ACCT 420: Logistic Regression

Session 5

Dr. Richard M. Crowley

Front matter

Learning objectives

- Theory:

- Further understand:

- Binary problems

- Further understand:

- Application:

- Detecting shipping delays caused by typhoons

- Methodology:

- Logistic regression

Datacamp

- Explore on your own

- No specific required class this week

Assignment 2

- Looking at Singaporean retail firms

- Mostly focused on time and cyclicality

- Some visualization

- A little of what we cover today

- Optional:

- You can work in pairs on the homework.

- If you choose to do this, please only make 1 submission and include both your names on the submission

- You can work in pairs on the homework.

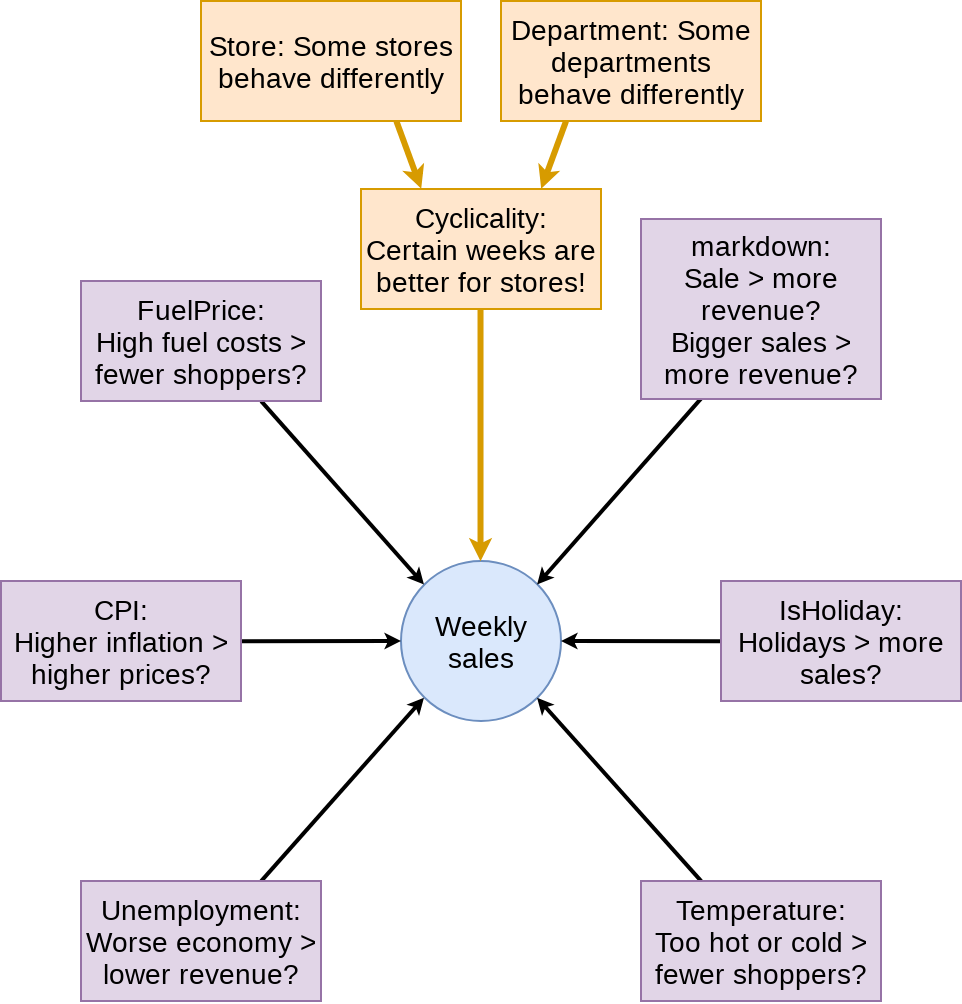

Weekly revenue prediction

Shifted from week 4

The question

How can we weekly departmental revenue for Walmart, leveraging our knowledge of Walmart, its business, and some limited historical information

- Predict weekly for 115,064 (Store, Department, Week) tuples

- From 2012-11-02 to 2013-07-26

- Using [incomplete] weekly revenue data from 2010-02-015 to 2012-10-26

- By department (some weeks missing for some departments)

More specifically…

- Consider time dimensions

- What matters:

- Time of the year?

- Holidays?

- Do different stores or departments behave differently?

- What matters:

- Wrinkles:

- Walmart won’t give us testing data

- But they’ll tell us how well the algorithm performs

- We can’t use past week sales for prediction because we won’t have it for most of the prediction…

- Walmart won’t give us testing data

The data

- Revenue by week for each department of each of 45 stores

- Department is just a number between 1 and 99

- Date of that week

- If the week is considered a holiday for sales purposes

- Super Bowl, Labor Day, Black Friday, Christmas

- Store data:

- Which store the data is for, 1 to 45

- Store type (A, B, or C)

- Store size

- Other data, by week and location:

- Temperature, gas price, sales (by department), CPI, Unemployment, Holidays

Walmart’s evaluation metric

- Walmart uses MAE (mean absolute error), but with a twist:

- They care more about holidays, so any error on holidays has 5 times the penalty

- They call this WMAE, for weighted mean absolute error

WMAE = \frac{1}{\sum w_i} \sum_{i=1}^{n} w_i \left|y_i-\hat{y}_i\right|

- n is the number of test data points

- \hat{y}_i is your prediction

- y_i is the actual sales

- w_i is 5 on holidays and 1 otherwise

wmae <- function(actual, predicted, holidays) {

sum(abs(actual-predicted)*(holidays*4+1)) / (length(actual) + 4*sum(holidays))

}Before we get started…

- The data isn’t very clean:

- Markdowns are given by 5 separate variables instead of 1

- Date is text format instead of a date

- CPI and unemployment data are missing in around a third of the testing data

- There are some (week, store, department) groups missing from our training data!

We’ll have to fix these

Also…

- Some features to add:

- Year

- Week

- A unique ID for tracking (week, firm, department) tuples

- The ID Walmart requests we use for submissions

- Average sales by (store, department)

- Average sales by (week, store, department)

Load data and packages

library(tidyverse) # we'll extensively use dplyr here

library(lubridate) # Great for simple date functions

library(broom)

weekly <- read.csv("../../Data/WMT_train.csv", stringsAsFactors=FALSE)

weekly.test <- read.csv("../../Data/WMT_test.csv", stringsAsFactors=FALSE)

weekly.features <- read.csv("../../Data/WMT_features.csv", stringsAsFactors=FALSE)

weekly.stores <- read.csv("../../Data/WMT_stores.csv", stringsAsFactors=FALSE)weeklyis our training dataweekly.testis our testing data – noWeekly_Salescolumnweekly.featuresis general information about (week, store) pairs- Temperature, pricing, etc.

weekly.storesis general information about each store

Cleaning

preprocess_data <- function(df) {

# Merge the data together (Pulled from outside of function -- "scoping")

df <- inner_join(df, weekly.stores)

df <- inner_join(df, weekly.features[,1:11])

# Compress the weird markdown information to 1 variable

df$markdown <- 0

df[!is.na(df$MarkDown1),]$markdown <- df[!is.na(df$MarkDown1),]$MarkDown1

df[!is.na(df$MarkDown2),]$markdown <- df[!is.na(df$MarkDown2),]$MarkDown2

df[!is.na(df$MarkDown3),]$markdown <- df[!is.na(df$MarkDown3),]$MarkDown3

df[!is.na(df$MarkDown4),]$markdown <- df[!is.na(df$MarkDown4),]$MarkDown4

df[!is.na(df$MarkDown5),]$markdown <- df[!is.na(df$MarkDown5),]$MarkDown5

# Fix dates and add useful time variables

df$date <- as.Date(df$Date)

df$week <- week(df$date)

df$year <- year(df$date)

df

}df <- preprocess_data(weekly)

df_test <- preprocess_data(weekly.test)Merge data, fix

markdown, build time data

What this looks like

df[91:94,] %>%

select(Store, date, markdown, MarkDown3, MarkDown4, MarkDown5) %>%

html_df()| Store | date | markdown | MarkDown3 | MarkDown4 | MarkDown5 | |

|---|---|---|---|---|---|---|

| 91 | 1 | 2011-10-28 | 0.00 | NA | NA | NA |

| 92 | 1 | 2011-11-04 | 0.00 | NA | NA | NA |

| 93 | 1 | 2011-11-11 | 6551.42 | 215.07 | 2406.62 | 6551.42 |

| 94 | 1 | 2011-11-18 | 5988.57 | 51.98 | 427.39 | 5988.57 |

df[1:2,] %>% select(date, week, year) %>% html_df()| date | week | year |

|---|---|---|

| 2010-02-05 | 6 | 2010 |

| 2010-02-12 | 7 | 2010 |

Cleaning: Missing CPI and Unemployment

# Fill in missing CPI and Unemployment data

df_test <- df_test %>%

group_by(Store, year) %>%

mutate(CPI=ifelse(is.na(CPI), mean(CPI,na.rm=T), CPI),

Unemployment=ifelse(is.na(Unemployment),

mean(Unemployment,na.rm=T),

Unemployment)) %>%

ungroup()

Apply the (year, Store)’s CPI and Unemployment to missing data

Cleaning: Adding IDs

- Build a unique ID

- Since Store, week, and department are all 2 digits, make a 6 digit number with 2 digits for each

sswwdd

- Since Store, week, and department are all 2 digits, make a 6 digit number with 2 digits for each

