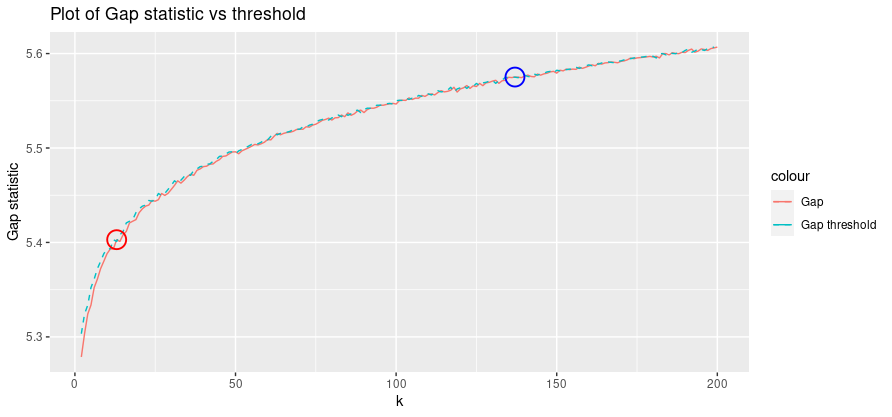

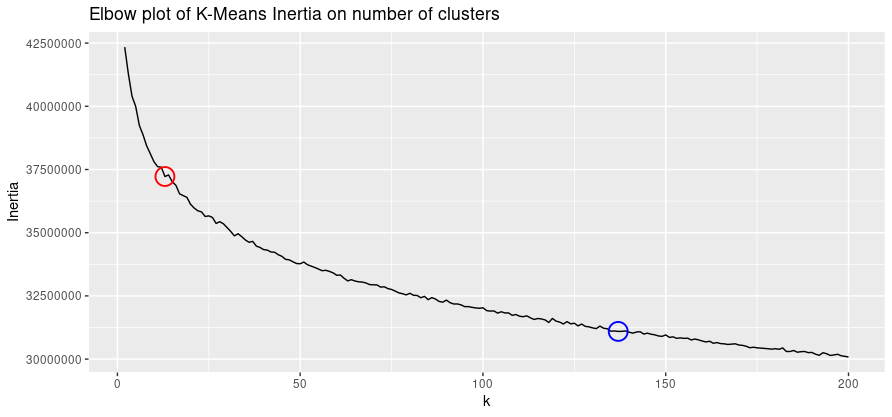

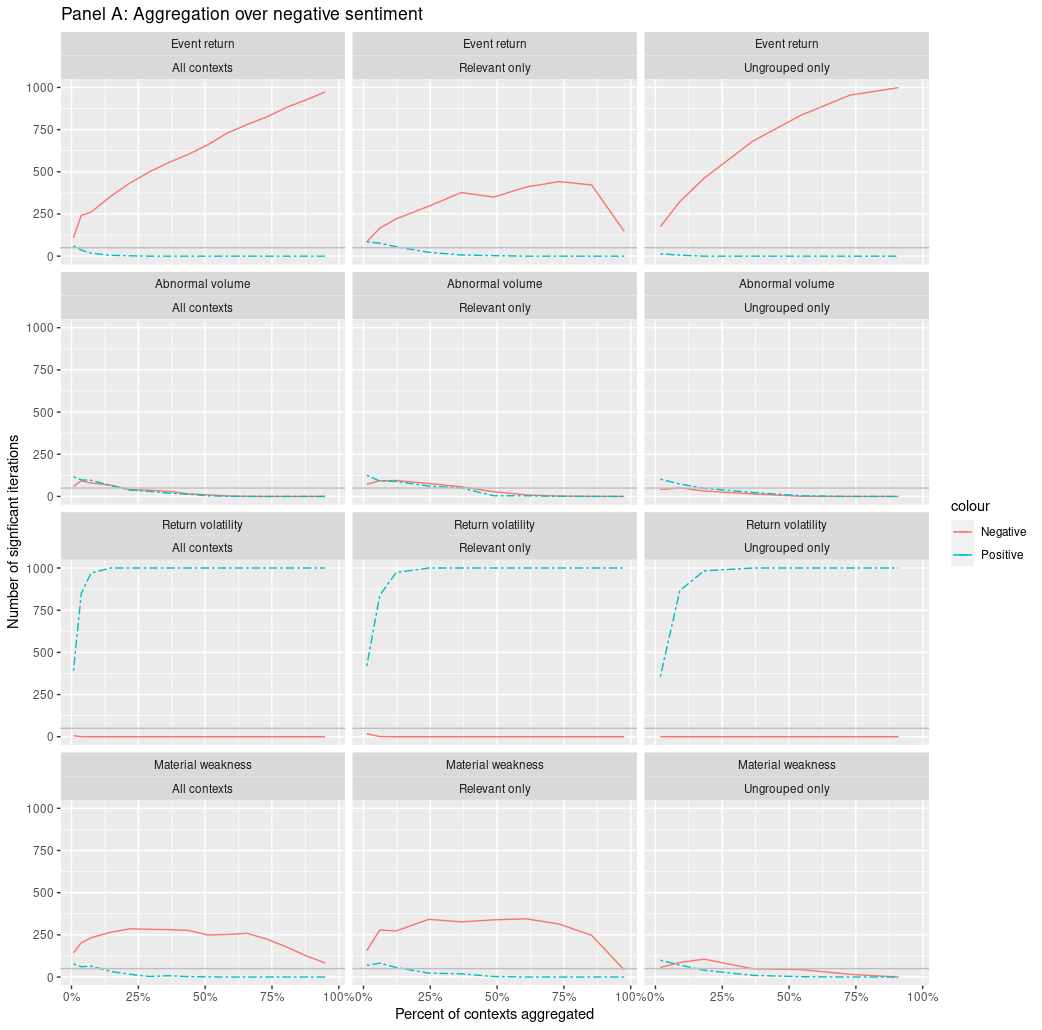

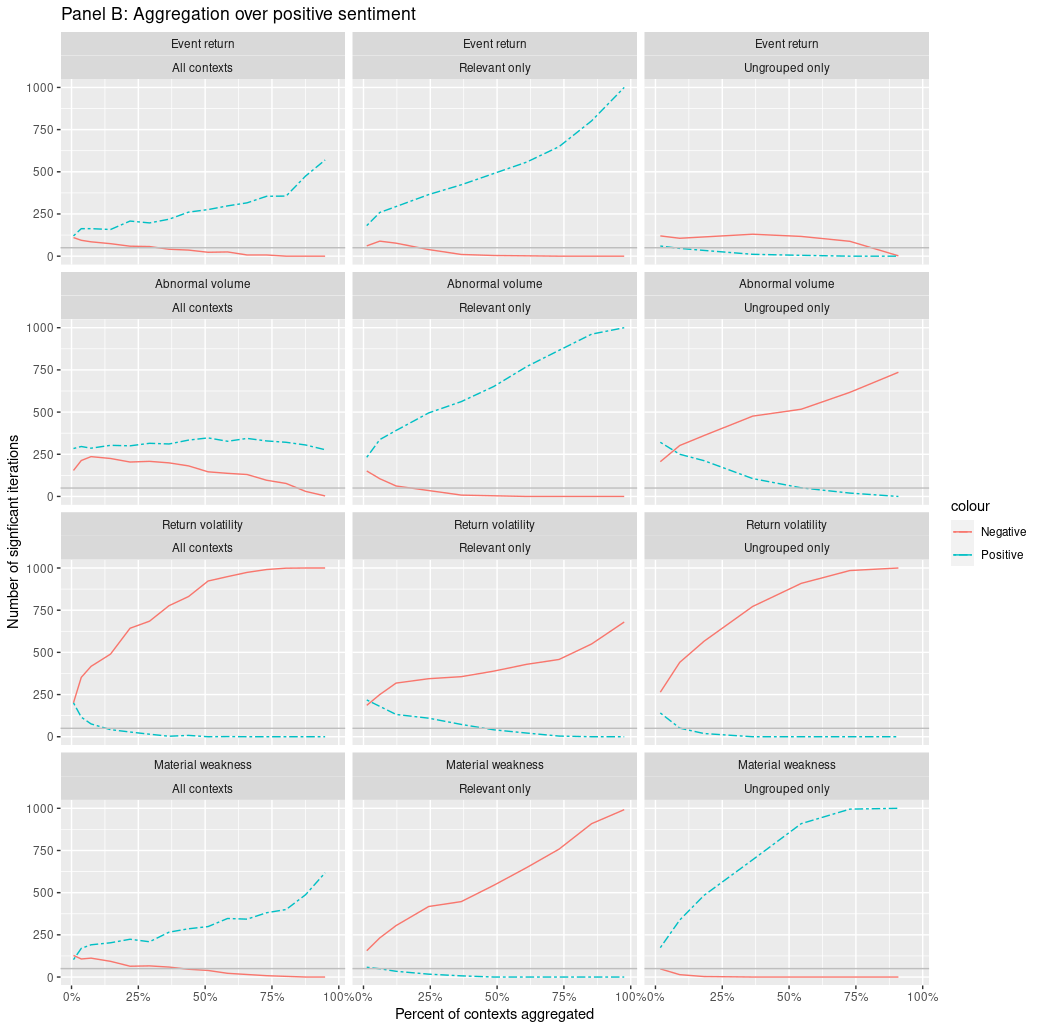

