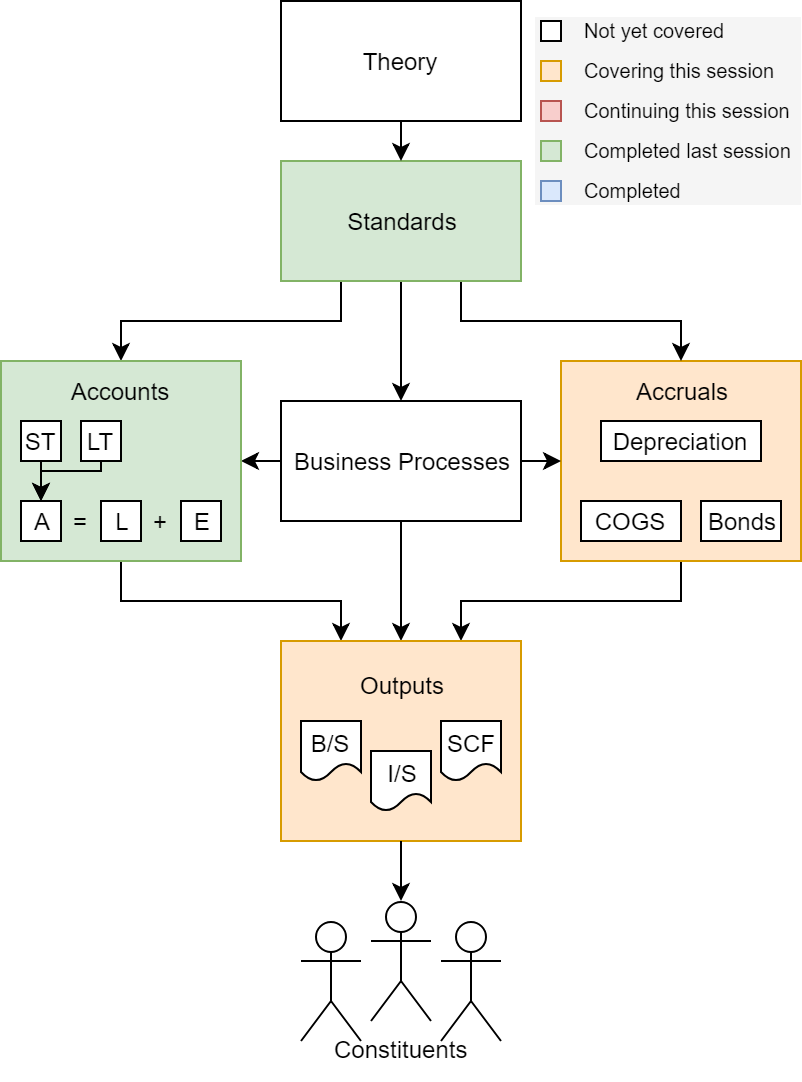

ACCT 101: Bookkeeping, accruals, and adjusting

Session 2

Dr. Richard M. Crowley

rcrowley@smu.edu.sg

http://rmc.link/

Front matter

Front matter

- Homework 1 due next week

- Available on eLearn

- Submit on eLearn

- Covers topics from today’s session

Learning objectives

- Bookkeeping (Chapter 2)

- Understand how accounting works

- Record transactions in the journal

- Construct a trial balance

- Accruals and Adjustments (Chapter 3)

- Relate accrual accounting and cash flows

- Apply the revenue and matching principals

- Adjust accounts

Debits and credits

History: Before double entry

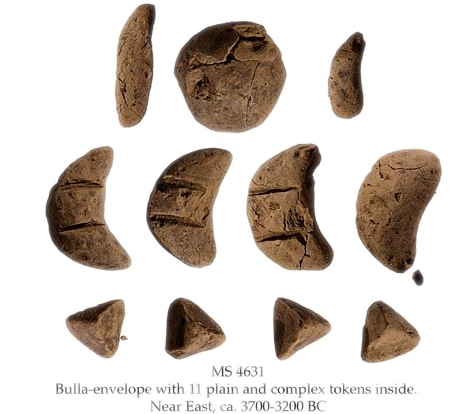

- 8500 BCE: Shaped clay tokens represent commodities

- 200 BCE: Arabic numerals (except 0)

- 600 CE: 0 developed

- 800 CE: 10-digit numerals spread throughout Europe

*Note: This slide is based on a history lecture by Dr. Pierre Liang at Carnegie Mellon from October 2017

History: Double entry

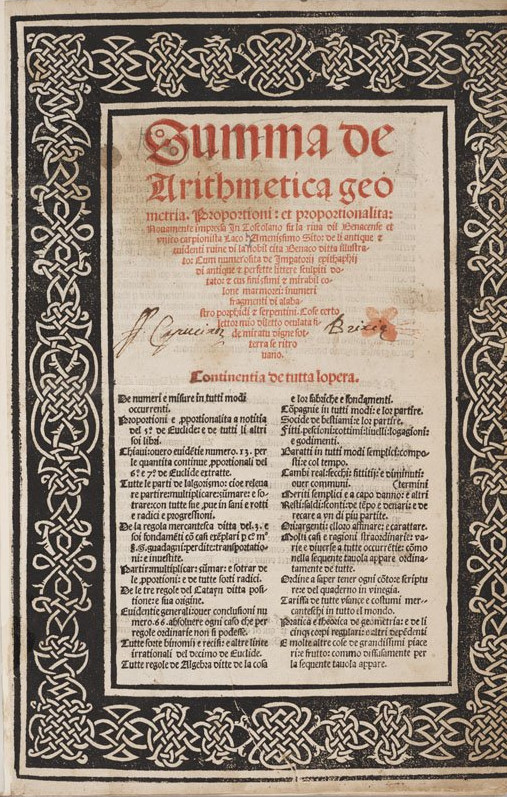

- 1400s CE: First evidence of double entry accounting in Italy

- 1494 CE Italian monk and scholar Luca Pacioli publishes first text on double entry bookkeeping

*Note: This slide is based on a history lecture by Dr. Pierre Liang at Carnegie Mellon from October 2017