- Build Walmart’s requested ID for submissions

ss_dd_YYYY-MM-DD

# Unique IDs in the data

df$id <- df$Store *10000 + df$week * 100 + df$Dept

df_test$id <- df_test$Store *10000 + df_test$week * 100 + df_test$Dept

# Unique ID and factor building

swd <- c(df$id, df_test$id) # Pool all IDs

swd <- unique(swd) # Only keep unique elements

swd <- data.frame(id=swd) # Make a data frame

swd$swd <- factor(swd$id) # Extract factors for using later

# Add unique factors to data -- ensures same factors for both data sets

df <- left_join(df,swd)

df_test <- left_join(df_test,swd)df_test$Id <- paste0(df_test$Store,'_',df_test$Dept,"_",df_test$date)What the IDs look like

html_df(df_test[c(20000,40000,60000),c("Store","week","Dept","id","swd","Id")])| Store | week | Dept | id | swd | Id |

|---|---|---|---|---|---|

| 8 | 27 | 33 | 82733 | 82733 | 8_33_2013-07-05 |

| 15 | 46 | 91 | 154691 | 154691 | 15_91_2012-11-16 |

| 23 | 52 | 25 | 235225 | 235225 | 23_25_2012-12-28 |

Add in (store, department) average sales

# Calculate average by store-dept and distribute to df_test

df <- df %>%

group_by(Store, Dept) %>%

mutate(store_avg=mean(Weekly_Sales, rm.na=T)) %>%

ungroup()

df_sa <- df %>%

group_by(Store, Dept) %>%

slice(1) %>%

select(Store, Dept, store_avg) %>%

ungroup()

df_test <- left_join(df_test, df_sa)## Joining, by = c("Store", "Dept")# 36 observations have messed up department codes -- ignore (set to 0)

df_test[is.na(df_test$store_avg),]$store_avg <- 0

# Calculate multipliers based on store_avg (and removing NaN and Inf)

df$Weekly_mult <- df$Weekly_Sales / df$store_avg

df[!is.finite(df$Weekly_mult),]$Weekly_mult <- NAAdd in (week, store, dept) average sales

# Calculate mean by week-store-dept and distribute to df_test

df <- df %>%

group_by(Store, Dept, week) %>%

mutate(naive_mean=mean(Weekly_Sales, rm.na=T)) %>%

ungroup()

df_wm <- df %>%

group_by(Store, Dept, week) %>%

slice(1) %>%

ungroup() %>%

select(Store, Dept, week, naive_mean)

df_test <- df_test %>% arrange(Store, Dept, week)

df_test <- left_join(df_test, df_wm)## Joining, by = c("Store", "Dept", "week")ISSUE: New (week, store, dept) groups

- This is in our testing data!

- So we’ll need to predict out groups we haven’t observed at all

table(is.na(df_test$naive_mean))##

## FALSE TRUE

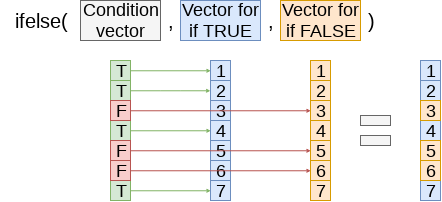

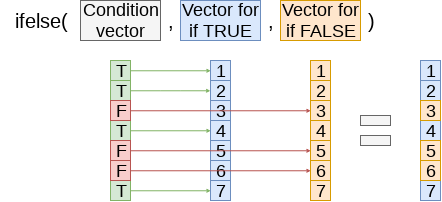

## 113827 1237- Fix: Fill with 1 or 2 lags where possible using ifelse() and lag()

- Fix: Fill with 1 or 2 leads where possible using ifelse() and lag()

- Fill with

store_avgwhen the above fail - Code is available in the code file – a bunch of code like:

df_test <- df_test %>%

arrange(Store, Dept, date) %>%

group_by(Store, Dept) %>%

mutate(naive_mean=ifelse(is.na(naive_mean), lag(naive_mean),naive_mean)) %>%

ungroup()Cleaning is done

- Data is in order

- No missing values where data is needed

- Needed values created

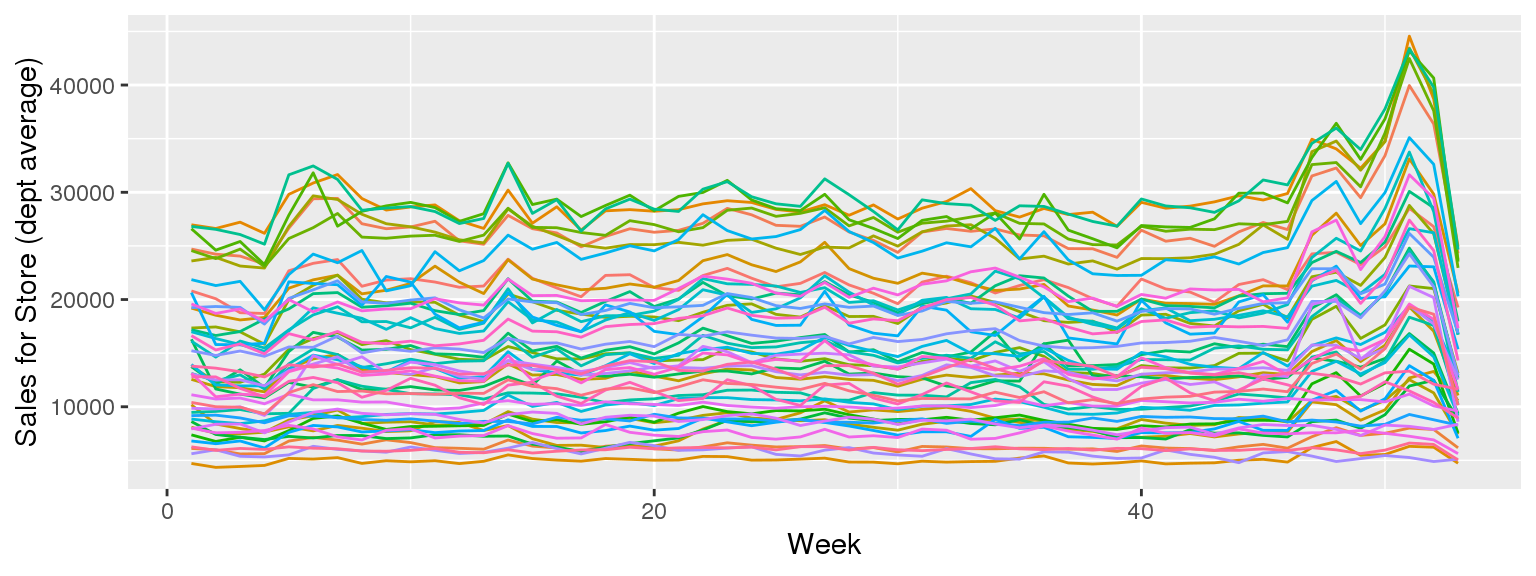

df %>%

group_by(week, Store) %>%

mutate(sales=mean(Weekly_Sales)) %>%

slice(1) %>%

ungroup() %>%

ggplot(aes(y=sales, x=week, color=factor(Store))) +

geom_line() + xlab("Week") + ylab("Sales for Store (dept average)") +

theme(legend.position="none")

Tackling the problem

First try

- Ideal: Use last week top predict next week!

- Like week 3

No data for testing…

- First instinct: try to use a linear regression to solve this

- Like from week 3

We have this

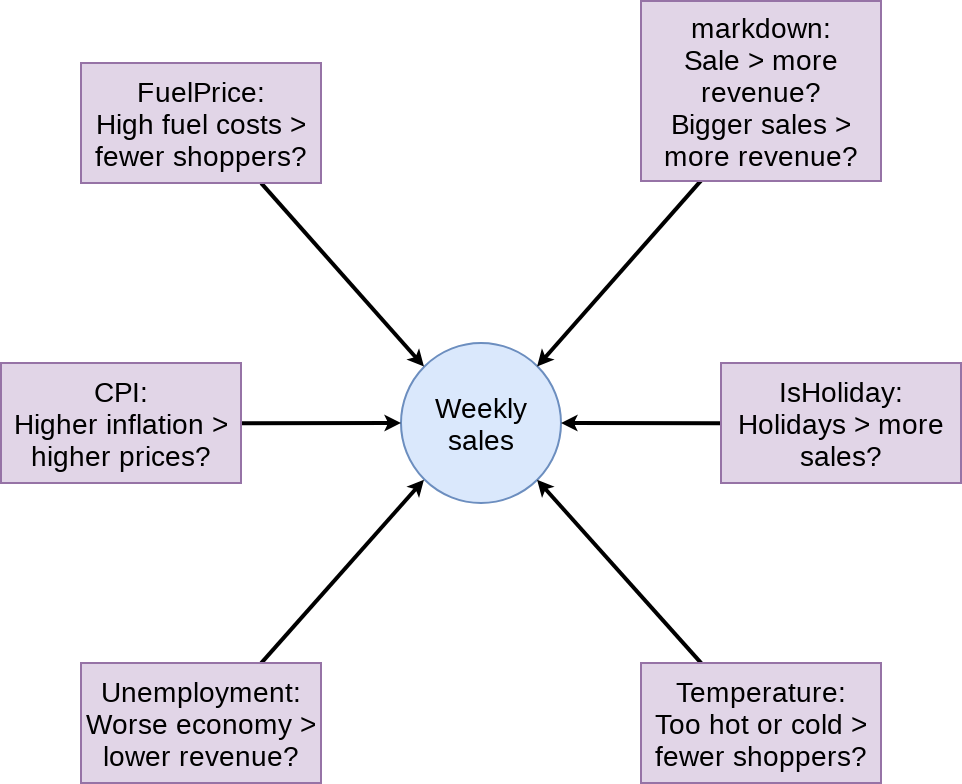

What to put in the model?