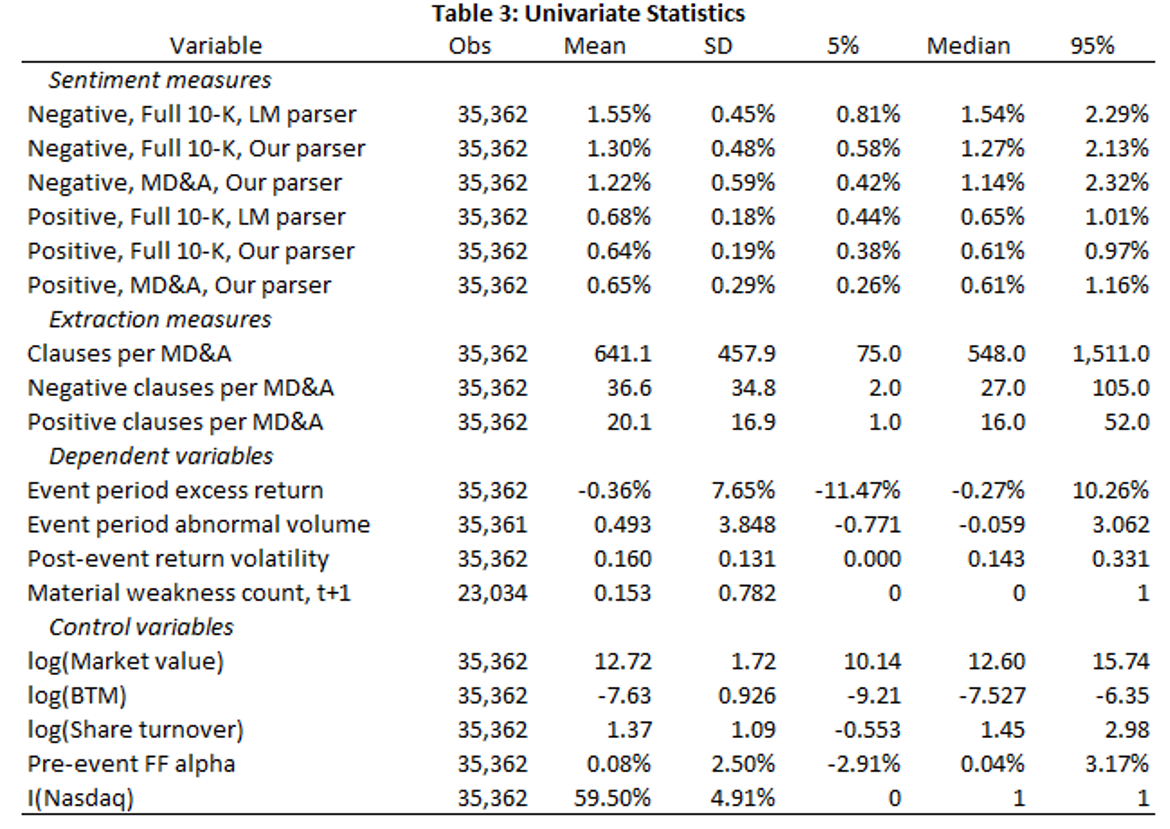

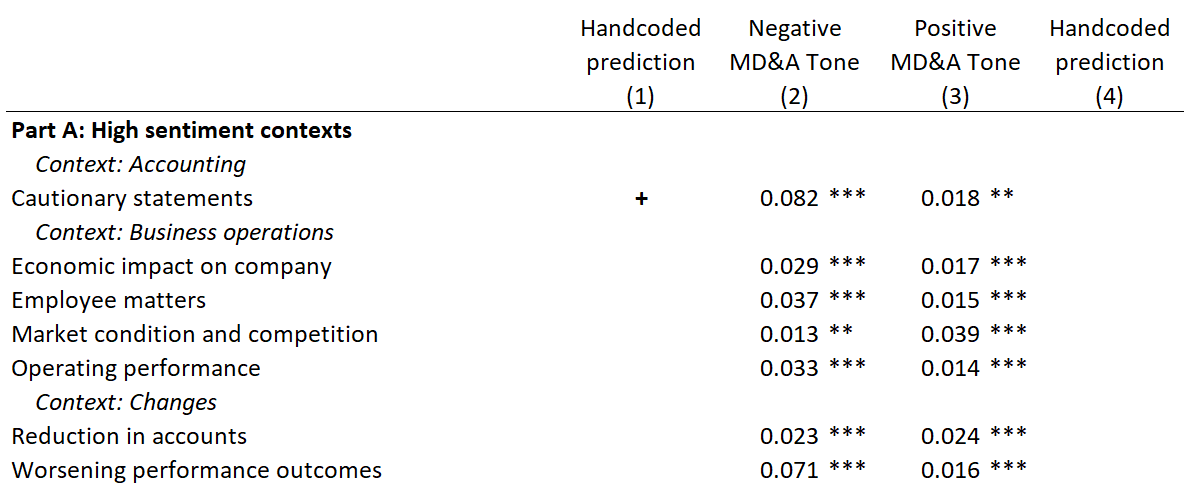

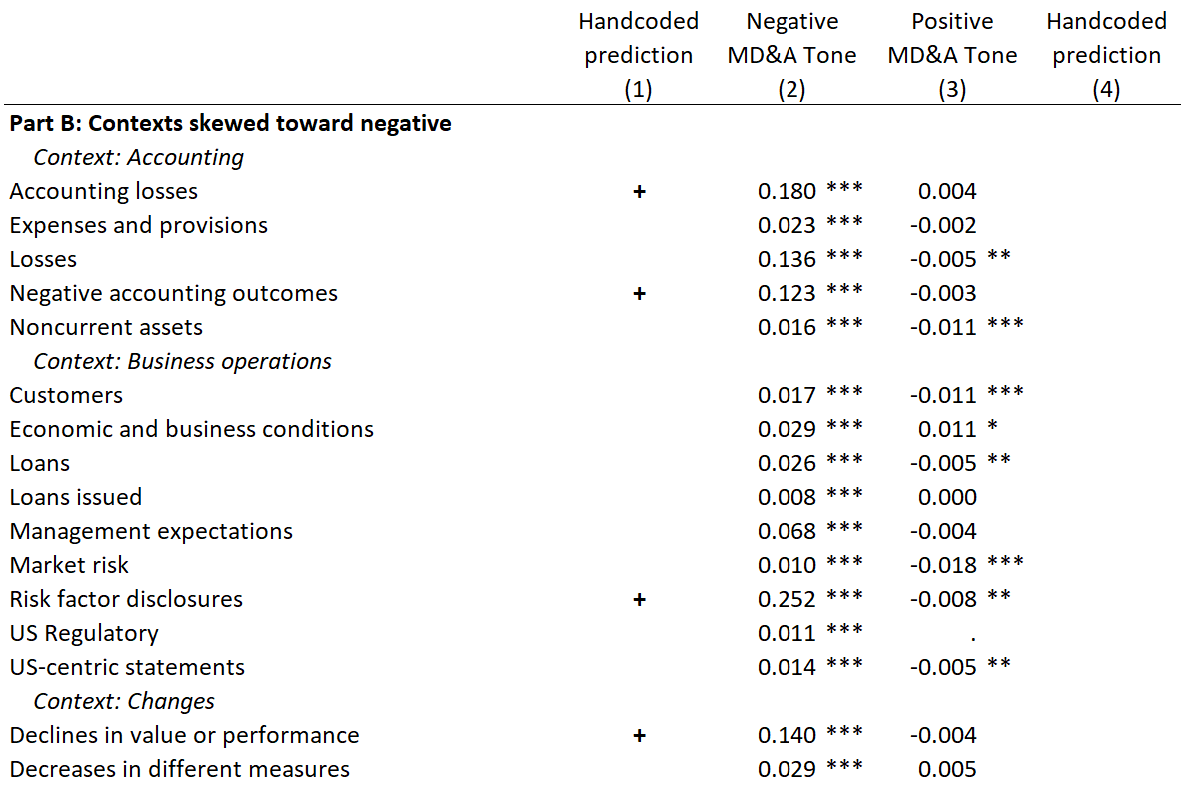

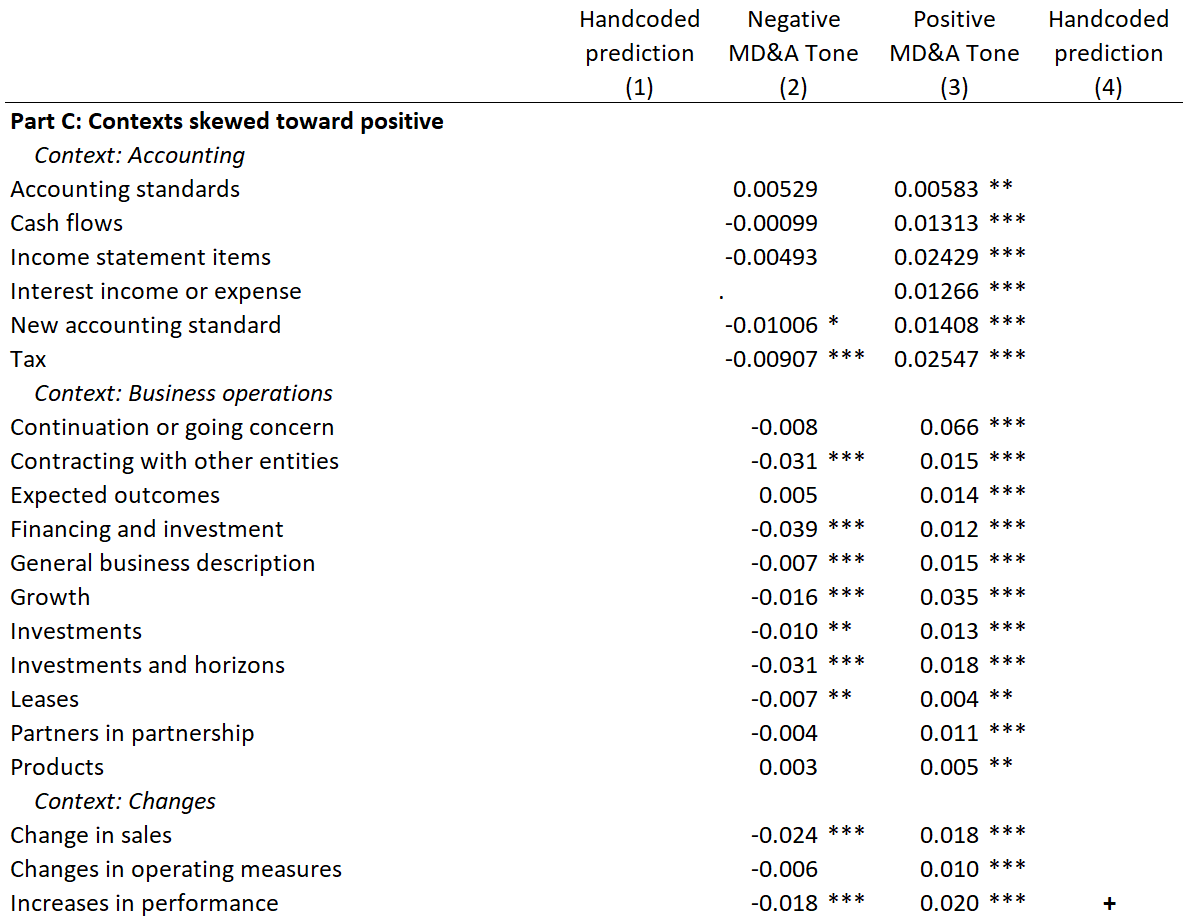