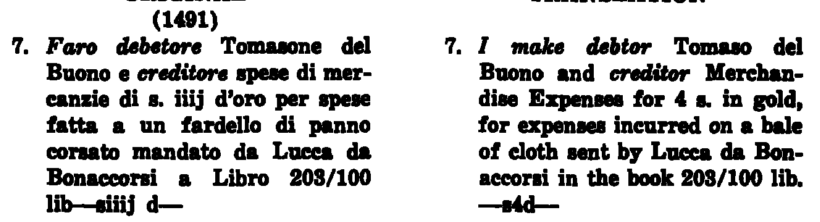

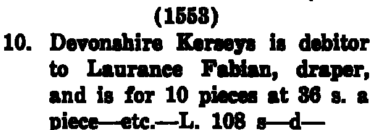

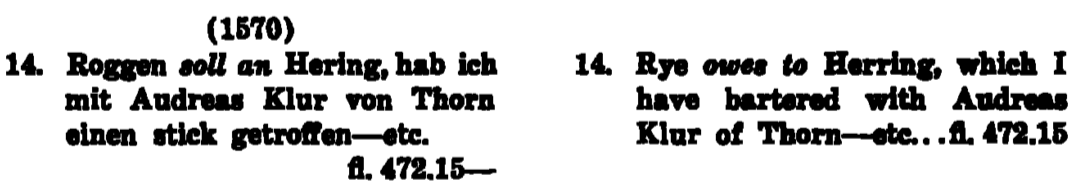

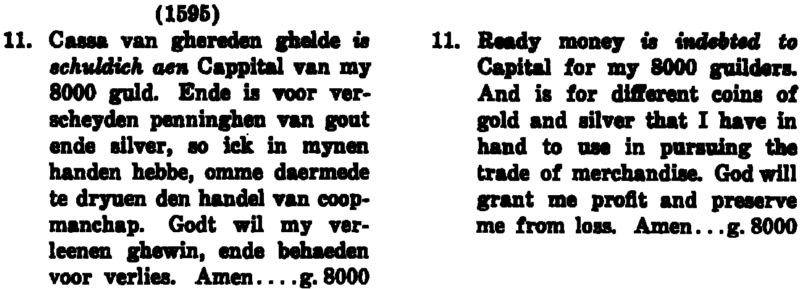

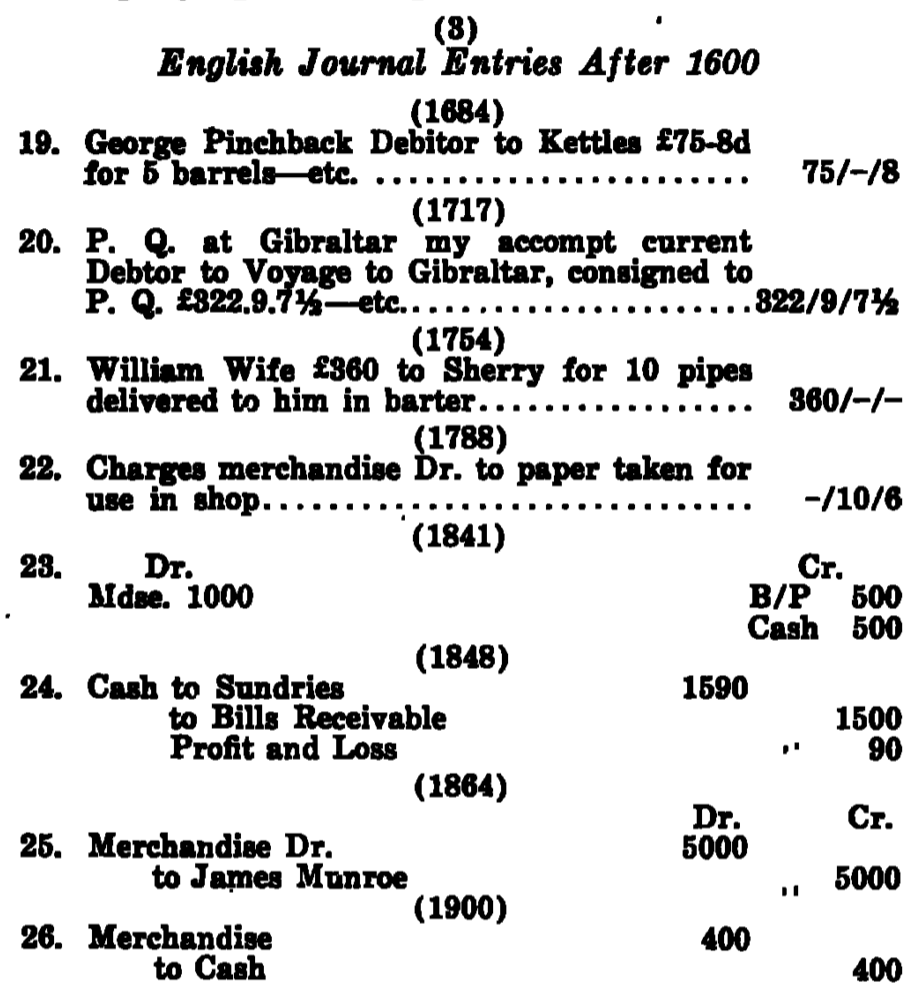

History: Journal entries

Images from Littleton 1928 TAR.

History: Journal entry evolution

Shakespeare likely did this sort of work for the British Navy! (Source: Reynolds 1974 JAR)

History: Impact

The Principles of Book-keeping by Double Entry constitute a theory which is mathematically by no means uninteresting: it is in fact like Euclid’s theory of ratios an absolutely perfect one, and it is only its extreme simplicity which prevents it from being as interesting as it would otherwise be.

– Arthur Cayley, FRS, The Principles of Book-keeping by Double Entry, 1894.

Bookkeeping has become a real technology instead of a simple clerical routine, and in addition there has grown up a profession of accounting which reaches quite beyond bookkeeping.

– A. C. Littleton, The Evolution of the Journal Entry, 1928.

← Debit | Credit →

Debits

on

the

left

Credits

on

the

right

Memorize this!