First model

mod1 <- lm(Weekly_mult ~ factor(IsHoliday) + factor(markdown>0) +

markdown + Temperature +

Fuel_Price + CPI + Unemployment,

data=df)

tidy(mod1)## # A tibble: 8 x 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 1.24 0.0370 33.5 4.10e-245

## 2 factor(IsHoliday)TRUE 0.0868 0.0124 6.99 2.67e- 12

## 3 factor(markdown > 0)TRUE 0.0531 0.00885 6.00 2.00e- 9

## 4 markdown 0.000000741 0.000000875 0.847 3.97e- 1

## 5 Temperature -0.000763 0.000181 -4.23 2.38e- 5

## 6 Fuel_Price -0.0706 0.00823 -8.58 9.90e- 18

## 7 CPI -0.0000837 0.0000887 -0.944 3.45e- 1

## 8 Unemployment 0.00410 0.00182 2.25 2.45e- 2glance(mod1)## # A tibble: 1 x 11

## r.squared adj.r.squared sigma statistic p.value df logLik AIC

## * <dbl> <dbl> <dbl> <dbl> <dbl> <int> <dbl> <dbl>

## 1 0.000481 0.000464 2.03 29.0 2.96e-40 8 -8.96e5 1.79e6

## # ... with 3 more variables: BIC <dbl>, deviance <dbl>, df.residual <int>Prep submission and check in sample WMAE

# Out of sample result

df_test$Weekly_mult <- predict(mod1, df_test)

df_test$Weekly_Sales <- df_test$Weekly_mult * df_test$store_avg

# Required to submit a csv of Id and Weekly_Sales

write.csv(df_test[,c("Id","Weekly_Sales")],

"WMT_linear.csv",

row.names=FALSE)

# track

df_test$WS_linear <- df_test$Weekly_Sales

# Check in sample WMAE

df$WS_linear <- predict(mod1, df) * df$store_avg

w <- wmae(actual=df$Weekly_Sales, predicted=df$WS_linear, holidays=df$IsHoliday)

names(w) <- "Linear"

wmaes <- c(w)

wmaes## Linear

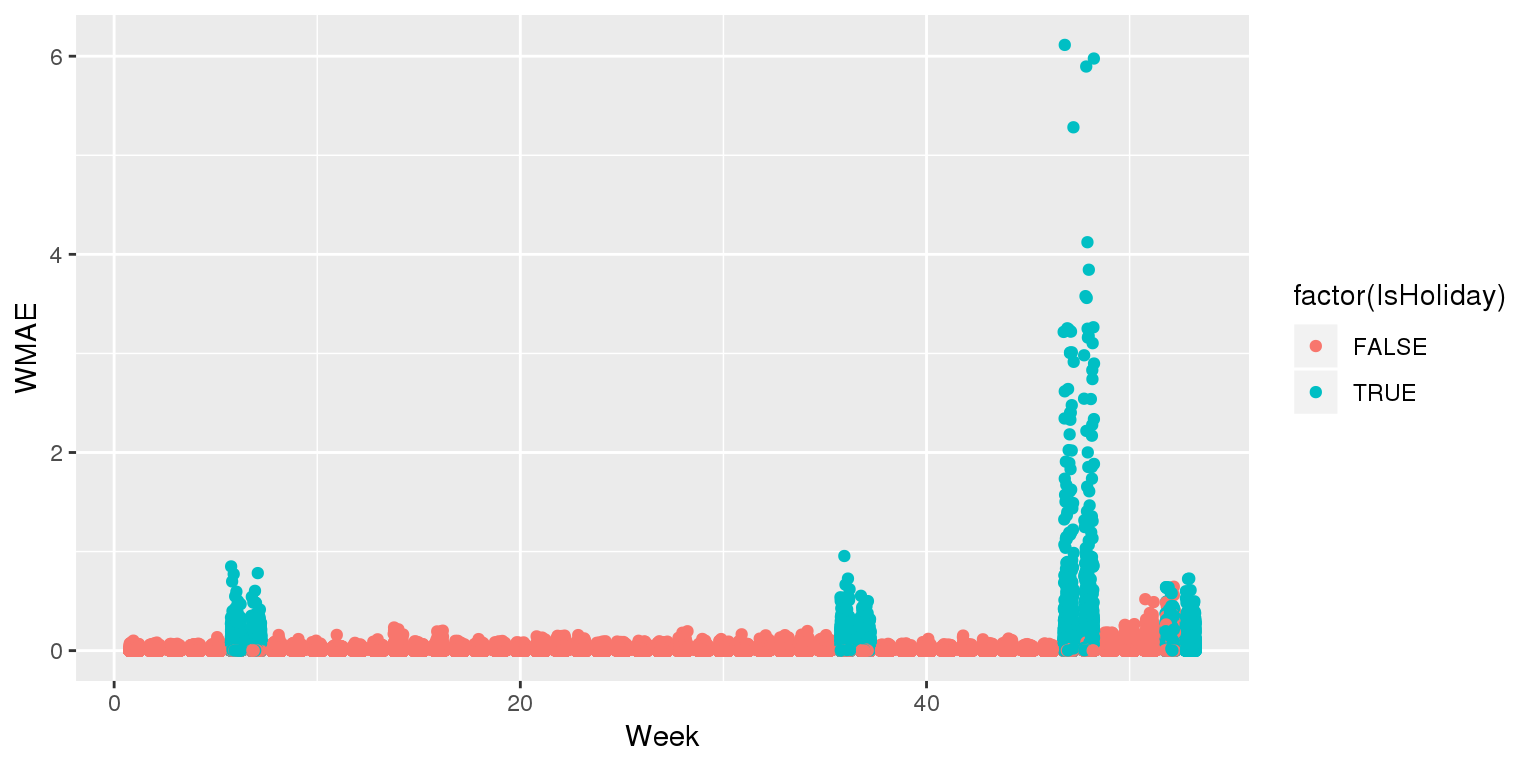

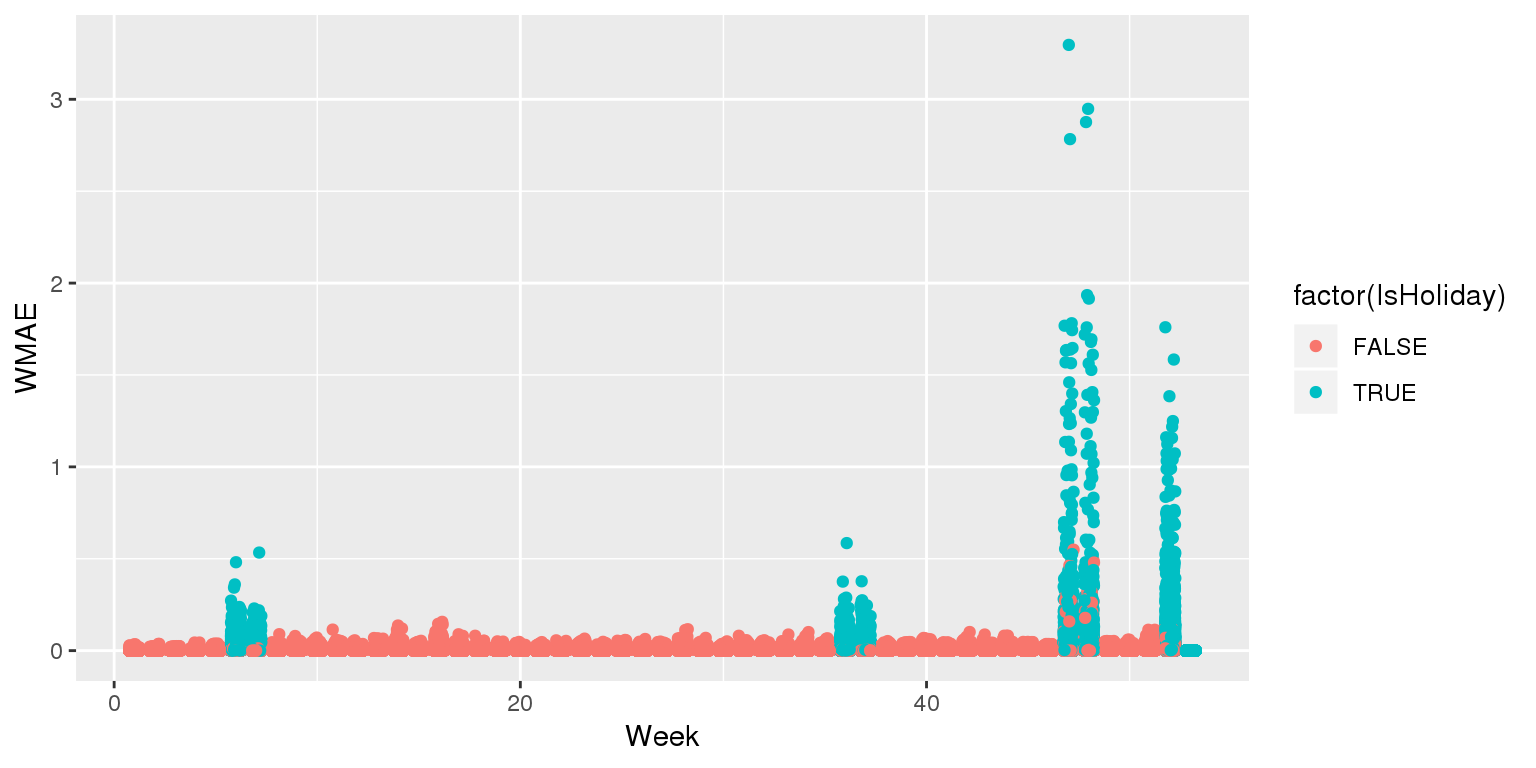

## 3073.57Visualizing in sample WMAE

wmae_obs <- function(actual, predicted, holidays) {

abs(actual-predicted)*(holidays*5+1) / (length(actual) + 4*sum(holidays))