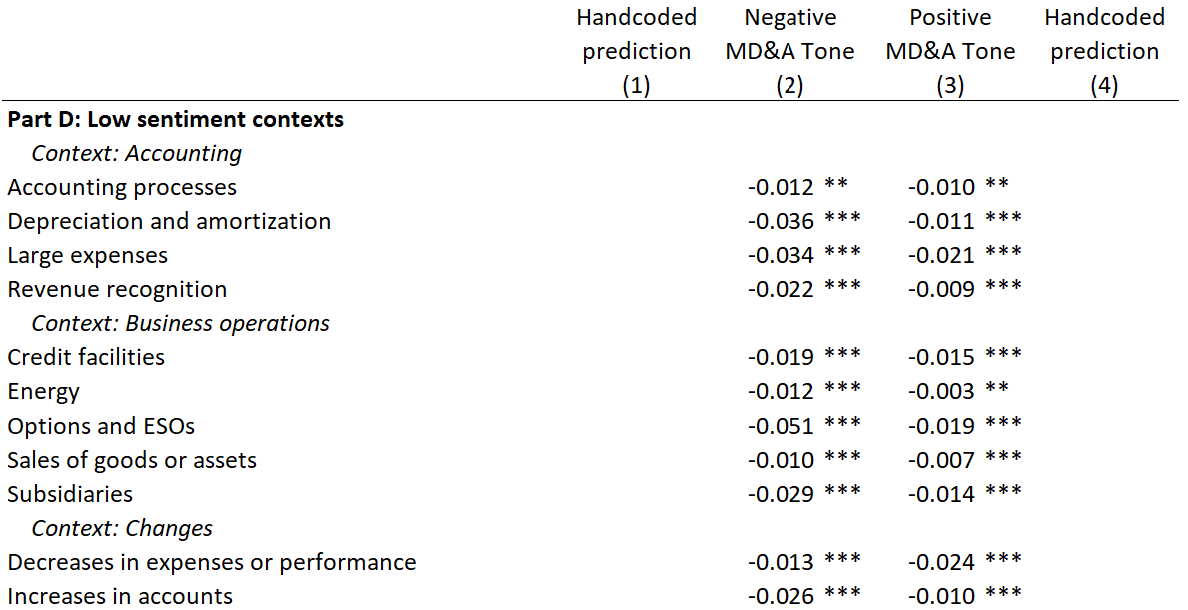

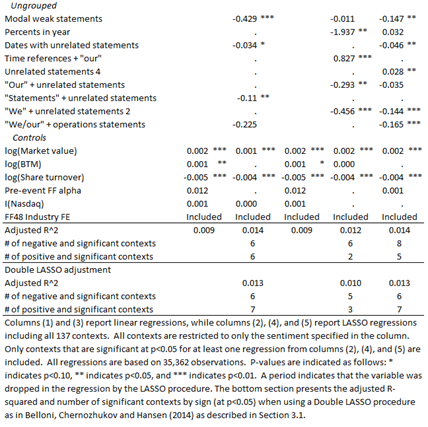

- Only a few key contexts drive each financial sentiment result