This is double entry accounting

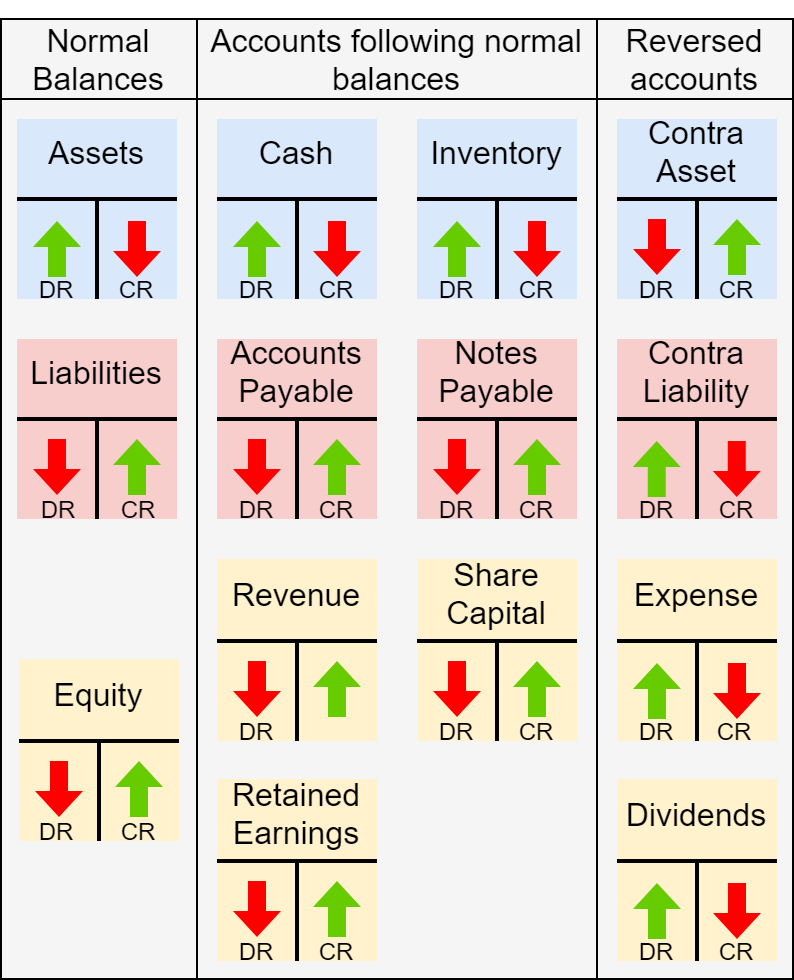

Debits and credits

Debits (DR)

- Increase assets

- Decrease liabilities

- Decrease equity

- Decrease revenue

- Increase expenses

Credits (CR)

- Decrease assets

- Increase liabilities

- Increase equity

- Increase revenue

- Decrease expenses

The side of an account that increases its balance is called the account’s normal balance

Debits always equal credits for a transaction

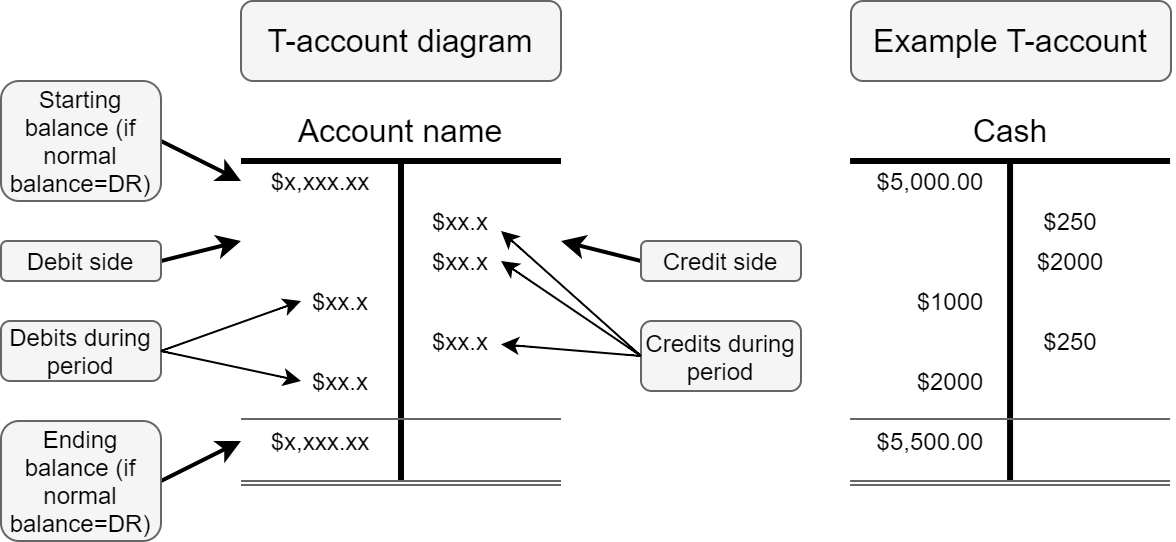

Representing accounts: T-accounts

Normal balances

Review: Debits & credits

- Where do debits go?

- Where do credits go?

- What do debits equal?

- What do credits equal?

Review: Debits & credits

- Where do debits go?

- Left!

- Where do credits go?

- Right!

- What do debits equal?

- Credits!

- What do credits equal?

- Debits!

Why does this all matter?

\[ \begin{align*} A = L + E\qquad &A,L,E \in (-\infty,\infty)\\ DR = CR\qquad &DR,CR > 0 \end{align*} \]

- Both of these equations inherently require that at least two changes are made with each transaction

- For the top equation, the changes must either:

- Affect both sides in the same direction, or

- Cancel out within one side

- For the bottom equation, the change must have a debit and a credit

- For the top equation, the changes must either:

- As these hold at the smallest element of the system, they aggregate up to hold for any amount of transactions

- I.e., for a whole company or any subset thereof

Now we have a robust way to check for mistakes anywhere in our accounting system – just check each equation!