}

df$wmaes <- wmae_obs(actual=df$Weekly_Sales, predicted=df$WS_linear,

holidays=df$IsHoliday)

ggplot(data=df, aes(y=wmaes, x=week, color=factor(IsHoliday))) +

geom_jitter(width=0.25) + xlab("Week") + ylab("WMAE")

Back to the drawing board…

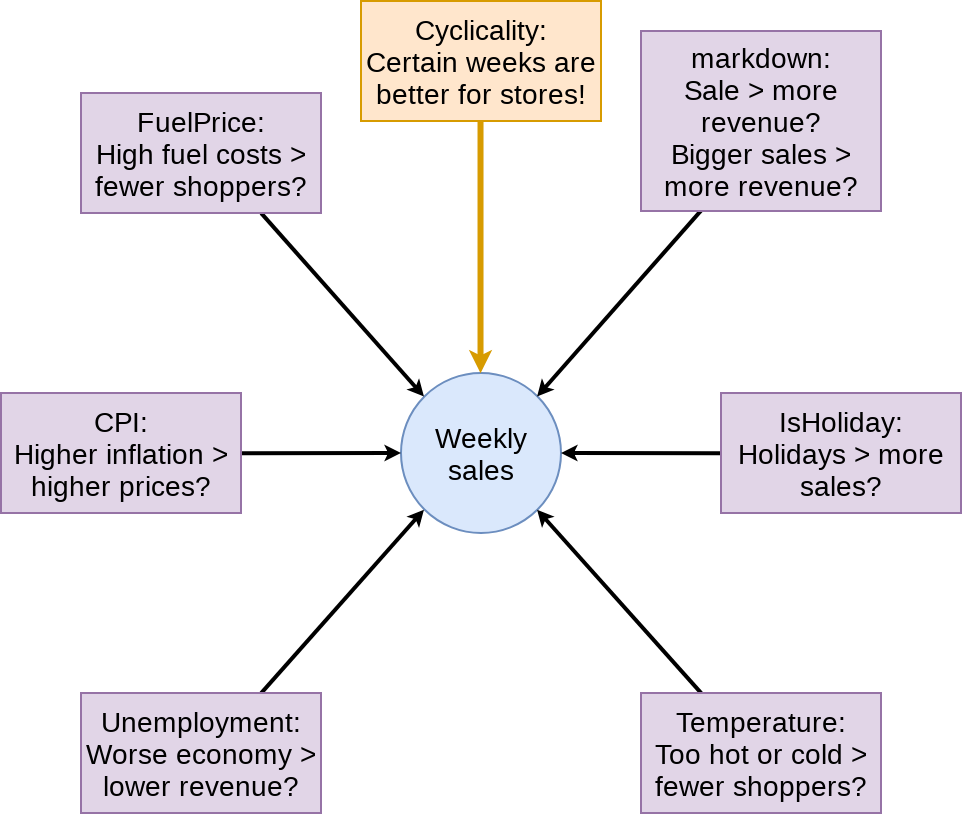

Second model: Including week

mod2 <- lm(Weekly_mult ~ factor(week) + factor(IsHoliday) + factor(markdown>0) +

markdown + Temperature +

Fuel_Price + CPI + Unemployment,

data=df)

tidy(mod2)## # A tibble: 60 x 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) 1.000 0.0452 22.1 3.11e-108

## 2 factor(week)2 -0.0648 0.0372 -1.74 8.19e- 2

## 3 factor(week)3 -0.169 0.0373 -4.54 5.75e- 6

## 4 factor(week)4 -0.0716 0.0373 -1.92 5.47e- 2

## 5 factor(week)5 0.0544 0.0372 1.46 1.44e- 1

## 6 factor(week)6 0.161 0.0361 4.45 8.79e- 6

## 7 factor(week)7 0.265 0.0345 7.67 1.72e- 14

## 8 factor(week)8 0.109 0.0340 3.21 1.32e- 3

## 9 factor(week)9 0.0823 0.0340 2.42 1.55e- 2

## 10 factor(week)10 0.101 0.0341 2.96 3.04e- 3

## # ... with 50 more rowsglance(mod2)## # A tibble: 1 x 11

## r.squared adj.r.squared sigma statistic p.value df logLik AIC

## * <dbl> <dbl> <dbl> <dbl> <dbl> <int> <dbl> <dbl>

## 1 0.00501 0.00487 2.02 35.9 0 60 -8.95e5 1.79e6

## # ... with 3 more variables: BIC <dbl>, deviance <dbl>, df.residual <int>Prep submission and check in sample WMAE

# Out of sample result

df_test$Weekly_mult <- predict(mod2, df_test)

df_test$Weekly_Sales <- df_test$Weekly_mult * df_test$store_avg

# Required to submit a csv of Id and Weekly_Sales

write.csv(df_test[,c("Id","Weekly_Sales")],

"WMT_linear2.csv",

row.names=FALSE)

# track

df_test$WS_linear2 <- df_test$Weekly_Sales

# Check in sample WMAE

df$WS_linear2 <- predict(mod2, df) * df$store_avg

w <- wmae(actual=df$Weekly_Sales, predicted=df$WS_linear2, holidays=df$IsHoliday)

names(w) <- "Linear 2"

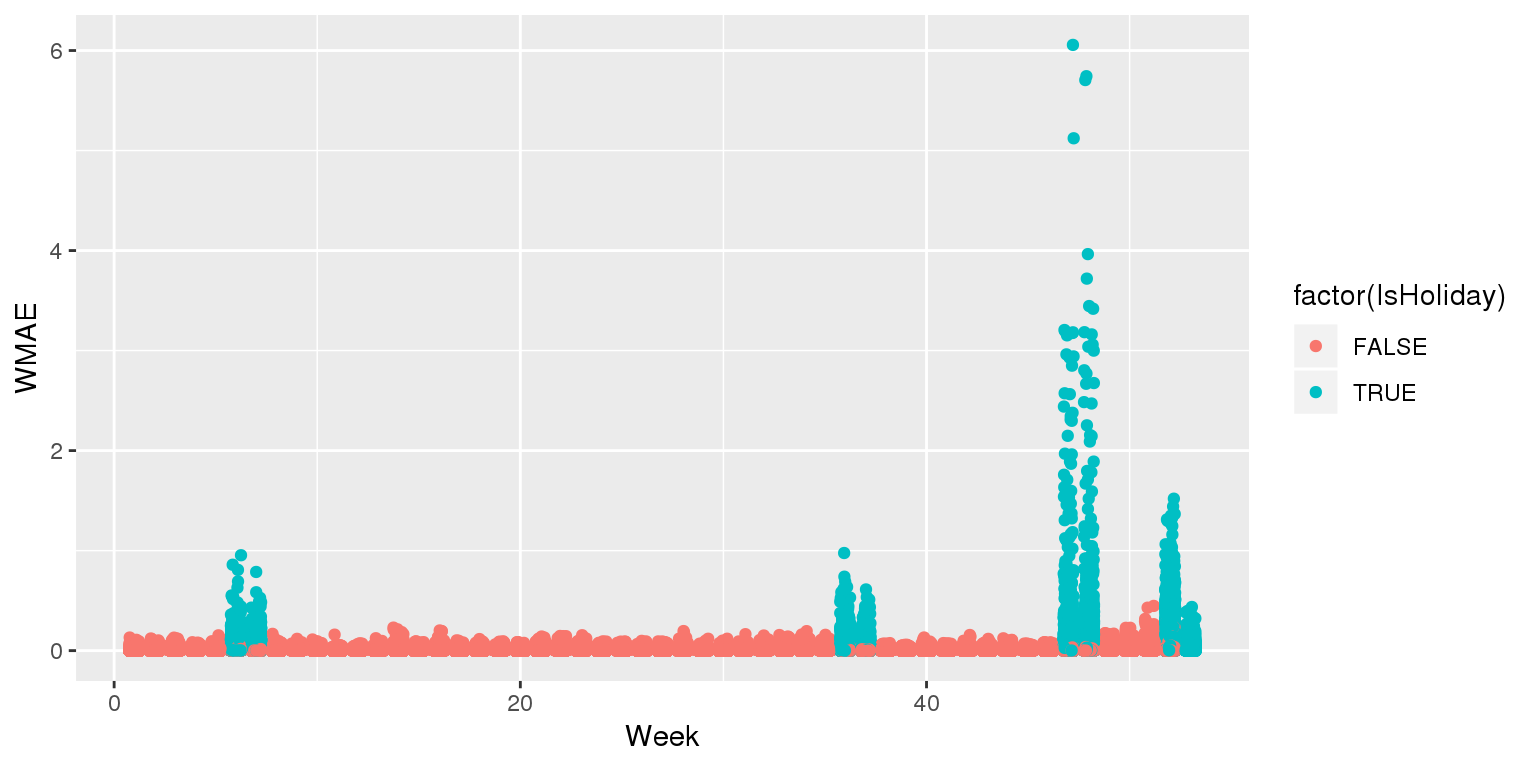

wmaes <- c(wmaes, w)

wmaes## Linear Linear 2

## 3073.570 3230.643Visualizing in sample WMAE

df$wmaes <- wmae_obs(actual=df$Weekly_Sales, predicted=df$WS_linear2,

holidays=df$IsHoliday)

ggplot(data=df, aes(y=wmaes,

x=week,

color=factor(IsHoliday))) +

geom_jitter(width=0.25) + xlab("Week") + ylab("WMAE")