- Aggregation to document-level sentiment adds a lot of noise

- Sentiment, at the context level, often contradicts prior results

- Aggregation removes nuance from our understanding

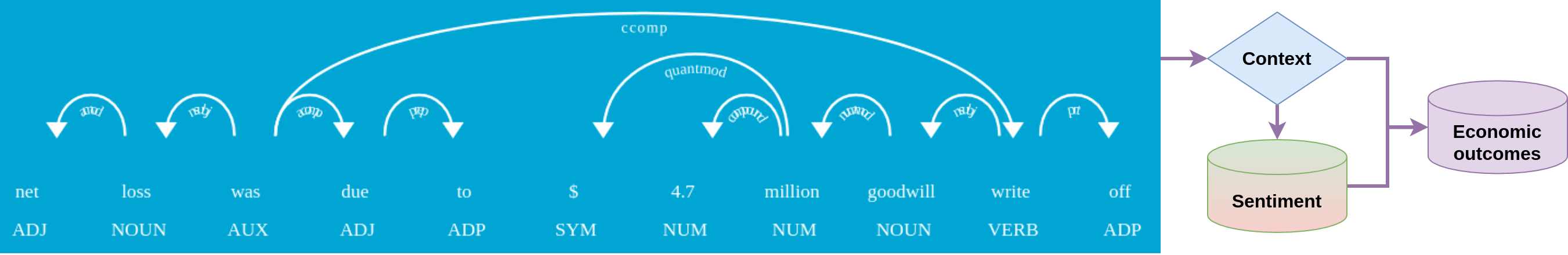

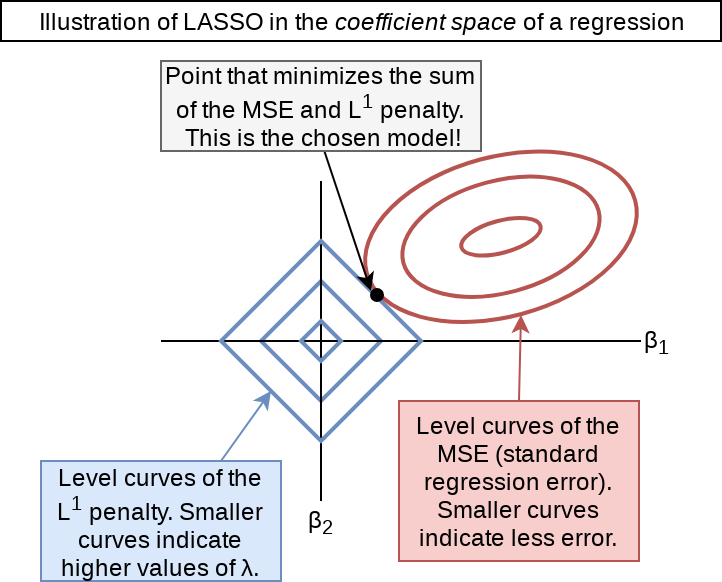

- Different contexts drive prediction for different DVs

- Sentiment captures different empirical constructs in different regressions

- The above results hold across 2 other financial sentiment dictionaries

- Our results are not unique to the LM dictionary

- The above results hold using a neural network-based sentiment measure

- Bag-of-words isn’t the problem – financial sentiment, as a construct, likely is