Bookkeeping

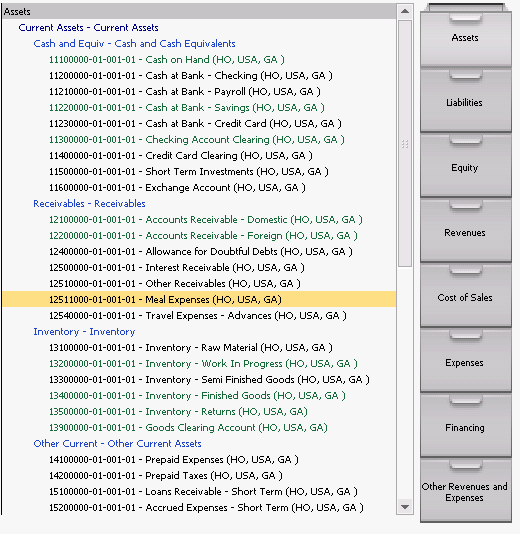

Accounts

- Assets: Cash, A/R, inventory, equipment, …

- Liabilities: A/P, debt, expenses payable, …

- Equities: Expenses, revenue, capital, ret. earnings, …

- Documented granularly in the Chart of Accounts

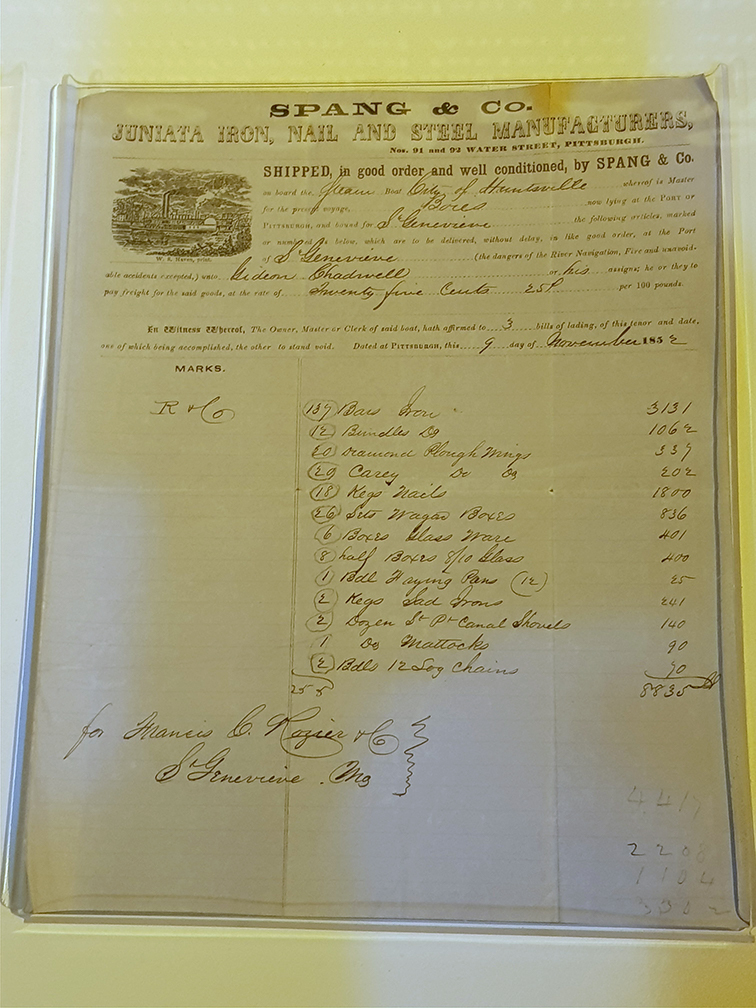

Source documents

- The paper trail

- Establishes amounts

- Confirms a traction occurred or was contracted

- Allows for analyzing and verifying at the transaction level

- Needed for auditing!

Bill of laiding, 1852

[Heinz Museum]