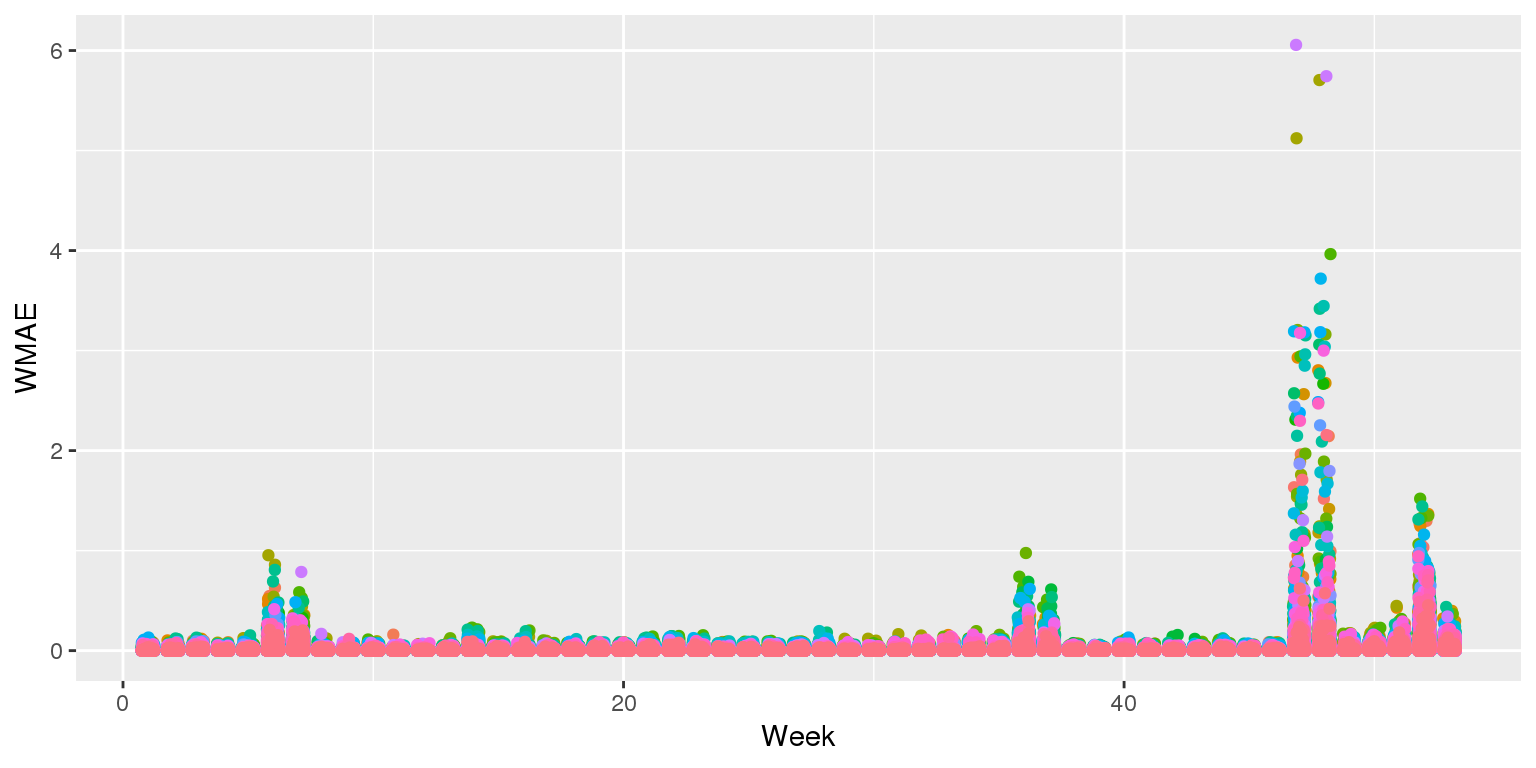

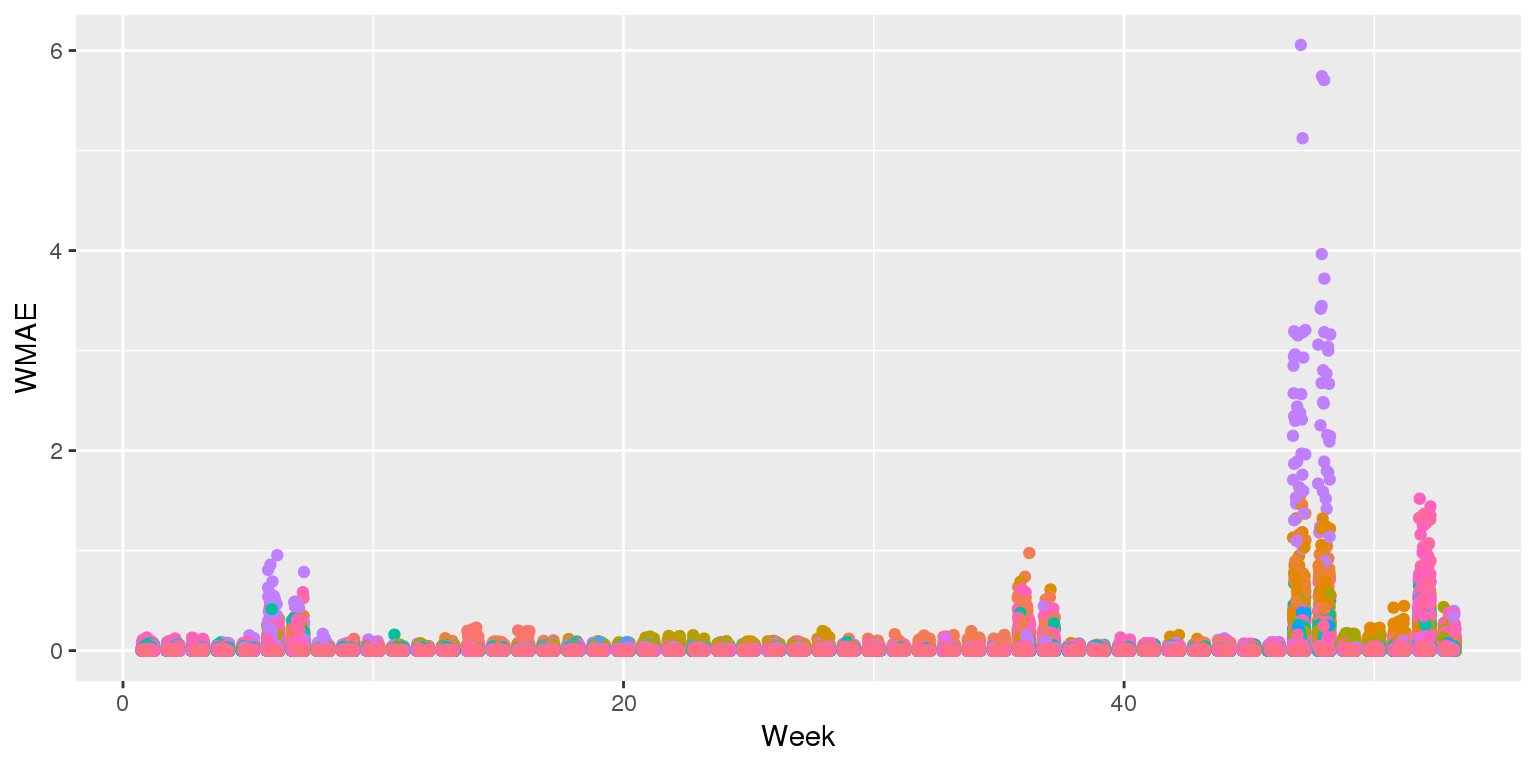

Visualizing in sample WMAE by Store

ggplot(data=df, aes(y=wmae_obs(actual=df$Weekly_Sales, predicted=df$WS_linear2,

holidays=df$IsHoliday),

x=week,

color=factor(Store))) +

geom_jitter(width=0.25) + xlab("Week") + ylab("WMAE") +

theme(legend.position="none")

Visualizing in sample WMAE by Dept

ggplot(data=df, aes(y=wmae_obs(actual=df$Weekly_Sales, predicted=df$WS_linear2,

holidays=df$IsHoliday),

x=week,

color=factor(Dept))) +

geom_jitter(width=0.25) + xlab("Week") + ylab("WMAE") +

theme(legend.position="none")

Back to the drawing board…

Third model: Including week x Store x Dept

mod3 <- lm(Weekly_mult ~ factor(week):factor(Store):factor(Dept) + factor(IsHoliday) + factor(markdown>0) +

markdown + Temperature +

Fuel_Price + CPI + Unemployment,

data=df)

## Error: cannot allocate vector of size 606.8Gb…

Third model: Including week x Store x Dept

library(lfe)

mod3 <- felm(Weekly_mult ~ markdown +

Temperature +

Fuel_Price +

CPI +

Unemployment | swd, data=df)

tidy(mod3)## # A tibble: 5 x 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 markdown -0.00000139 0.000000581 -2.40 1.65e- 2

## 2 Temperature 0.00135 0.000442 3.05 2.28e- 3

## 3 Fuel_Price -0.0637 0.00695 -9.17 4.89e-20

## 4 CPI 0.00150 0.00102 1.46 1.43e- 1

## 5 Unemployment -0.0303 0.00393 -7.70 1.32e-14glance(mod3)## # A tibble: 1 x 7

## r.squared adj.r.squared sigma statistic p.value df df.residual

## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 0.823 0.712 1.09 7.43 0 259457 259457PROBLEM

- We need to be able to predict out of sample to make our submission

felm() models don’t support predict

- So build it:

predict.felm <- function(object, newdata, use.fe=T, ...) {

# compatible with tibbles

newdata <- as.data.frame(newdata)

co <- coef(object)

y.pred <- t(as.matrix(unname(co))) %*% t(as.matrix(newdata[,names(co)]))

fe.vars <- names(object$fe)

all.fe <- getfe(object)

for (fe.var in fe.vars) {

level <- all.fe[all.fe$fe == fe.var,]

frows <- match(newdata[[fe.var]],level$idx)

myfe <- level$effect[frows]

myfe[is.na(myfe)] = 0

y.pred <- y.pred + myfe

}

as.vector(y.pred)

