Discretionary Dissemination on Twitter, 2018

Abstract: Using a machine learning approach to analyze 12.8 million tweets posted by S&P 1500 firms from 2012 to 2016, we find that firms time financial tweets around earnings announcements, accounting filings as well as other important corporate events, and are more likely to use media (images or video) and links in those tweets. The above pattern holds for both good and bad news. Moreover, we find that feedback from Twitter users encourages future financial tweets and use of media and links. These results collectively suggest that firms make discretionary choices in timing and presentation format when disseminating information on social media and that they incorporate instantaneous feedback from Twitter users into their dissemination strategies.

A copy of the paper is available at SSRN:

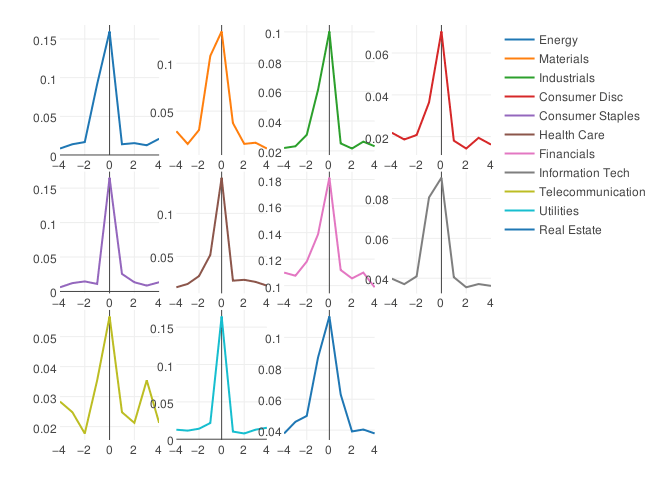

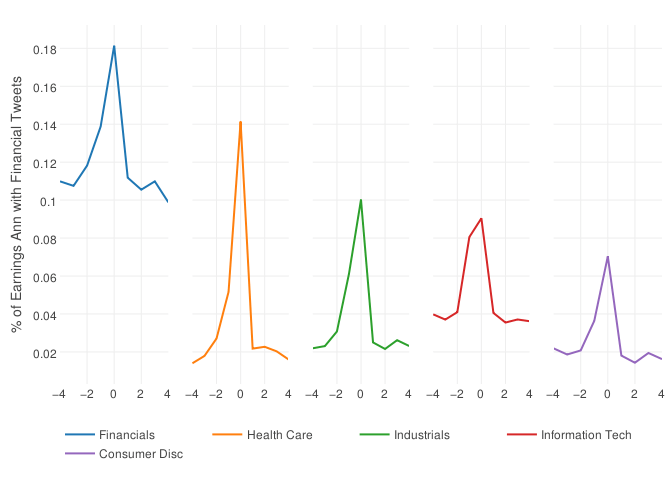

Presentations of this paper included some other descriptive figures of Tweeting by S&P 1500 firms. For instance, the below figure shows, for a window of -4 days to +4 days around earnings announcements, the percent of firms that are tweeting financial information in each industry. While some industries are more likely to tweet than others (as is nicely illustrated by the header image above), firms across all industries ramp up their tweeting of financial information around earnings announcements.