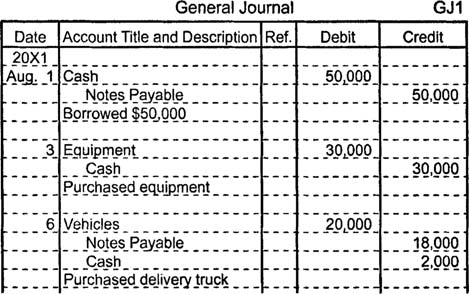

General journal

- Where everything is recorded first

- Everything

- Every little transaction

- Specifies the accounts, values, and document for each transaction

- We will skip references

- We will be doing journal entries through session 9

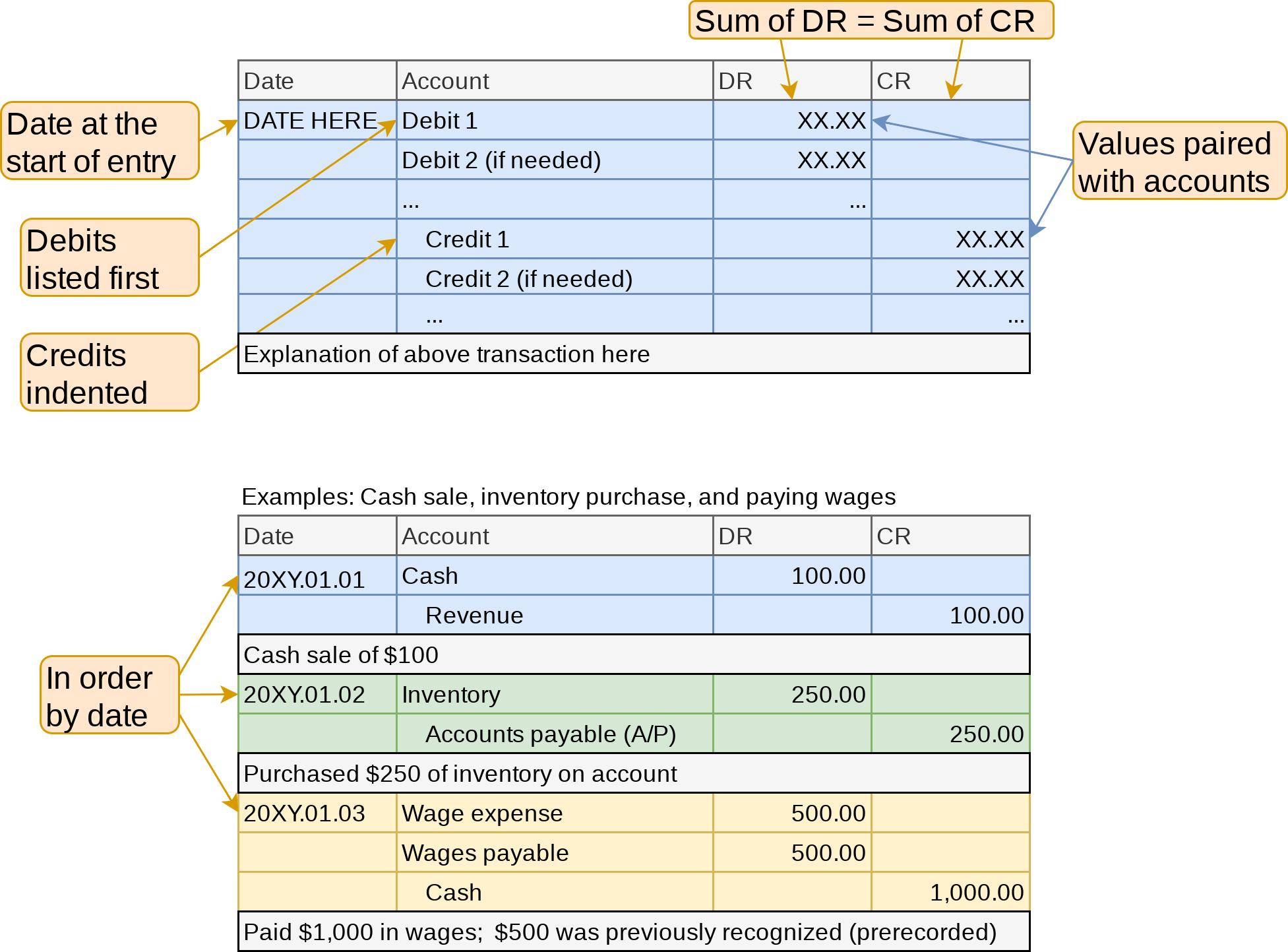

- Always list debits first

DR = CR for each entry

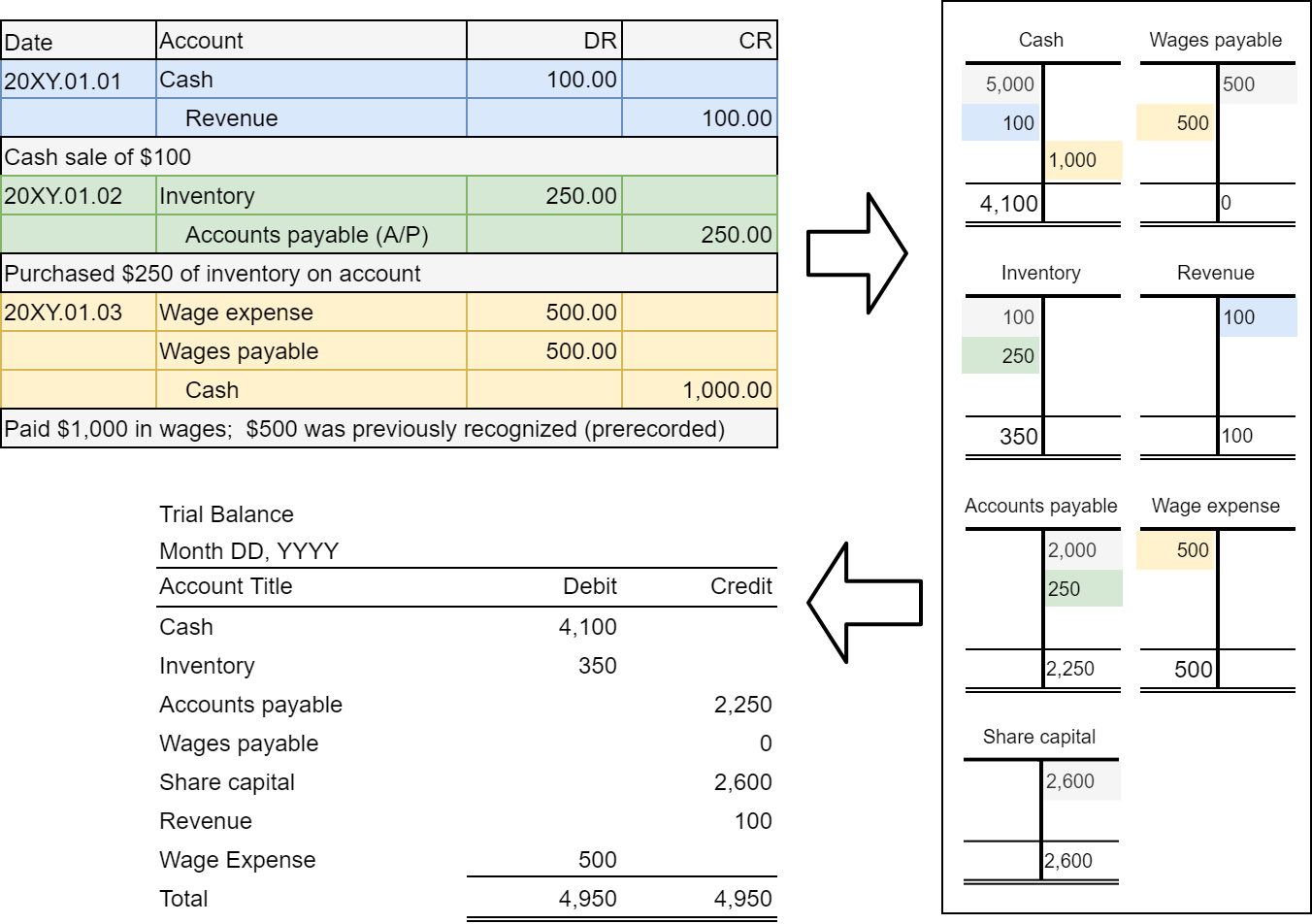

Constructing journal entries

Constructing journal entries

- Get the in class activity spreadsheet

- Session_2_Activity.xlsx

- We’ll go through the first three transactions together

- Journal entries

- Journal (i.e., right out journal entries for) the next 11 transactions with your group in the blue tab of the spreadsheet