}Prep submission and check in sample WMAE

# Out of sample result

df_test$Weekly_mult <- predict(mod3, df_test)

df_test$Weekly_Sales <- df_test$Weekly_mult * df_test$store_avg

# Required to submit a csv of Id and Weekly_Sales

write.csv(df_test[,c("Id","Weekly_Sales")],

"WMT_FE.csv",

row.names=FALSE)

# track

df_test$WS_FE <- df_test$Weekly_Sales

# Check in sample WMAE

df$WS_FE <- predict(mod3, df) * df$store_avg

w <- wmae(actual=df$Weekly_Sales, predicted=df$WS_FE, holidays=df$IsHoliday)

names(w) <- "FE"

wmaes <- c(wmaes, w)

wmaes## Linear Linear 2 FE

## 3073.570 3230.643 1552.173Visualizing in sample WMAE

df$wmaes <- wmae_obs(actual=df$Weekly_Sales, predicted=df$WS_FE,

holidays=df$IsHoliday)

ggplot(data=df, aes(y=wmaes,

x=week,

color=factor(IsHoliday))) +

geom_jitter(width=0.25) + xlab("Week") + ylab("WMAE")

Maybe the data is part of the problem?

- What problems might there be for our testing sample?

- What is different from testing to training?

- Can we fix them?

- If so, how?

This was a real problem!

- Walmart provided this data back in 2014 as part of a recruiting exercise

- This is what the group project will be like

- 4 to 5 group members tackling a real life data problem

- You will have training data but testing data will be withheld

- Submit on Kaggle

Project deliverables

- Kaggle submission

- Your code for your submission, walking through what you did

- A 15 minute presentation on the last day of class describing:

- Your approach

- A report discussing

- Main points and findings

- Exploratory analysis of the data used

- Your model development, selection, implementation, evaluation, and refinement

- A conclusion on how well your group did and what you learned in the process

Binary outcomes

What are binary outcomes?

- Thus far we have talked about events with continuous outcomes

- Revenue: Some positive number

- Earnings: Some number

- ROA: Some percentage

- Binary outcomes only have two possible outcomes

- Did something happen, yes or no?

- Is a statement true or false?

Accounting examples of binary outcomes

- Financial:

- Will the company’s earnings meet analysts’ expectations

- Will the company have positive earnings?

- Managerial:

- Will we have ___ problem with our supply chain?

- Will our customer go bankrupt?

- Audit:

- Is the company committing fraud?

- Tax:

- Is the company too aggressive in their tax positions

We can assign a probability to any of these

Regression approach: Logistic regression

- When approaching a binary outcome, we use a logistic regression

- A.k.a. logit model

- The logit function is logit(x) = \text{log}\left(\frac{x}{1-x}\right)

- Also called log odds

\text{log}\left(\frac{\text{Prob}(y=1|X)}{1-\text{Prob}(y=1|X)}\right)=\alpha + \beta_1 x_1 + \beta_2 x_2 + \ldots + \varepsilon

Implementation: Logistic regression

- The logistic model is related to our previous linear models as such:

Both linear and logit models are under the class of General Linear Models (GLMs)

- To regress a GLM, we use the glm() command.

- To run a Logit regression:

mod <- glm(y ~ x1 + x2 + x3 + ..., data=df, family=binomial)

summary(mod)Interpreting logit values

- The sign of the coefficients means the same as before

- +: increases the likelihood of y occurring

- -: decreases the likelihood of y occurring

- The level of the coefficient is different

- The relationship isn’t linear between x_i and y now

- Instead, coefficient is in log odds

- Thus, e^{\beta_i} gives you the odds, o

- To get probability, p, we can calculate p=\frac{o}{1+o}

- You can directly interpret the log odds for a coefficient (increased by \beta\%)

- You can directly interpret the odds for a coefficient (increased by (o-1)\%)

- You need to sum all relevant log odds before converting to probability!

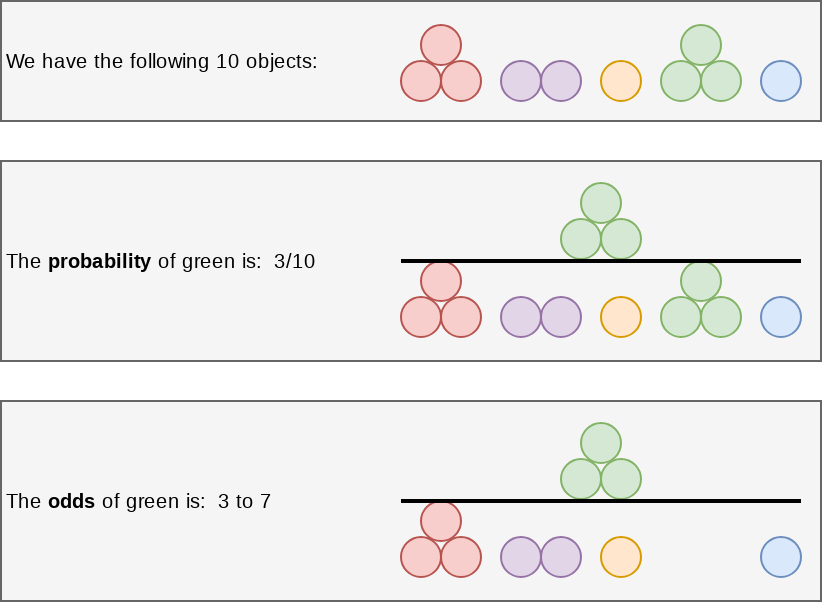

Odds vs probability

Example logit regression

Do holidays increase the likelihood that a department more than doubles its store’s average weekly sales across departments?

# Create the binary variable

df$double <- ifelse(df$Weekly_Sales > df$store_avg*2,1,0)fit <- glm(double ~ IsHoliday, data=df, family=binomial)

summary(fit)##

## Call:

## glm(formula = double ~ IsHoliday, family = binomial, data = df)

##

## Deviance Residuals:

## Min 1Q Median 3Q Max

## -0.3260 -0.2504 -0.2504 -0.2504 2.6375

##

## Coefficients:

## Estimate Std. Error z value Pr(>|z|)

## (Intercept) -3.446804 0.009236 -373.19 <2e-16 ***

## IsHolidayTRUE 0.538640 0.027791 19.38 <2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## (Dispersion parameter for binomial family taken to be 1)

##

## Null deviance: 120370 on 421569 degrees of freedom

## Residual deviance: 120039 on 421568 degrees of freedom

## AIC: 120043

##

## Number of Fisher Scoring iterations: 6Converting logit coefficients

odds <- exp(coef(fit))

odds## (Intercept) IsHolidayTRUE

## 0.03184725 1.71367497probability <- odds / (1 + odds)

probability## (Intercept) IsHolidayTRUE

## 0.03086431 0.63149603R practice: Logit

- A continuation of last week’s practices answering:

- Is Walmart more likely to see a year over year decrease in quarterly revenue during a recession?

- Practice using mutate() and glm()

- Do exercises 1 and 2 in today’s practice file

- R Practice

- Shortlink: rmc.link/420r5

Today’s Application: Shipping delays

The question

Can we leverage global weather data to predict shipping delays?

A bit about shipping data

- WRDS doesn’t have shipping data

- There are, however, vendors for shipping data, such as:

- They pretty much have any data you could need:

- Over 650,000 ships tracked using ground and satellite based AIS

- AIS: Automatic Identification System

- Live mapping

- Weather data

- Fleet tracking

- Port congestion

- Inmarsat support for ship operators

- Over 650,000 ships tracked using ground and satellite based AIS

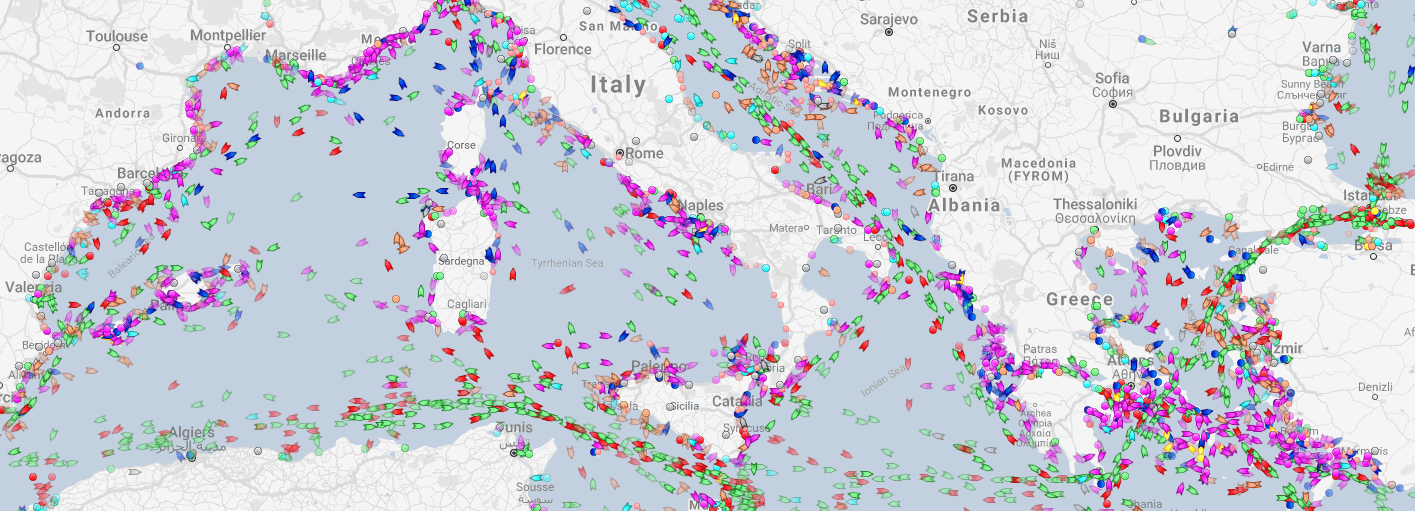

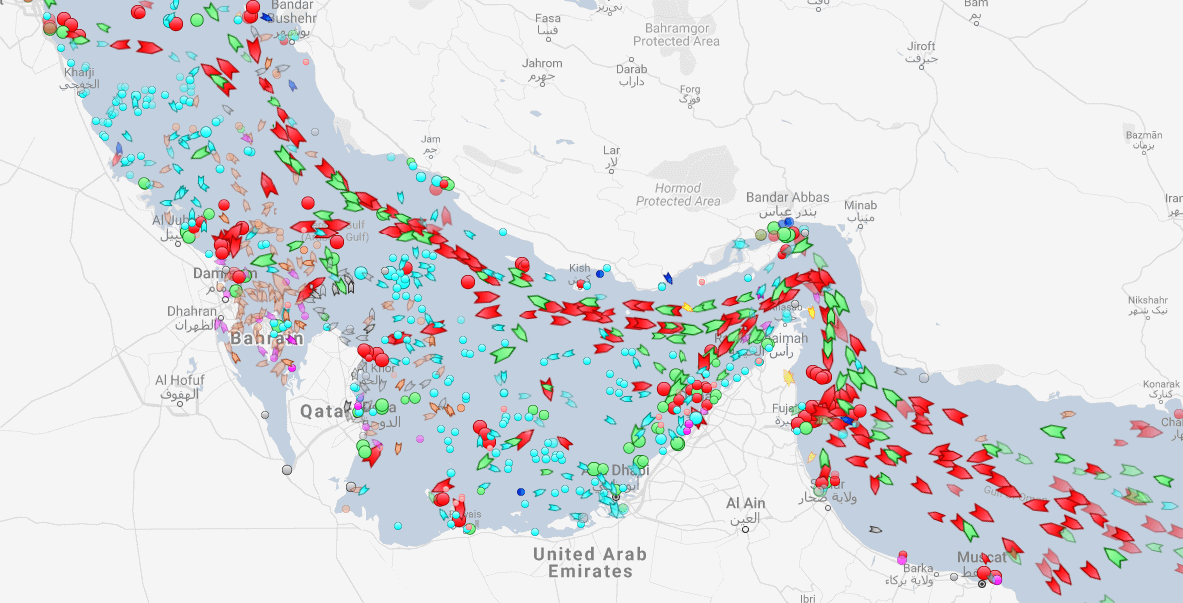

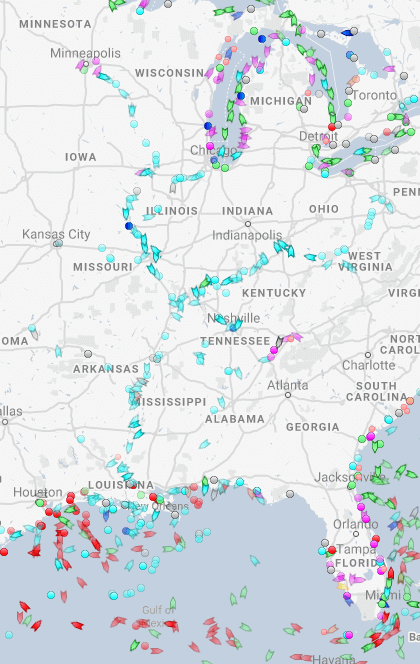

What can we see from naval data?

Yachts in the Mediterranean

Oil tankers in the Persian gulf

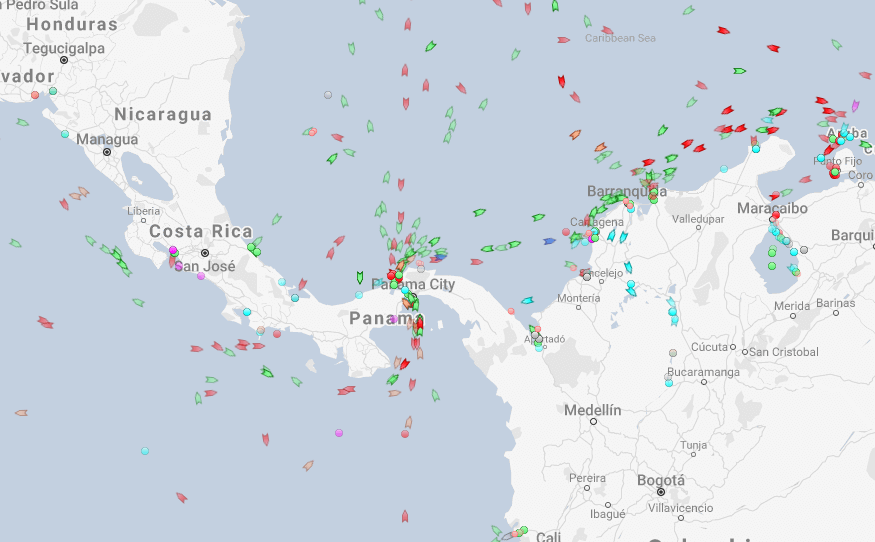

What can we see from naval data?

Shipping route via the Panama canal

River shipping on the Mississippi river, USA

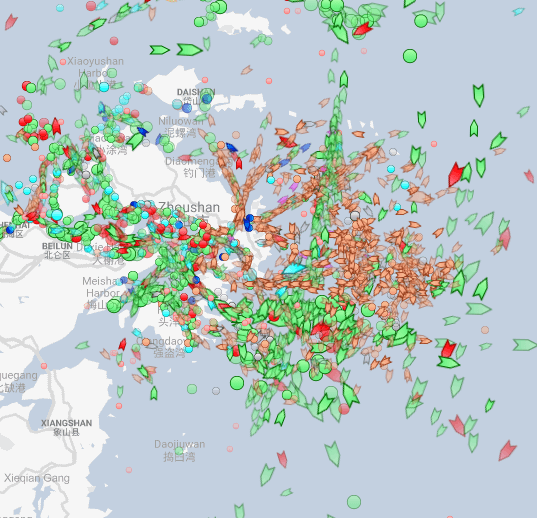

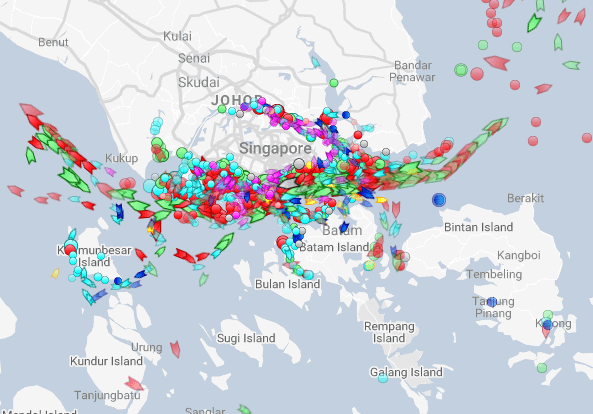

What can we see from naval data?

Busiest ports by containers and tons (Shanghai & Ningbo-Zhoushan, China)

Busiest port for transshipment (Singapore)

Examining Singaporean owned ships

Code for last slide’s map

library(plotly) # for plotting

library(RColorBrewer) # for colors

# plot with boats, ports, and typhoons

# Note: geo is defined in the appendix -- it controls layout

palette = brewer.pal(8, "Dark2")[c(1,8,3,2)]

p <- plot_geo(colors=palette) %>%

add_markers(data=df_ports, x = ~port_lon, y = ~port_lat, color = "Port") %>%

add_markers(data=df_Aug31, x = ~lon, y = ~lat, color = ~ship_type,

text=~paste('Ship name',shipname)) %>%

add_markers(data=typhoon_Aug31, x = ~lon, y = ~lat, color="TYPHOON",

text=~paste("Name", typhoon_name)) %>%

layout(showlegend = TRUE, geo = geo,

title = 'Singaporean owned container and tanker ships, August 31, 2018')

p- plot_geo() is from plotly

- add_markers() adds points to the map

- layout() adjusts the layout

- Within geo, a list, the following makes the map a globe

projection=list(type="orthographic")

Singaporean ship movement

Code for last slide’s map

library(sf) # Note: very difficult to install except on Windows

library(maps)

# Requires separately installing "maptools" and "rgeos" as well

# This graph requires ~7GB of RAM to render

world1 <- sf::st_as_sf(map('world', plot = FALSE, fill = TRUE))

df_all <- df_all %>% arrange(run, imo)

p <- ggplot(data = world1) +

geom_sf() +

geom_point(data = df_all, aes(x = lon, y = lat, frame=frame,

text=paste("name:",shipname)))

ggplotly(p) %>%

animation_opts(

1000, easing = "linear", redraw = FALSE)world1contains the map data- geom_sf() plots map data passed to ggplot()

- geom_point() plots ship locations as longitude and latitude

- ggplotly() converts the graph to html and animates it

- Animation follows the

frameaesthetic

- Animation follows the

What might matter for shipping?

What observable events or data might provide insight as to whether a naval shipment will be delayed or not?