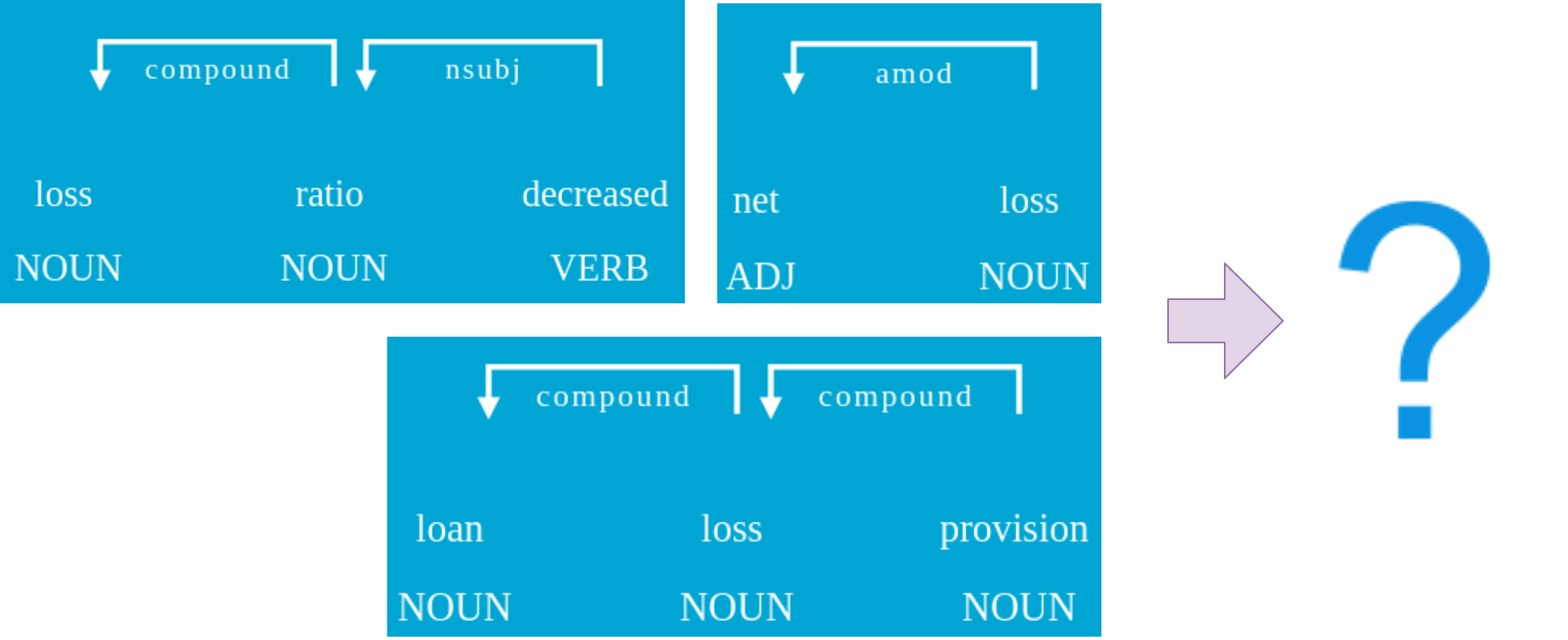

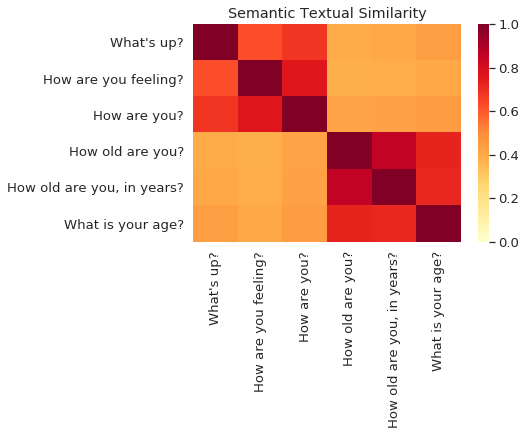

Punchline: Sentiment should be measured on fine-grained contexts, not full documents

- In other words, a precise matching between the text used and the economic question examined is needed