- We’ll do the rest of the activity throughout the class today

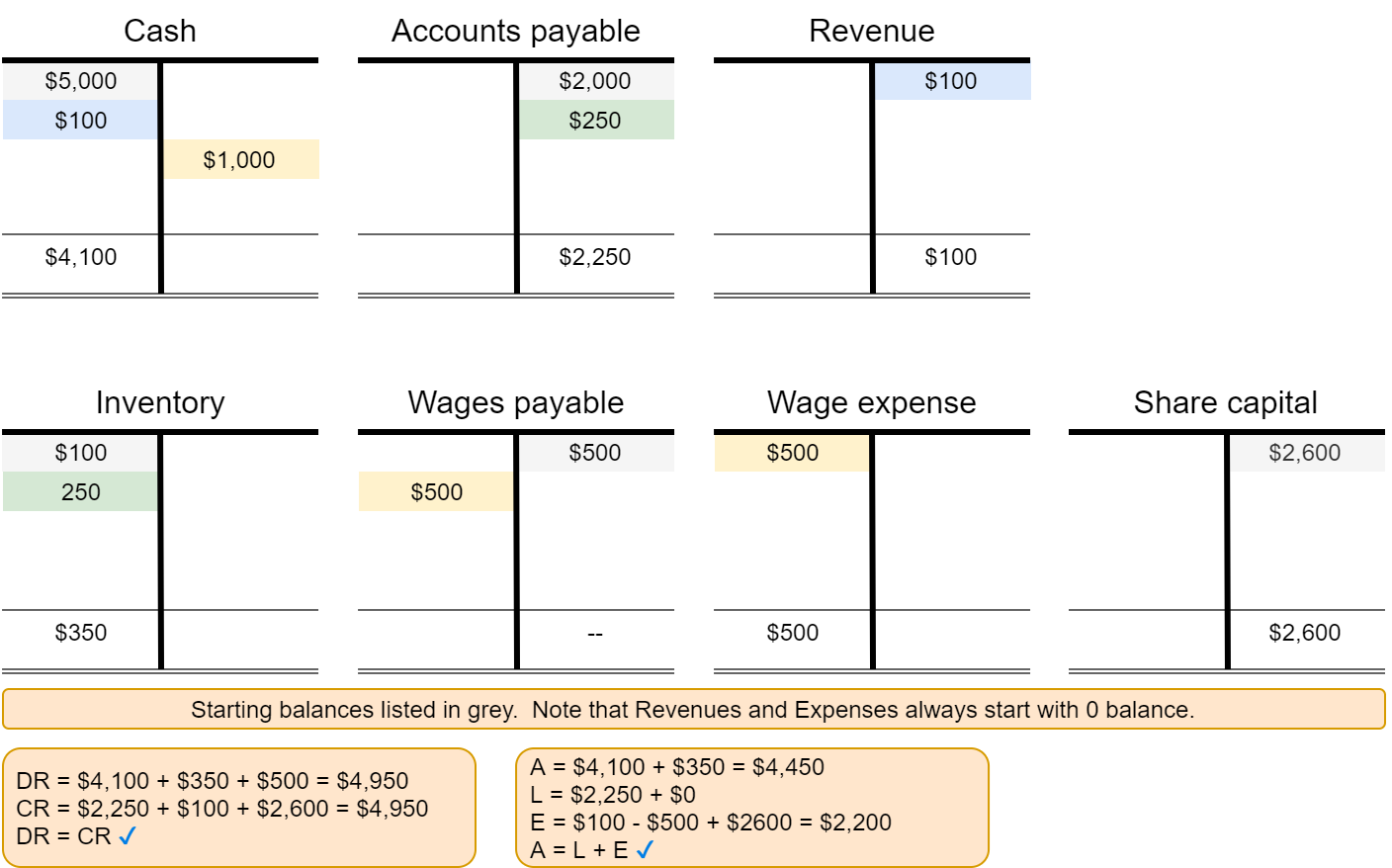

General ledger

- An aggregation of all the accounts

- Shows all account balances

- Includes details of each account

- T-accounts sufficient for this course

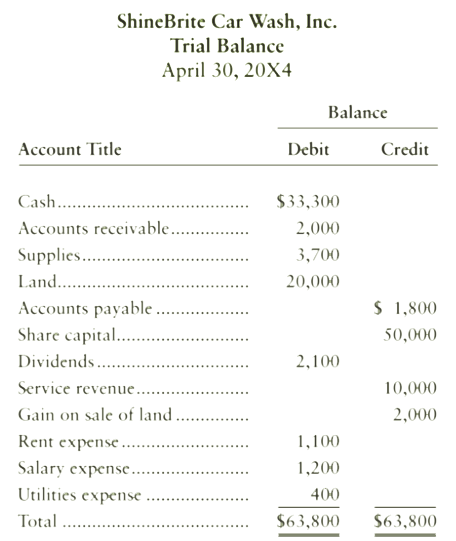

Trial Balance

- Shows all account balances just like the general ledger

- Make sure they add up!

- Use it to verify DR = CR

- Use it to verify the accounting equation

- Usually prepared at the end of a period

- Can prepare income statement and balance sheet from it

DR = CR for totals

Constructing the trial balance

Limits of the trial balance

- Can’t catch:

- Unrecorded transactions

- Because there’s no trace of them

- Wrong amounts in transactions that balance in the journal

- Everything still balances

- Wrong accounts of the same type used in the journal

- Everything still balances

- \(A = L + E\) holds

- Unrecorded transactions

What you can catch

- Let the Out of balance (OOB) amount be:

- \(OOB = Assets - Liabilities - Equity\)

- If OOB / 2 is an integer

- DR and CR in a transaction may be flipped

- Ex.: Recorded a cash sale as a CR to cash and a CR to revenue

- Should be a DR to cash and a CR to revenue

- Ex.: Recorded a cash sale as a CR to cash and a CR to revenue

- DR and CR in a transaction may be flipped

- If OOB / 9 is an integer, there may be a:

- Slide error (multiplied by 10 or divided by 10):

- Ex.: Recorded 5,400 instead of 54,000

- Transposition error (flipped the first 2 digits)

- Ex.: Recorded 45,000 instead of 54,000

- Slide error (multiplied by 10 or divided by 10):

T-accounts and the trial balance

- Return to the in class activity

- We’ll do the first one as a class

- Finish the rest of the activity with your group

- Do the two green tabs

Accruals vs. Cash

Cash basis accounting

- Records cash only transactions

- Used by small companies

- \(Profit = Cash~in - Cash~out\)

PROBLEM

- This ignores underlying economic activity

- If we make a sale on credit, that doesn’t add to profit

- If we put an expense on credit, it doesn’t lower profit

Accrual accounting

- Records impact of transactions as they occur

- Required per IAS1, “Presentation of Financial Statements”

- Revenue recorded when it is “more likely than not”