Typhoon Jebi

Typhoons in the data

Code for last slide’s map

# plot with boats and typhoons

palette = brewer.pal(8, "Dark2")[c(1,3,2)]

p <- plot_geo(colors=palette) %>%

add_markers(data=df_all[df_all$frame == 14,], x = ~lon, y = ~lat,

color = ~ship_type, text=~paste('Ship name',shipname)) %>%

add_markers(data=typhoon_Jebi, x = ~lon,

y = ~lat, color="Typhoon Jebi",

text=~paste("Name", typhoon_name, "</br>Time: ", date)) %>%

layout(showlegend = TRUE, geo = geo,

title = 'Singaporean container/tanker ships, September 4, 2018, evening')

p- This map is made the same way as the first map

Typhoons in the data using leaflet

Code for last slide’s map

library(leaflet)

library(leaflet.extras)

# icons

typhoonicons <- pulseIcons(color='red',

heartbeat = ifelse(typhoon_Jebi$intensity_vmax > 150/1.852, 0.8,

ifelse(typhoon$intensity_vmax < 118, 1.6, 1.2)),

iconSize=ifelse(typhoon_Jebi$intensity_vmax > 150/1.852, 12,

ifelse(typhoon_Jebi$intensity_vmax < 118, 3, 8)))

shipicons <- iconList(

ship = makeIcon("../Figures/ship.png", NULL, 18, 18))

# plot

leaflet() %>%

addTiles() %>%

setView(lng = 136, lat = 34, zoom=4) %>%

addPulseMarkers(data=typhoon_Jebi, lng=~lon, lat=~lat, label=~date,

icon=typhoonicons) %>%

addMarkers(data=df_all[df_all$frame == 14,], lng=~lon, lat=~lat,

label=~shipname, icon=shipicons)- pulseIcons(): pulsing icons from leaflet.extras

- iconList(): pulls icons stored on your computer

- leaflet(): start the map; addTiles() pulls from OpenStreetMap

- setView(): sets the frame for the map

- addPulseMarkers(): adds pulsing markers

- addMarkers(): adds normal markers

R Practice on mapping

- Practice mapping typhoon data

- Practice using plotly and leaflet

- Do exercises 3 and 4 in today’s practice file

- R Practice

- Shortlink: rmc.link/420r5

Predicting delays due to typhoons

Data

- If the ship will report a delay of at least 3 hours in the next 12-24 hours

- Ship location

- Typhoon location

- Typhoon wind speed

We need to calculate distance between ships and typhoons

Distance for geo

- There are a number of formulas for this

- Haversine for a simple calculation

- Vincenty’s formulae for a complex, incredibly accurate calculation

- Accurate within 0.5mm

- Use distVincentyEllipsoid() from geosphere to get a reasonably quick and accurate calculation

- Calculates distance between two sets of points, x and y, structured as matrices

- Matrices must have longitude in the first column and latitude in the second column

- Provides distance in meters by default

library(geosphere)

x <- as.matrix(df3[,c("lon","lat")]) # ship location

y <- as.matrix(df3[,c("ty_lon","ty_lat")]) # typhoon location

df3$dist_typhoon <- distVincentyEllipsoid(x, y) / 1000Clean up

- Some indicators to cleanly capture how far away the typhoon is

df3$typhoon_500 = ifelse(df3$dist_typhoon < 500 &

df3$dist_typhoon >= 0, 1, 0)

df3$typhoon_1000 = ifelse(df3$dist_typhoon < 1000 &

df3$dist_typhoon >= 500, 1, 0)

df3$typhoon_2000 = ifelse(df3$dist_typhoon < 2000 &

df3$dist_typhoon >= 1000, 1, 0)

Do typhoons delay shipments?

fit1 <- glm(delayed ~ typhoon_500 + typhoon_1000 + typhoon_2000, data=df3,

family=binomial)

summary(fit1)##

## Call:

## glm(formula = delayed ~ typhoon_500 + typhoon_1000 + typhoon_2000,

## family = binomial, data = df3)

##

## Deviance Residuals:

## Min 1Q Median 3Q Max

## -0.2502 -0.2261 -0.2261 -0.2261 2.7127

##

## Coefficients:

## Estimate Std. Error z value Pr(>|z|)

## (Intercept) -3.65377 0.02934 -124.547 <2e-16 ***

## typhoon_500 0.14073 0.16311 0.863 0.3883

## typhoon_1000 0.20539 0.12575 1.633 0.1024

## typhoon_2000 0.16059 0.07106 2.260 0.0238 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## (Dispersion parameter for binomial family taken to be 1)

##

## Null deviance: 14329 on 59184 degrees of freedom

## Residual deviance: 14322 on 59181 degrees of freedom

## (3866 observations deleted due to missingness)

## AIC: 14330

##

## Number of Fisher Scoring iterations: 6It appears so!

Interpretation of coefficients

odds1 <- exp(coef(fit1))

odds1## (Intercept) typhoon_500 typhoon_1000 typhoon_2000

## 0.02589334 1.15111673 1.22800815 1.17420736- Ships 1,000 to 2,000 km from a typhoon have 17% higher odds of having a delay

prob_odds1 <- c(exp(coef(fit1)[1]),

exp(coef(fit1)[c(2, 3, 4)] + coef(fit1)[c(1, 1, 1)]))

probability1 <- prob_odds1 / (1 + prob_odds1)

probability1## (Intercept) typhoon_500 typhoon_1000 typhoon_2000

## 0.02523980 0.02894356 0.03081733 0.02950702- Ships 1,000 to 2,000 km from a typhoon have a 3% chance of having a delay (baseline of 2.5%)

What about typhoon intensity?

- Hong Kong’s typhoon classification: Official source

- 41-62 km/h: Tropical depression

- 63-87 km/h: Tropical storm

- 88-117 km/h: Severe tropical storm

- 118-149 km/h: Typhoon

- 150-184 km/h: Severe typhoon

- 185+km/h: Super typhoon

# Cut makes a categorical variable out of a numerical variable using specified bins

df3$Super <- ifelse(df3$intensity_vmax * 1.852 > 185, 1, 0)

df3$Moderate <- ifelse(df3$intensity_vmax * 1.852 >= 88 &

df3$intensity_vmax * 1.852 < 185, 1, 0)

df3$Weak <- ifelse(df3$intensity_vmax * 1.852 >= 41 &

df3$intensity_vmax * 1.852 < 88, 1, 0)

df3$HK_intensity <- cut(df3$intensity_vmax ,c(41, 63, 88, 118, 150, 1000)/1.852)

table(df3$HK_intensity)##

## (22.1,34] (34,47.5] (47.5,63.7] (63.7,81] (81,540]

## 13715 13228 9238 2255 21141Typhoon intensity and delays

fit2 <- glm(delayed ~ (typhoon_500 + typhoon_1000 + typhoon_2000) :

(Weak + Moderate + Super), data=df3,

family=binomial)

tidy(fit2)## # A tibble: 10 x 5

## term estimate std.error statistic p.value

## <chr> <dbl> <dbl> <dbl> <dbl>

## 1 (Intercept) -3.65 0.0290 -126. 0

## 2 typhoon_500:Weak -0.00879 0.213 -0.0413 0.967

## 3 typhoon_500:Moderate 0.715 0.251 2.86 0.00430

## 4 typhoon_500:Super -8.91 123. -0.0726 0.942

## 5 typhoon_1000:Weak 0.250 0.161 1.55 0.121

## 6 typhoon_1000:Moderate 0.123 0.273 0.451 0.652

## 7 typhoon_1000:Super -0.0269 0.414 -0.0648 0.948

## 8 typhoon_2000:Weak 0.182 0.101 1.80 0.0723

## 9 typhoon_2000:Moderate 0.0253 0.134 0.189 0.850

## 10 typhoon_2000:Super 0.311 0.136 2.29 0.0217Moderate storms predict delays when within 500km

Super typhoons predict delays when 1,000 to 2,000km away

Interpretation of coefficients

odds2 <- exp(coef(fit2))

odds2[c(1, 3, 10)]## (Intercept) typhoon_500:Moderate typhoon_2000:Super

## 0.02589637 2.04505487 1.36507575- Ships within 500km of a moderately strong storm have 104% higher odds of being delayed

- Ships 1,000 to 2,000km from a super typhoon have 36% higher odds

prob_odds2 <- c(exp(coef(fit2)[1]),

exp(coef(fit2)[c(3, 10)] + coef(fit2)[c(1, 1)]))

probability2 <- prob_odds2 / (1 + prob_odds2)

probability2## (Intercept) typhoon_500:Moderate typhoon_2000:Super

## 0.02524268 0.05029586 0.03414352- Ships within 500km of a moderately strong storm have a 5% chance of being delayed (baseline: 2.5%)

- Ships 1,000 to 2,000km from a super typhoon have a 3.4% chance

What might matter for shipping?

What other observable events or data might provide insight as to whether a naval shipment will be delayed or not?

- What is the reason that this event or data would be useful in predicting delays?

- I.e., how does it fit into your mental model?

End matter

For next week

- For next week:

- Second individual assignment

- Finish by the end of next Thursday

- Submit on eLearn

- Think about who you want to work with for the project

- Second individual assignment

Packages used for these slides

Custom code

# styling for plotly maps

geo <- list(

showland = TRUE,

showlakes = TRUE,

showcountries = TRUE,

showocean = TRUE,

countrywidth = 0.5,

landcolor = toRGB("grey90"),

lakecolor = toRGB("aliceblue"),

oceancolor = toRGB("aliceblue"),

projection = list(

type = 'orthographic', # detailed at https://plot.ly/r/reference/#layout-geo-projection

rotation = list(

lon = 100,

lat = 1,

roll = 0

)

),

lonaxis = list(

showgrid = TRUE,

gridcolor = toRGB("gray40"),

gridwidth = 0.5

),

lataxis = list(

showgrid = TRUE,

gridcolor = toRGB("gray40"),

gridwidth = 0.5

)

)