- Expenses recorded as incurred

- Profit = Revenue - Expenses

PROBLEM

- Profit may not be indicative of cashflows

- This is a concern for lenders

- If there’s no cash, profit doesn’t matter, as the company will go bankrupt

- This is a concern for lenders

Accrual transaction examples

| Cash Transactions | Noncash Transactions |

|---|---|

| Cash sale | Sales on account (A/R) |

| Borrowing money | Inventory purchases on account (A/P) |

| Paying expenses such as wages and rent | Expenses incurred but not yet paid |

| Receiving cash from interest earned | Depreciation expense |

| Paying off loans | Usage of prepaid expenses (rent, utilities, etc.) |

| Receiving cash from shares issued | Revenue from long-term projects with up-front cash collection |

Periodicity

- Divides time into artificial segments to understand a firm’s changes over time

- Fiscal year, fiscal quarter

- Breadtalk: Jan 1 - Dec 31

- Citigroup: Jan 1 - Dec 31

- Microsoft: Jul 1 - Jun 30

- Walt Disney

- 2020: Sept 29 - Oct 2

- 2019: Sept 30 - Sept 28

- 2018: Oct 1 - Sept 29

Don’t focus on this too much for this class

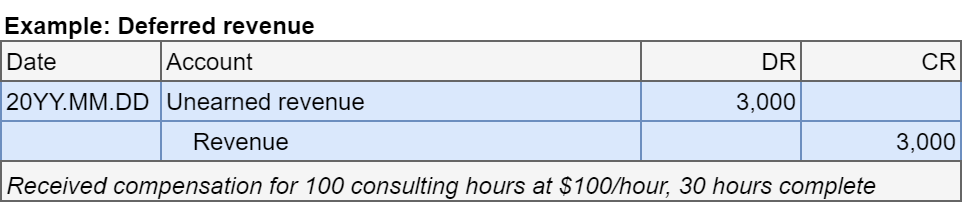

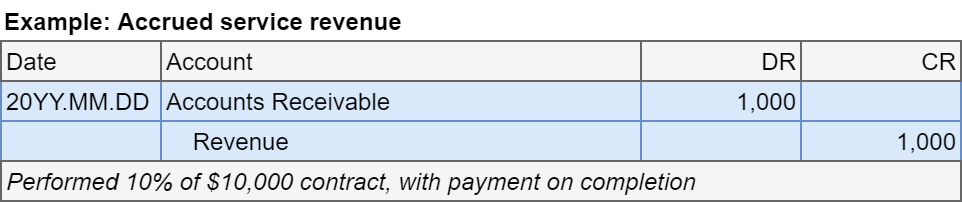

Revenue recognition principal

- Recognize revenue in the period it was earned

- This may not be when cash is received

- Goods revenue recorded when it is more likely than not

- Service revenue recorded at the percentage complete

- If 50% of the work is finished, record 50% of the revenue

- If 20% of the work is finished, record 20% of the revenue

This will lead to a lot of tricky accounting, but mostly around period ends

Recognizing revenue

- Record revenue when:

- Revenue can be measured reliably

- Economic benefits are more likely than not

- For goods, you also need to:

- Transfer any significant risks to buyer

- If we are shipping [FOB destination], wait until received

- If they handle shipping [FOB shipping point], wait until picked up for delivery

- Have no continuing managerial involvement (to an extent)

- Be able to reliably measure all costs incurred from the transaction

- Transfer any significant risks to buyer

- For services, you also need to be able to reliably measure:

- The stage of completion

- The costs incurred to date and costs to finish

Expense recognition

- Recognize expenses only when an asset is used up

- Asset purchase \(\ne\) expense

- Can record partial usage

- Formally, expenses are recognized when:

- Obligations are incurred, such as when services have been received

- Obligations are offset against recognized revenues (matching principle)

Matching principal: Expenses are recorded in the same period as the related revenue

- E.g., even if we aren’t given an electricity bill that neatly aligns with our fiscal year end, we need to record the portion of the next one associated with the ending fiscal year

Expense matching

- 3 ways to match

- Directly

- The expense is easy to track to an account

- Ex.: Inventory

- The expense is easy to track to an account

- Indirectly (over a period)

- The asset has a long life or is difficult to track

- Ex.: Buildings

- The asset has a long life or is difficult to track

- With acquisition

- Simultaneous usage and acquisition

- Ex.: Utilities, rent, labor

- Often prepaid expenses

- Simultaneous usage and acquisition

When should we record…

- A sale we are shipping at our expense

- A sale we are shipping at the buyer’s expense

- Revenue for a week long consulting project paid for up front

- Electricity usage

- Building usage (our building)

- Sale of inventory for revenue

When should we record…

- A sale we are shipping at our expense

- Once the product reaches the buyer

- A sale we are shipping at the buyer’s expense

- Once we ship the product

- Revenue for a week long consulting project paid for up front

- Once the project is finished

- Electricity usage

- When billed or at period end (matching principle)

- Building usage (our building)

- At period end (matching principle)

- Sale of inventory for revenue

- At the time the revenue is recognized

Adjustments

Why do we need to adjust?

- The matching principle

- Everything needs to be matched at period end

- Do before balance sheet and income statement

- Adjustments will go to the trial balance once we record them

- We call this an Adjusted trial balance

- Why not do this continuously?

- Too costly – some accounts continuously change

- Investors only see period-end statements anyway

We’ll only do this at period end

What do we need to adjust?

- Adjustments needed to:

- Asset values

- Prepaid expenses

- Inventory, supplies, etc.

- Noncurrent assets

- Liabilities

- Payables we have yet to recognize

- Unearned revenues

- Asset values

- Balanced by:

- Revenues

- Expenses

- All adjustments affect:

- 1 B/S account

- Assets

- Liabilities

- Equity excluding revenues/expenses

- 1 I/S account

- Revenue or expense

- 1 B/S account

- NEVER affects cash

Adjusting entry types

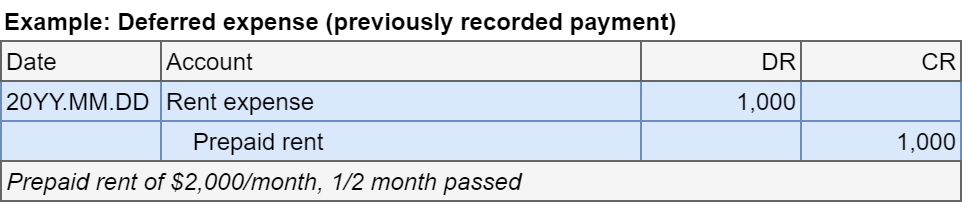

- Deferral

- Adjust for prepaid expense (some used)

- Adjust for unearned revenue (some may be earned)

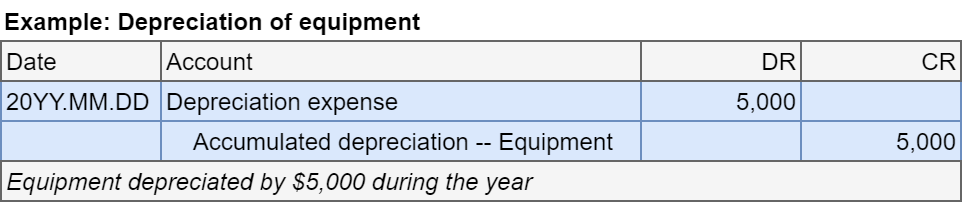

- Depreciation

- Some long term assets have been used up

- Accrual

- Record an expense in advance

Deferral

- Adjustment for cash paid or received in advance

- Expense or revenue has yet to occur

- We defer some of it to the next period

Depreciation

- Adjustment for allocating the cost of Property, Plant and Equipment (PP&E) over its useful life

- Record to accumulated depreciation

- Asset’s book value is asset account minus accumulated depreciation

- Depreciate to salvage value

- What you expect to get when it is used up

Depreciation methods

- Straight line

- Same amount each period

- If \(N\) periods, \(S\) salvage value, \(H\) historical cost:

- \((H-S)/N\) per period

- Units of activity

- Expense based on units produced

- Good if capacity is known and tracked

- Declining balance

- More depreciation early on, less later

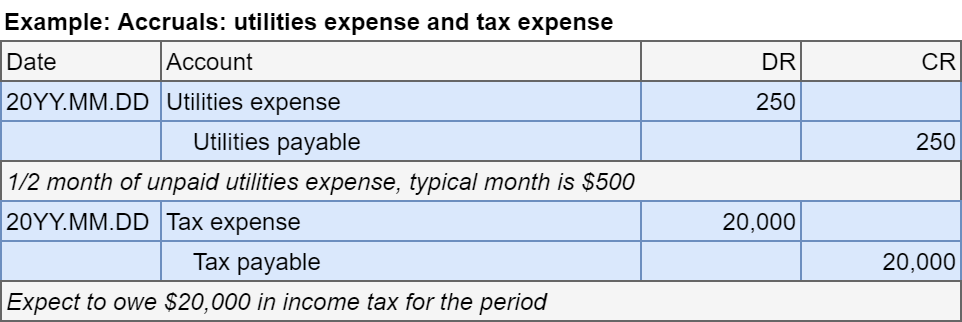

Accrual

- Accrued expense: debit expense, credit liability

- Accrued revenue: debit asset, credit revenue

Overall effects

| Type | Asset (↑=DR) | Liability (↑=CR) | Expense (↑=DR) | Revenue (↑=CR) |

|---|---|---|---|---|

| Deferal: prepaid expense | ↓ | ↑ | ||

| Deferal: unearned revenue | ↓ | ↑ | ||

| Depreciation | ↓ | ↑ | ||

| Accrual: accrued expense | ↑ | ↑ | ||

| Accrual: accrued revenue | ↑ | ↑ |

Adjusting entries

- Return to the in class activity

- 4 adjusting entries to add in

- Do the three yellow tabs

Closing the books

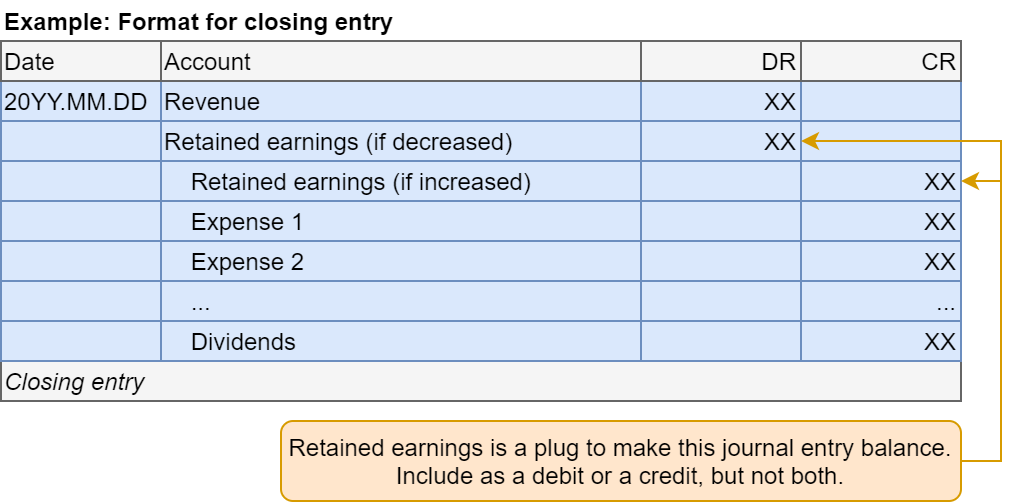

Closing the books

- Reset all temporary accounts to 0

- All revenues

- All expenses

- Dividends

- Record a credit to temporary accounts with debit balances

- Expenses, losses, dividends

- Record a debit to temporary accounts with credit balance

- Revenues, gains

- Helps to track income through each period

- Since all income-related accounts start each period with 0 balance

Reset temporary accounts at period end

- We close the accounts into retained earnings directly

- Or close into income summary, and then close that into retained earnings

- Debit Revenue, Credit Retained earnings

- Debit Retained earnings, Credit Expense

- Debit Retained earnings, Credit Dividends

Closing entry

- Return to the in class activity

- 1 closing entry to add in

- Do the two red tabs

End Matter

Wrap up

- For next week

- Recap the reading for this week

- Read the pages for next week

- Capital Structure (Chapter 10)

- Accounting Statements (Chapter 3, Part B)

- Homework to turn in next week

- Available on eLearn

- Submit on eLearn

- Practice on eLearn

- Practice on journal entries

- Automatic feedback provided

- Survey on the class session at rmc.link/101survey2

Packages used for these slides

- kableExtra

- knitr

- revealjs